Upstox Originals

Key lessons from Dabur India’s turnaround story

.png)

5 min read | Updated on August 05, 2024, 12:57 IST

SUMMARY

Business turnaround stories always provide great insights and learning opportunities. From troubled times, investors can study mistakes made, evaluate their impact, and then apply these assessments to their current investments. Similarly, studying turnarounds - helps understand the importance of strong management, the necessity of tough decisions. In this article, we take on one such story of Dabur India.

Stock list

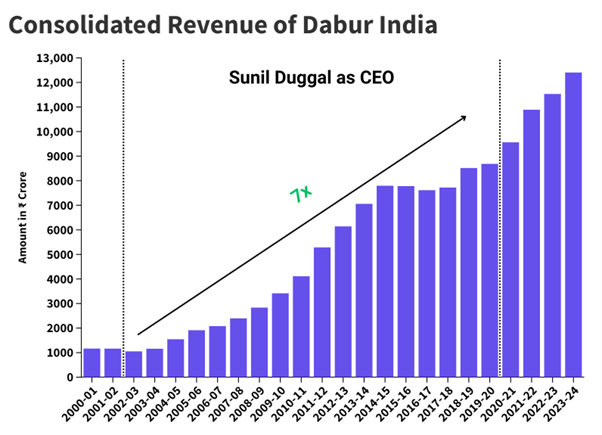

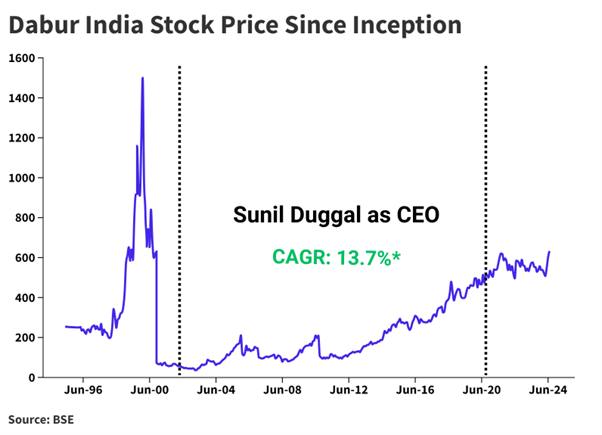

Dabur's share price returned almost 14% pa during Mr. Duggal's tenure

Despite being a household name with a strong presence in the FMCG market, Dabur India found its growth stagnating at the turn of the century. The company faced stiff competition, and despite high demand for its products, it struggled to expand its market share and improve profitability.

Financial snapshot during tough times

| Financial Metric | FY98 | FY99 | FY00 | FY01 | FY02 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| Revenue (in ₹ Crore) | 811 | 915 | 1,043 | 1167 | 1,163 | 7.5% |

| Net Profit (in ₹ Crore) | 45 | 50 | 77 | 78 | 64 | 7.3% |

| Operating Profit Margin | 10.2% | 8.8% | 9.0% | 10.2% | 9.2% | -2.0% |

| ROCE | 16.3% | 14.0% | 14.3% | 18.7% | 15.2% | -1.4% |

Source: Dabur Annual Reports

What were the key challenges faced:

Before 2002 Dabur was grappling with several significant challenges, including:

-

Stagnant growth: Despite robust demand, Dabur's revenue growth was sluggish. Dabur's revenue growth rates were less than 10% annually, failing to keep pace with the broader FMCG market growth of around 15% during the same period.

-

Intense competition: Dabur faced fierce competition from larger FMCG companies like HUL and P&G, which had more extensive resources and larger marketing budgets. This led to a loss in market share for Dabur.

-

Inefficient operations: Dabur's operations were hampered by inefficiencies, particularly in its production and supply chain processes. Significant resources were diverted to maintain outdated production facilities and handle logistical challenges.

-

Limited product portfolio: Dabur's product portfolio was heavily reliant on a few key products like Dabur Chyawanprash and Dabur Amla Hair Oil. When consumer trends began to shift towards new categories like ready-to-drink beverages and premium skincare products, it hurt Dabur.

-

Weak distribution network: Dabur’s distribution network was not extensive enough, particularly in rural areas. In many rural parts of India, Dabur's products were not available in local kirana (grocery) stores, which limited the company’s reach to a significant portion of potential customers.

-

Management challenges: Internal management challenges included a lack of clear strategic direction and leadership. Different divisions pursued disparate strategies without a unified vision, leading to fragmented efforts and inefficiencies.

Enter Sunil Duggal: A New Era

In mid-2002, Sunil Duggal took over as the CEO of Dabur India. His appointment marked a turning point. Mr. Duggal is an engineering graduate from the Birla Institute of Technology and Science and holds an MBA from IIM-C. Before joining Dabur in 1995, he worked at Bennett, Coleman and Co. and PepsiCo. He stepped down as Dabur’s CEO in July 2020.

Strategic overhaul: Mr Duggal's key initiatives

-

Outsourcing non-core businesses: One of his first moves was to streamline operations by outsourcing non-core functions such as IT. This allowed Dabur to focus more on its core competencies.

-

Entering new categories: Dabur diversified its product portfolio, venturing into new categories like skincare, packaged fruit juices, and toothpaste. The introduction of innovative products like Dabur Red Toothpaste, which modernised the traditional dant manjan, was a significant success.

-

Targeting rural India: He developed a blueprint to widen Dabur’s distribution network in these areas. This move paid off handsomely, as rural India became a key growth driver for the company.

-

Expanding overseas: Dabur went global and established manufacturing facilities in countries like the UAE, Egypt, Nepal, and Nigeria. This not only helped Dabur reach new consumers but also mitigated risks by diversifying its market base.

Impact on performance

Under Sunil Duggal's leadership, Dabur's financial performance saw a remarkable improvement. Revenues increased 7x, and profits soared by almost 22x (From FY02-FY20). The company's strategic acquisitions, such as those of Balsara's hygiene and home products business and the Turkish personal care firm Hobi Kozmetik, significantly bolstered its market position.

Financial Snapshot: before and after

A comparative analysis of Dabur's financials before and after Mr. Duggal's appointment highlights the transformation:

| Financial Metric | Pre-Duggal (FY02) | Post-Duggal (FY20) | 18-Year CAGR |

|---|---|---|---|

| Revenue (in ₹ Crore) | 1,163 | 8,685 | 12% |

| Net Profit (in ₹ Crore) | 64 | 1,448 | 19% |

| Operating Profit Margin | 9.2% | 20.6% | NA |

| ROCE | 15.2% | 28.0% | NA |

Source: Dabur Annual Reports, screener.in

Source: Dabur Annual Reports, screener.in

Data Source: BSE | * CAGR Period: June 2002 to July 2020

Data Source: BSE | * CAGR Period: June 2002 to July 2020Lessons for today

Dabur's turnaround offers several valuable lessons:

-

Innovation and consumer focus: Constant innovation and a keen focus on consumer needs can drive long-term success. Dabur’s product revamps and new launches kept it relevant and competitive.

-

Adaptability: Businesses must be willing to adapt to changing market conditions and consumer preferences. Dabur’s shift to new product categories and rural markets is a prime example.

-

Strategic focus: Concentrating on core strengths while outsourcing non-core activities can lead to greater efficiency and better resource allocation.

-

Global expansion: Diversifying markets can mitigate risks and provide new growth opportunities. Dabur’s international ventures helped buffer it against domestic market fluctuations.

While these may seem like very obvious points to highlight, we encourage you to analyse your investments under this microscope and check how many can tick all of these points. Companies that consistently meet most of this criteria are likely to deliver meaningful long-term shareholder value.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story