Upstox Originals

US or China: Who will blink first?

8 min read | Updated on April 11, 2025, 20:25 IST

SUMMARY

Both the US and China continue to escalate tariffs with no end in sight. At this point, what started as a trade war has transformed into a clash of titans. As this disrupts global trade with the entire world as collateral damage, one might wonder: who will blink first?

China accounted for 69% of the world's production of rare earth elements in 2023. | Image: Shutterstock

While he was referring to an actual war, the quote might even apply to the ongoing global trade war. President Donald Trump, on April 8, announced an additional 50% tariff on Chinese imports, effectively bringing the total tariff on Chinese goods to a whopping 104%.

If one were to be honest, at this rate, it's not a tariff, it's an embargo! An over 100% hike in the cost of goods is not only going to make them expensive, it will make them unaffordable.

President Trump has taken this action in retaliation to China imposing ~34% tariff on American goods, which in itself was a retaliation to the tariffs imposed on China as a part of America’s so-called ‘Liberation Day’ tariff announcement.

To a certain extent, the Liberation Day tariffs have had some impact, with more than 50 countries, including India, offering to negotiate with America. Among major countries, China was the only exception. It insisted that China would not be bullied into submitting to America.

Which brings us to our central point - at this point, the ‘game’ is not about tariffs and trade anymore, but a clash of egos between two of the world’s largest economies and we are now left wondering - Who will blink first?

First, let’s look at some facts.

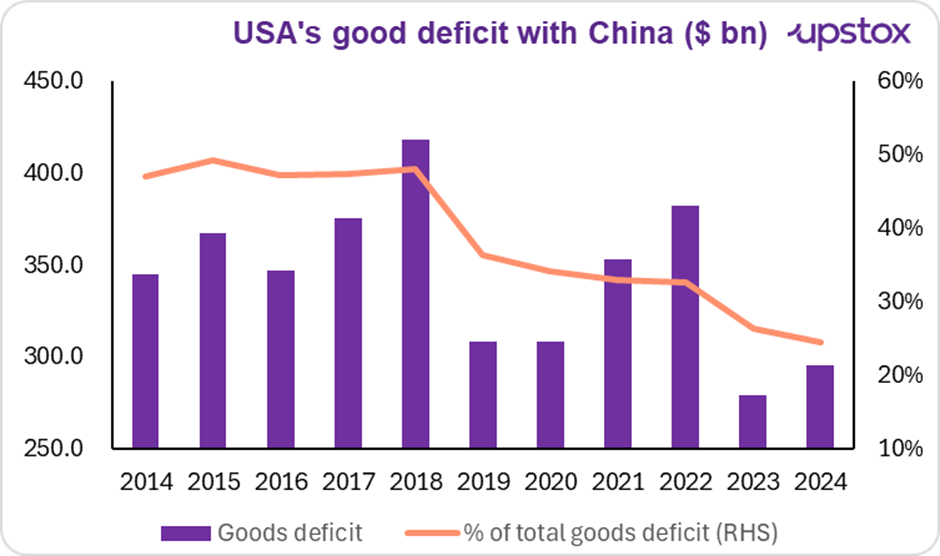

Would you believe it if told that the US's goods trade deficit with China has actually been reducing as a percentage of its overall goods trade deficit?

Source: Census.gov (American government website)

This has taken us by surprise, given all the noise America has been making about their trade deficit with China. Yes, it’s increasing in absolute terms, but as percentage of the overall deficit it has actually been reducing

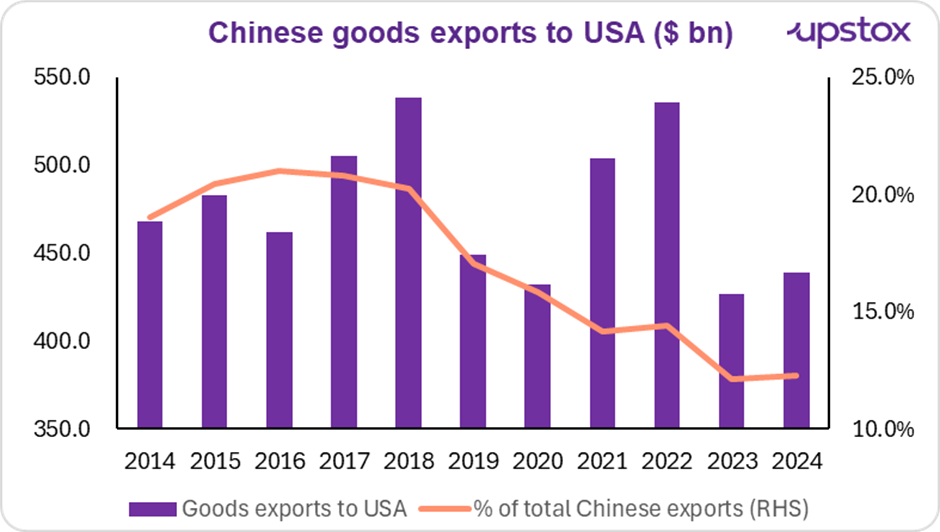

What could be the reason for the same? As can be seen from the chart below, since 2018, when tariffs were first introduced in Trump 1.0, China has started to diversify its exports away from the US, reducing its reliance on the country.

