Upstox Originals

Shelter from the storm: What do the charts say?

4 min read | Updated on January 13, 2025, 17:17 IST

SUMMARY

As 2025 starts on a sombre note for the markets, investors are deciding what their next move should be in the markets. With the help of charts, we analyse some key sectors that are technically well-positioned to provide a safe shelter in this stormy weather. A combination of relative strength and relative rotation graphs point towards three sectors that are poised to fare better than the others. Read on to find out more.

Nifty FMCG, Consumption and Pharma could be suitable for risk-averse investors

The Nifty displayed notable optimism in the first half of 2024, followed by a more cautious and resilient stance in the latter half. As 2025 begins on a subdued note, year-to-date (YTD; as of close on January 10, 2025) returns for key indices reflect a decline. The Nifty 50 and Nifty 500 have posted negative returns of (-1.3%) and (-3.0%), respectively, while the Bank Nifty has underperformed significantly, recording a deeper decline of (-4.6%).

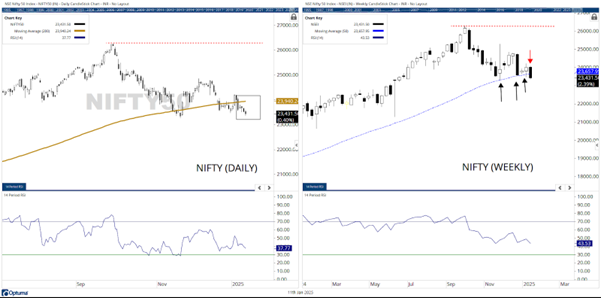

A potential top?

The Nifty faces two significant technical challenges that signal potential downside pressure. By the close of the week ending Friday, January 10, the Nifty has decisively breached two critical support levels.

Firstly, the index has closed firmly below its 200-day moving average (200-DMA), currently positioned at 23,940, marking a bearish development. Secondly, it has violated the 50-week moving average (50-WMA) at 23,657, a level previously tested three times without breaking. This repeated test, followed by a breach, exacerbates the negative sentiment.

These developments have shifted resistance levels lower, with the 23,650–24,000 zone now acting as a formidable resistance area for the foreseeable future. Furthermore, the recent peak of 23,277 is likely to serve as a significant top for the index, and it appears improbable that this level will be breached any time soon in 2025.

RS’s critical role in portfolio management

Incorporating relative strength as a guiding principle in portfolio construction not only enhances return potential but also fortifies the portfolio against adverse market conditions, ensuring sustainable performance over time.

Defensive positioning: Key sectors to watch out for

The prevailing technical setup in the markets suggests the emergence of a risk-off sentiment, steering investors toward a more defensive stance. In such an environment, the focus naturally shifts to sectors that demonstrate resilience and the potential for relative strength, both of which are essential for safeguarding portfolios during uncertain times.

The Relative Strength line of the Nifty FMCG index has found support at a multi-month trendline, indicating a strong potential for bottoming out.

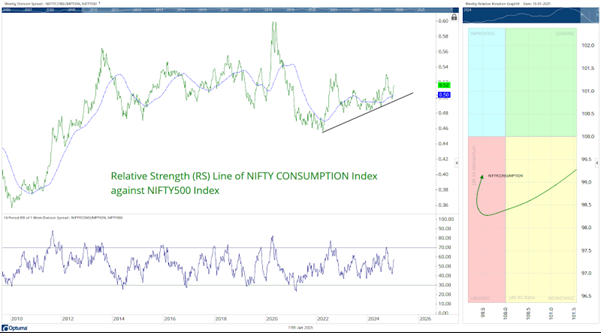

The Relative Strength line of the Nifty Consumption index is on an upward trajectory, positioned above its 50-week moving average, and is expected to continue improving its relative performance.

Despite currently residing in the lagging quadrant of the Relative Rotation Graph (RRG) when benchmarked against the broader Nifty 500 index, the index is displaying a significant enhancement in its Relative Momentum, indicating a potential shift toward stronger relative outperformance.

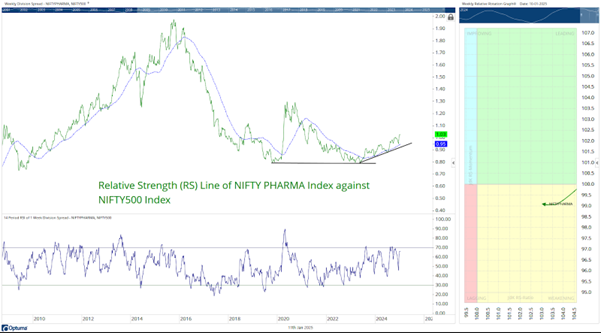

The Relative Strength line of the Nifty Pharma index, when compared to the Nifty 500, has established a classic double-bottom support and is now trending upward, forming a series of higher highs and higher lows while remaining above its 50-week moving average.

Currently positioned within the weakening quadrant of the Relative Rotation Graph (RRG), the index shows strong potential for improving its Relative Momentum against the broader market, signaling the likelihood of enhanced relative performance in the near term.

Investor insights

Nifty FMCG and Nifty Consumption benefit from their exposure to staples and consumer-driven products, which are less sensitive to economic cycles. Meanwhile, Nifty Pharma offers stability, supported by the inelastic demand for healthcare and pharmaceuticals. These sectors collectively provide a balanced mix of defensive attributes and potential relative strength, making them attractive choices for risk-averse investors.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story