Wednesday, January 24, 2024 4:08 pm

When a company announces a Rights Issue, they invite existing shareholders to buy more shares, usually at a discounted price. These shares are known as Rights Shares. After the Rights Issue is announced, the company credits its existing shareholders’ Demat Accounts with something called REs (Rights Entitlements). These REs are not the actual Rights Shares and need to be used to apply for the Rights Shares.

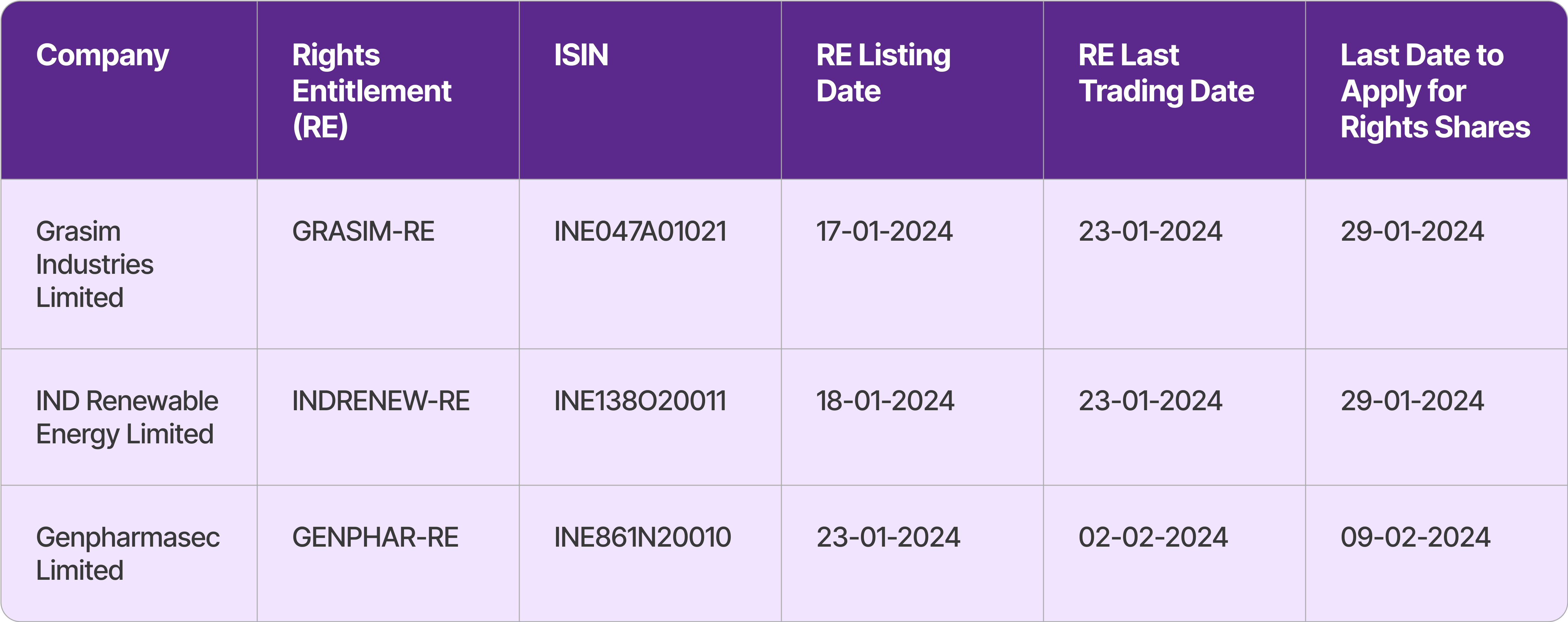

The 3 companies which have listed Rights Entitlements in January 2024 are:

NOTE: REs will exist as temporary Demat securities in your account. If they are not used to apply for Right Shares or traded, they will lapse.

How to use REs to apply for Rights Shares?

REs can be used to apply for Rights Shares in the following 3 ways:

- - Online through ASBA (Applications Supported by Blocked Amount) if your bank supports it just like you do for an IPO

- - Online through the RTA (Registrar and Transfer Agent) website***- [https://rights.integratedindia.in/](https://rights.integratedindia.in/)***

- - Offline by filling the Composite Application Form (CAF) received in your courier from the company’s RTA and then submitting it at a Self Certified Syndicate Banks (SCSBs) branch.

To learn more about rights, click here.