Short Put Ladder Options Strategy

Written by Upstox Desk

Published on July 31, 2025 | 5 min read

A Short Put Ladder strategy belongs to the “ladder strategy” family of options strategy. It is also known as Bear Put Ladder strategy. The outlook for the strategy ranges from being neutral at the onset to exceedingly bearish towards the end. Since it's a ladder strategy, it consists of three option legs and is improvisation over Bull Put spread. (Click here) The strategy involves selling or writing an ITM put option, buying an ATM put option and buying yet another OTM put option at lower strike. The chronologically arranged strike makes the spread appear as a ladder. The writing of spread fetches premium, which is used to fund purchase of two put options at lower strikes.

In order for the spread to turn profitable, the prices have to decline significantly. The strategy offers potentially unlimited profits on the downside and limited potential loss when prices trade in a narrow range. In case of unforeseen price rally, the losses are reduced and the holder is able to retain some part of profit.

Illustration:

Nifty 50 is currently trading at 18,000.

| Strategy | Index | Action | Strike | Premium |

Short Put Ladder | Nifty50 | Buy Put | 17,900 (strike 1) | -50 |

Buy Put | 18,000 (strike 2) | -90 | ||

| Sell Put | 18,100 (strike 3) | 160 | ||

| Net Premium | 20 |

This is a net credit strategy, as selling ITM put at higher strike fetches the most premium. The long ATM and OTM puts are priced lower as they are devoid of any intrinsic value and contain only time value. The net premium received is instrumental in reducing the overall cost of the strategy.

Just like the Short Call Ladder strategy, this option strategy has two breakeven points.

Upper breakeven point = (strike 3 – net premium received) = 18,100 – 20 = 18080 Lower breakeven point = (strike 1 + strike 2 – strike 3 + net premium received) = (17,900 + 18,000 - 18,100 + 20) = 17,820

Max potential profit on the downside = Unlimited Max potential profit on the upside = (Net premium received * lot size) = ₹20 * 50 = ₹1,000

Max potential loss = (strike 3 – strike 2 – net premium received) * lot size = (18,100 – 18,000 – ₹20) * 50 = ₹80 * 50 = ₹4,000

The Short Put Ladder is a bearish strategy, with the potential to retain some profit in case of unexpected price rally in underlying assets. A short put would usually indicate a bullish outlook but this is not to be confused by the name of the strategy. The strategy results in profit when prices trade on either side of breakeven points. When the prices breach lower breakeven point, the profit is unlimited and when the prices move past upper breakeven point, the spread is still profitable.

The spread incurs a loss when prices trade in a narrow range in between the two breakeven points. When the price trades in a narrow range the long-put position expires worthless and the premium paid for creating these long put positions has to be forfeited.

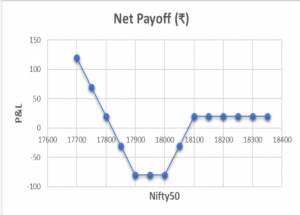

Payoff Schedule

Nifty50 @ Expiry | Net Payoff (₹) |

| 17,700 | 120 |

| 17,750 | 70 |

17,800 | 20 |

17,850 | -30 |

| 17,900 | -80 |

| 17,950 | -80 |

| 18,000 | -80 |

18,,050 | -30 |

18,100 | 20 |

18,150 | 20 |

| 18,200 | 20 |

| 18,250 | 20 |

Payoff chart

Impact of Options Greeks:

- The rapid movement of price due to increase in implied volatility leads to expansion of Vega. So, overall Vega is positive.

- A strong Vega leads to Delta expansion and as price trends downward, the Delta of long puts will expand and out weight short put Delta.

- The rapid Delta expansion leads to shrinking of Gamma. Hence, this is a Gamma negative spread.

Conclusion:

-

The short put ladder strategy is easy to implement and manage, even for a novice trader or investor.

-

The strategy is essential based on bearish outlook and anticipated increase in implied volatility. Therefore, one must not initiate this strategy to earn profit from upside movement of prices.

-

This is an excellent strategy and can be implemented to hedge the existing long portfolio or long position. In case of strong down move, the portfolio could lose value but the profits from short put ladder could be used to partially preserve the value.

-

Similarly, in case of an unexpected up move, the portfolio could go up in value. A conventional hedge would suffer loss and nullify any gain. But a short put ladder strategy circumvents this problem by retaining the premium received. Thus aiding the overall appreciation of the portfolio.

-

The time value will erode faster in long OTM puts compared to short ITM put. Near expiration, the Theta of short ITM put will become positive leading to retention of premium. But, overall, the Theta is negative for the spread due to higher number of long put options.

-

The default ratio of option position remains 1:1:1, where we are selling ITM put option and buying two put options, at lower strikes. But experienced traders usually prefer to side with market direction and change the combination to 2:1:1 or 1:1:2 to earn a disproportionately high amount of profit.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.