Upstox Originals

How to earn better returns in the current IPO market

.png)

3 min read | Updated on May 08, 2024, 13:19 IST

SUMMARY

In this thriving IPO market, are there segments which can deliver better returns for investors? In this article, we aim to identify potential opportunity areas that are likely to generate higher returns. Read on to find out more.

Aadhar Housing Finance to TBO Tek IPOs: 9 Public issues to open for subscription this week

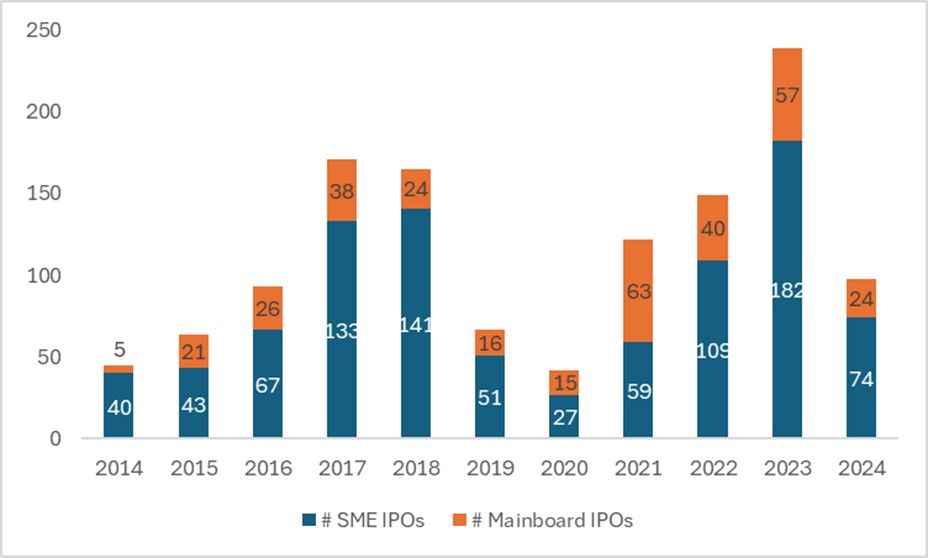

Anyone who reads financial news, or notices billboards for that matter, must have noted the flurry of IPOs being announced or listed. The total number of successful IPOs since 2021 has been consistently increasing.

In fact, the number of successful mainboard IPOs has been higher in each year during the 2021-2023 period, than in any year since 2014.

Finally, as of April 2024, we have already surpassed the run rate of 2023 (mainboard + SME).

Number of successful IPOs continue to rise*

Source: Public data, news articles; *Figures for 2024 are till April.

Now to the question: Where are the pockets of opportunities?

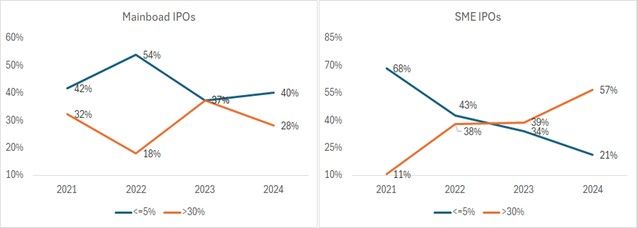

The chart below indicates that listing gains in SME IPOs have been consistently increasing, with more than 50% SME IPOs in 2024 delivering listing gains higher than 30%. Enthusiasm in the mainboard IPOs seems to be slowing down, with only 28% of them delivering listing gains higher than 30%, down from 37% in 2023.

Listing day gains higher in SME IPOs versus Mainboard IPOs*

Why is this happening?

There could be multiple reasons; here are two we would like to highlight: Valuations: As we show below, valuations of SME companies are more reasonable than the mainboard ones. We believe this could make them potentially more appealing to investors and help deliver outperformance. We take note of the moderation in 2024 mainboard valuations and an increase in SME valuations. Could it impact performance? We will have to wait and watch.

SME valuations more reasonable than mainboard IPOs*

| Median PE (x) | ||

|---|---|---|

| Year | Mainboard | SME |

| 2022 | 33.9 | 17.9 |

| 2023 | 32.1 | 15.2 |

| 2024 | 25.2 | 18.3 |

Source: Public data, news articles; *Figures for 2024 are till April; 2021 not included due to paucity of data

Risk-on environment: While difficult to prove with data, during bull markets, investors tend to have a risk-on approach and are willing to bet a little more riskier than they usually would. SME IPOs that typically represent more riskier investment propositions have benefitted from this approach.

Also Read: Key things to know about Aadhar Housing Finance IPO

What should investors do?

At the outset, let us make one thing clear: this is not blanket advice. SME IPOs are delivering better returns for investors. Consequently, investors could search for investment opportunities in the SME space.

A word of caution: Since sentiments change quickly, investors should evaluate each company on its merits before making any investing decisions.

Upcoming IPOs with opening dates

| Date | Type | Company |

|---|---|---|

| 03-05-2024 | SME | Slone Infosystems |

| 06-05-2024 | SME | Refractory Shapes |

| 06-05-2024 | SME | Winsol Engineers |

| 06-05-2024 | Mainline | Indegene |

| 07-05-2024 | SME | Finelistings Technologies |

| 07-05-2024 | SME | Silkflex Polymers |

| 08-05-2024 | SME | TGIF Agribusiness |

| 08-05-2024 | Mainline | TBO Tek |

| 08-05-2024 | Mainline | Aadhar Housing Finance |

| 09-05-2024 | SME | Energy Mission Machineries |

To know more about IPOs listing, schedule and upcoming IPOs, click here

About The Author

Next Story