Source: Macrotrends.com, Census.gov

On the other hand, American exports to China have stagnated not only in absolute terms, but also in percentage terms

Source: Census.gov

This gives China two critical advantages:

-

It is less reliant on America, so it can always find ways to increase its export share with its other trading partners, many of whom are also target of the Liberation Day tariffs

-

More importantly, if US-China continue to escalate the rate of tariffs, the US will face a higher impact. Let’s take a simple example to understand this. Assume China exports $100 worth of goods to the US and the US exports $50 worth of goods to China. Assuming a 50% equal tariff, mathematically, the US will get impacted more than China, because the US’s exports are lower.

One could argue that at the current rates, US consumers can always buy alternative products. While true over the longer term, in the short term substitution is not always that easy.

A few other points that work in China’s favour are:

Manufacturing excellence

One must (even grudgingly) admit that Chinese manufacturing technology and efficiency are unmatched globally. Here is what Apple CEO, Tim Cook, said in September 2024. Comments below are paraphrased.

"The popular perception is that companies come to China because of low labour costs. The truth is China stopped being a low labour cost country many years ago. The reason is because of the skill, the quantity of skill in one location, and the type of skill it is.” He noted that Apple products require "really advanced tools and precision. And the tooling skill is very strong here. You know, in the US, you could have a meeting of tooling engineers, and I am not sure we could fill the room. In China, you could fill multiple football fields."

Ironically, after the video was circulated, President Trump’s close confidant Elon Musk, commented, "True" on X (formerly Twitter)

China’s rare earth control

China today has a monopoly on rare earth minerals like dysprosium, gadolinium, lutetium, samarium, among others. While one might have ignored studying these names when learning about the elements table, their role in the global economy is undeniable. They play an important role in vital areas of defence, electronics, medicines, etc.

China accounted for 69% of the world's production of rare earth elements in 2023, far ahead of the United States (12%), Burma (11%) and Australia (5%).

On April 4, 2024, China imposed an export ban on these rare earth minerals to the USA, an indirect way to impose pressure on the country.

China can manage the market easier

Chinese state-run capital plays a vital role in managing their markets and economy. For instance, on April 7th, Central Huijin Investment, a unit of China Investment Corp, intervened in China-listed shares via exchange-traded funds in order to contain the fall in the markets.

China is known to use state directed capital to smoothen out any sharp market volatility. This is somewhat similar to India, where institutions like LIC are asked to step in during times of market turmoil. While one can argue the economics of this, the point is, that China’s active intervention definitely softens the blow in the short term.

China can be long term focussed

Unlike Trump, who has a mid-term election to worry about in 2026 and a proper Presidential election in 2029, Chinese politicians can be much more long-term focussed. This gives them an edge and an ability to wait it out, till they are able to achieve favourable terms.

China’s growing global influence

China has seen an undeniable increase in its global influence. For instance, China is Latin America’s top trading partner and a major source of both foreign direct investment and energy and infrastructure lending. China is also Africa's largest bilateral trading partner. In 2024, the total trade between China and Africa reached ~$295.5 billion. As such, one could argue that the US’s ‘America First’ policy might just strengthen Beijing’s international reach.

This is, of course not to say, the United States does not have a few aces up its own sleeve.

It’s the world’s largest consumer

America is the world’s largest consumer market - accounting for 30% of global consumer spending despite representing less than 5% of the global population. In 2023, the personal consumption expenditure in the US was almost ~$16 trillion. Not only does America consume the most, it is also one of the more premium markets which means producers can realise higher margins.

The United States is too important a market to disregard, especially for a country like China, which has developed substantial production capabilities.

Other countries willing to play ball

Most other impacted countries have offered to lower their tariffs in order to bring back the status quo with America. As many as 50+ countries have reached out to Washington to start negotiations and strike deals.

Yes, right now, America is fighting a war on multiple fronts, but if it is able to quickly strike deals with other countries, it will then solely be able to focus on its equation with China.

Trump’s popularity

Trump currently enjoys massive popularity and even loyalty in America. He has a strong control over his party, both houses of Congress and enjoys almost unquestioned support from his voter base. This gives him strength to persevere even in these challenging times.

China’s trade practices

There is definitely an argument to be made that Chinese trade practices are perceived as unfair across many countries. India itself has imposed tariffs (or equivalent measures) to contain what it has called unfair trade practices. At some point, China might also be forced to relook at its trade practices to arrive at a more even playing ground.

In summary

Tit For Tat is a well enshrined principle of game theory. Both players benefit if they cooperate. Both stand to make losses if one or both of them defect. However, even more dangerous is the fact that if only one defects they lose out more.

Codified by mathematical psychologist Anatol Rapoport, the strategy is however more effective when it is tit for tat with forgiveness. This involves occasionally cooperating even when there are other defects. It is easy for two opponents to get stuck in a cycle of mutual defection from which they cannot escape unless and until one decides to cooperate.

While one may hope cooler heads prevail, the situation currently seems volatile, without either side looking to relent. Both sides have announced that they are unwilling to cede ground. At this point, their strategy seems more on the lines of a few other words by Napoleon - "Never interrupt your enemy when he is making a mistake."

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story