Upstox Originals

The slowdown signal: Driven by capex, offset by consumption

.png)

5 min read | Updated on January 17, 2025, 15:48 IST

SUMMARY

As per the NSO, two sectors that account for 16% of India’s overall Gross Value Added (GVA) have already started to slow down. A drop in the government’s capital expenditure is weighing on overall economic growth. On a more optimistic note, resilient rural growth has provided a buoy. In this article, we take a detailed look at these factors and break down what this means for investors.

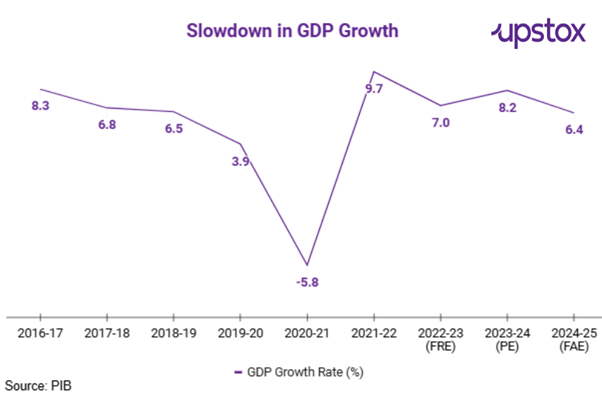

As per the NSO’s India is expected to clock in a GDP growth rate of 6.4% in FY25

As per the NSO’s India is expected to clock in a GDP growth rate of 6.4% in FY25. This is the slowest growth in the last few years. This outlook suggests a cautious approach, indicating that short-term consumer-driven growth may not be enough to offset the long-term impact of subdued investment.

Note: FRE: First Revised Estimates; PE: Provisional Estimates; FAE: First Advance Estimates.

A deeper look into economic slowdown

Gross Fixed Capital Formation (GFCF), which means capital expenditure (capex) by the government is expected to moderate to 6.4% in FY25, down from 9.0% in FY24. This is primarily due to an election-led slowdown in the pace of spending. We do note that some reports indicate that the government does intend to once again pick up the pace of this spend.

That said, for now, the overall spending is projected to fall short of the budgeted estimates, contributing to a slowdown in the economy.

To that end, management commentary in the ongoing Q3FY25 results (quarter ended December 2024) will be keenly monitored.

On the macroeconomic side, rising crude prices, pace of INR depreciation are all worrying factors that are impacting the overall economy

On a positive note - private consumption is poised to be a major driver of growth in FY25, with an estimated increase of 7.3%, a notable rebound from the 4.0% growth in FY24.

Do note that recently consumption is also slowing down when compared with previous years but it remains the fastest growing GDP component. Any further slowdown in consumption could have a significant impact on the final GDP numbers.

| YoY% | FY23 | FY24 | FY25AE |

|---|---|---|---|

| Real GDP | 7.0 | 8.2 | 6.4 |

| Private consumption | 7.5 | 4.0 | 7.3 |

| Government consumption | 0.1 | 2.5 | 4.1 |

| Gross Fixed Capital Formation | 11.4 | 9.0 | 6.4 |

| Exports of Goods and Services | 13.6 | 2.6 | 5.9 |

| Import of Goods and Services | 17.1 | 10.9 | -1.3 |

Source: NSO; *AE stands for Advance Estimate

Which sectors are causing a slowdown?

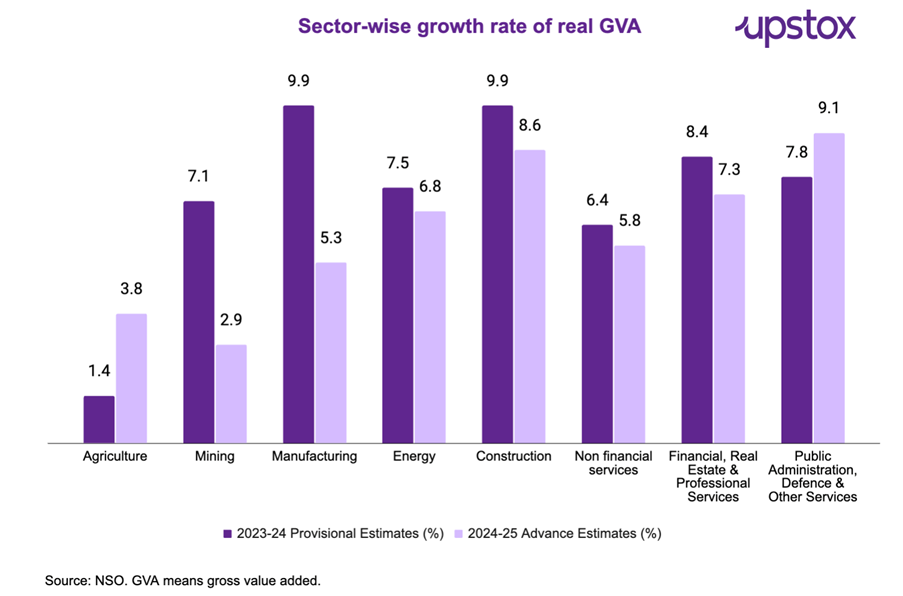

India’s manufacturing sector has seen a notable deceleration, with growth slipping to 5.3% from 9.9% in the previous year. The mining sector paints a similar picture, with growth dropping to 2.9%, down from a robust 7.1% last year. These two sectors combined account for about 16% of the country’s Gross Value Added (GVA).

In simple words, Gross Value Added (GVA) is the value that producers have added to the goods and services they have bought. While GDP measures the total value of all goods and services produced in a country, GVA measures the value added to a product.

If it's still a little confusing, think of GVA as the difference between the total value of a product (let’s say ₹1,000) and the cost to produce it (₹400). So GVA here would be $₹600. That is the value the producer of the product has added.

Why does this matter?

This decline comes at a time when India is striving to establish itself as a global manufacturing hub. Reducing GVA effectively disincentivises new players to enter a field and set up their own plants. So, reducing GVA is something to take seriously.

The impact of this slowdown could extend beyond the sectors themselves, potentially dampening overall momentum and highlighting the need for policy measures to reignite growth.

Amid these challenges, agriculture has emerged as a bright spot, recording 3.8% growth this year compared to a modest 1.4% last year. Additionally, government spending on public services has accelerated to 9.1% from 7.8%, driven by rising rural demand.

How are companies faring?

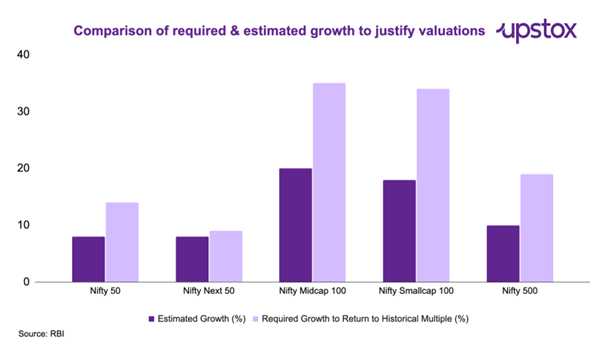

Earnings performance in Q2FY25 revealed a slowdown in earnings. As the RBI has noted, this has increased the asking rate for earnings growth in the future. Basically, if companies want to maintain current valuations, they will need to deliver higher growth. If they fail to do so, share prices could be meaningfully impacted.

What does this all mean?

The Indian economy is currently facing some challenging waters. Timely steps in the form of manufacturing incentives, measures to boost consumption, and efforts to renew private capex could all help stem this tide. To that end, the upcoming union budget and the ongoing Q3FY25 earnings would be key monitorable for most investors.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story