What is a Strike Price?

Written by Upstox Desk

Published on August 29, 2025 | 5 min read

Strike price in the options is a predetermined price at which the security or any underlying asset can be bought or sold on or before the expiry of the contract. The strike price on the day of expiry can also be referred to as the "exercise price".

It means that the strike price is essential in determining an option's moneyness and is a necessary component for calculating the break-even point and profit or loss for all options positions. A strike price is an anchor price (fixed, predetermined) around which the trade revolves.

As the price of the security or underlying (spot price) constantly varies and the strike price is fixed throughout the life of the option contract, the moneyness of options, whether it is a call or a put, is determined by the relative difference between the strike price and underlying price.

How to calculate the strike price?

The strike prices in the share market are computed and declared by the exchange for every security or underlying listed for derivatives trading. As we know, securities that have a higher open float, and are widely traded, are included in derivatives trading. For a security to be included in options trading, there are set criteria of exchange, some of which include volatility, risk tolerance and standard deviation of daily price change. The stock exchange may also consider the total contract value as one of the eligibility criteria.

Difference between the exercise price and strike price

In the derivatives market, both strike price and exercise price hold the same meaning. Usually, traders use the term 'exercise price' while exercising the option closer to the expiry of the contract.

Let’s understand the strike price with the help of an example

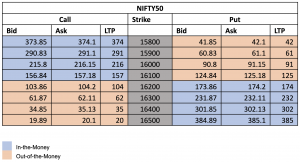

Let's assume that the Nifty50 spot is trading at 16,200. In this scenario, the Nifty50's 16,200 call option strike will be termed an "at the money" (ATM) option. Similarly, the 16,300 call option strike will be referred to as an "out of the money" (OTM) option. And the 16,100 call option strike will be known as the "in the money" (ITM) option.

Similarly, for the put options, if the Nifty50 is trading at 16,200— the 16,200 strike price will be termed "at the Money" (ATM). The 16,100 strike price will be referred to as "out of the Money" (OTM), and the 16,300 strike price will be known as "in the Money" (ITM).

The strike price is a threshold to determine the intrinsic value of options. “in-the-Money” or ITM option strike prices will always have positive intrinsic value. “at-the Money” or ATM strikes and “out-of-the-Money” or OTM strikes will have no intrinsic value

As indicated in the table above, the corresponding price (LTP) to the call and put option indicates the moneyness of the strikes.

For call options, if the price of the underlying is above the strike price (Nifty50 Spot > Nifty50 Strike), then it is considered an “in the money” option. As shown in the table above, all the deep in the money strikes are expensive and have a higher intrinsic value. Similarly, for put options, if the price of the underlying is above the strike price (Nifty50 Spot < Nifty50 Strike), then it is called an “in-the-money” option.

How to select the right strike price?

After taking into account the moneyness of the options strikes, let’s understand the factors which a trader should know before selecting a strike price.

Check Liquidity: The strike prices that are heavily traded and have higher open interest often represent support and resistance levels of the particular security. The deep “out of the money” and deep “in-the-Money” strikes are generally illiquid, which means that the bid/ask spread is wide and not attractive for trading.

The role of time decay: ATM or “at-the-Money” strikes are strongly impacted by the time decay compared to ITM and OTM strikes. The primary reason is that they are the most traded strikes in terms of volume and open interest.

Check bid-ask spread: Traders must always check the bid-ask spread before executing a trade. Some strike prices or illiquid scrips have big gaps between the bid and offer price. Sometimes traders look at the “LTP (Last Traded Price)” and enter the trade without checking the bid-offer prices. This leads to unexecuted orders and chasing the prices.

Buying far out of the money options: Traders prefer far out-of-the-money options as they are cheaper to buy. These can be profitable in a trending market, but it hurts the overall strategy if the market or a stock remains range-bound or doesn't make a big move. It is crucial for a trader to not give in to the lure of “cheap options” instead choose the right strike price which allows him or her a quick exit if the market moves favourably. Usually, this means buying at-the-money options or out-of-the-money options closer to the current market price.

Break-even points for options

Break-even points for options | |

Long Call | Strike price + option premium paid |

| Short Call | Strike price + option premium received |

Long Put | Strike price - option premium paid |

| Short Put | Strike price - option premium received |

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.