Monday, December 7, 2020 4:07 pm

PRICOL-RE | 750650 | INE726V20018

Pricol Limited has issued rights to its existing shareholders. This means if you hold shares of this company as on record date you can apply for more shares of the same company (in proportion to your existing shares - 2 for every 7 shares held) at a discounted price of Rs.30.

Pricol Limited will issue Right Entitlements (REs) to anyone who holds its shares as on record date 25th November, 2020. These REs will be temporarily traded on the exchanges and then get deactivated. You can use the REs to apply for the rights shares or you can sell them in the market (You will not be able to transact the REs intraday as they are settled on a trade-to-trade basis). Once you receive the REs from the company or purchase it from the market, you can apply for the rights shares.

For the above corporate action keep these dates in mindRecord date - 25th November 2020. The date before which you need to have shares in your demat to receive RE benefit L ast trading day of RE** - 11th December 2020. If you do not wish to subscribe, you can sell the RE online on or before 11th December 2020.

Subscription close date - 17th December 2020. The date by which you need to subscribe after which the RE ceases to exist.

Note: If you do not take any action, you would forfeit your rights allowing them to expire, bringing their value to Rs. 0.

How To Apply? You can apply for a rights issue online through ASBA (Applications Supported by Blocked Amount) if your bank supports it just like you do for an IPO.

OR

You can apply offline by filling the Composite Application Form (CAF) received in your courier from the company’s RTA (Registrar and Transfer Agent) and then submitting it at a Self Certified Syndicate Banks (SCSBs) branch.

Due to the lockdown, SEBI has allowed applying for these rights by visiting the RTA website. Just follow these steps-

-

Visit ** https://rights.integratedindia.in/** and choose Pricol

-

Then choose ‘Apply for Right Issue and Payment’

-

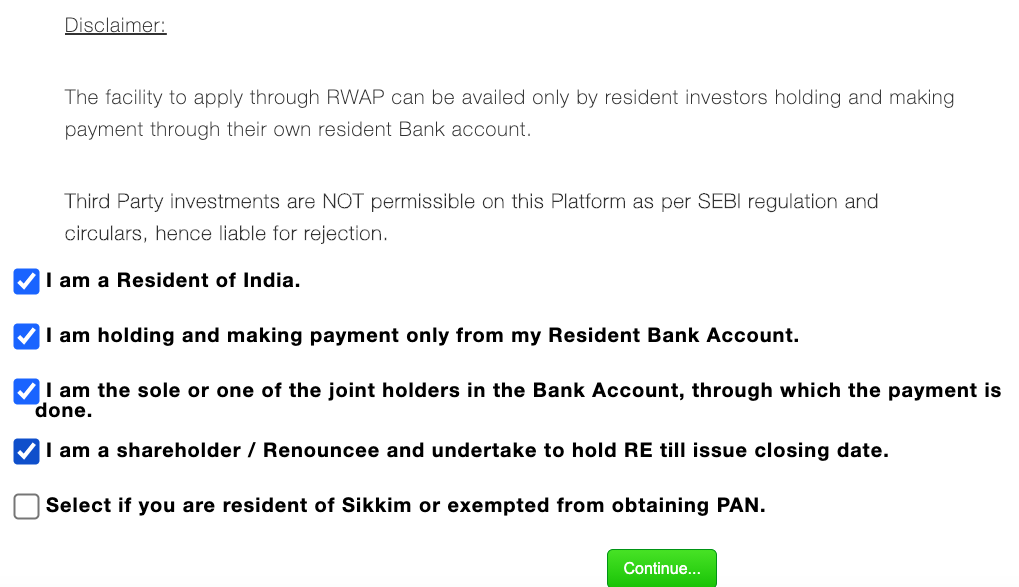

Select below declarations:

4. Select below eligible options:

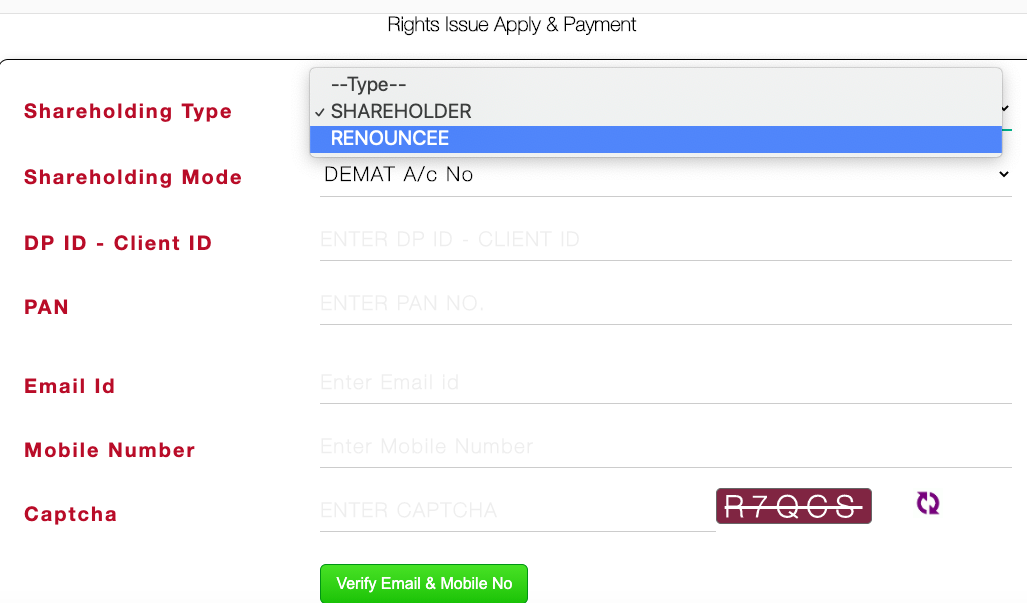

4. Select below eligible options:a. If you hold the shares on Record date, select first option “SHAREHOLDER”

b. If you bought RE shares in the open market, select second option “RENOUNCEE”

c. Fill in your DP ID Client ID (check details below on how to find your DP details), and other details

5. Click on ‘Email & Mobile No.’

5. Click on ‘Email & Mobile No.’- Pay for your order using UPI or NEFT

**You can find your DP and Client ID with these steps -**1. Log-in to the Upstox Pro Mobile app with your credentials

-

Click the icon with three lines on the top left corner

-

Click on your name at the top left corner of the page

-

You will see your account details listed on a screen similar to the one below

-

Note down the depository name and your Demat account number.

-

The first 8 digits of your 16 digits Demat account number is your DP ID and last 8 digits is your Client ID. Your DP Name is RKSV securities India Private Limited.

In case you still own physical shares despite opening a Demat account, select ‘Demat Account number Information registration’ and follow the instructions on the screen.

The Rights Shares will be credited to your Demat account and you will also receive a confirmation SMS from the depository for the same. Note that the Rights Shares under temporary ISIN will not be available for trading/holding until listed on Exchange.

To know more, read the circular here.

To know more about FAQs on Rights Entitlement Trading visit below links:

-

FAQs by the NSE