Upstox Originals

Revving up or slowing down? Checking up on auto majors

.png)

7 min read | Updated on November 14, 2024, 19:25 IST

SUMMARY

The Q2 results of the Indian auto sector reveal a weak performance, with most players missing market expectations. This outlines the broader demand slowdown that companies have been highlighting for the past few months. On a more positive note, auto companies have managed to keep costs under check, which has helped keep margins stable in a challenging environment.

Auto OEMs have reported a weak performance in Q2FY25

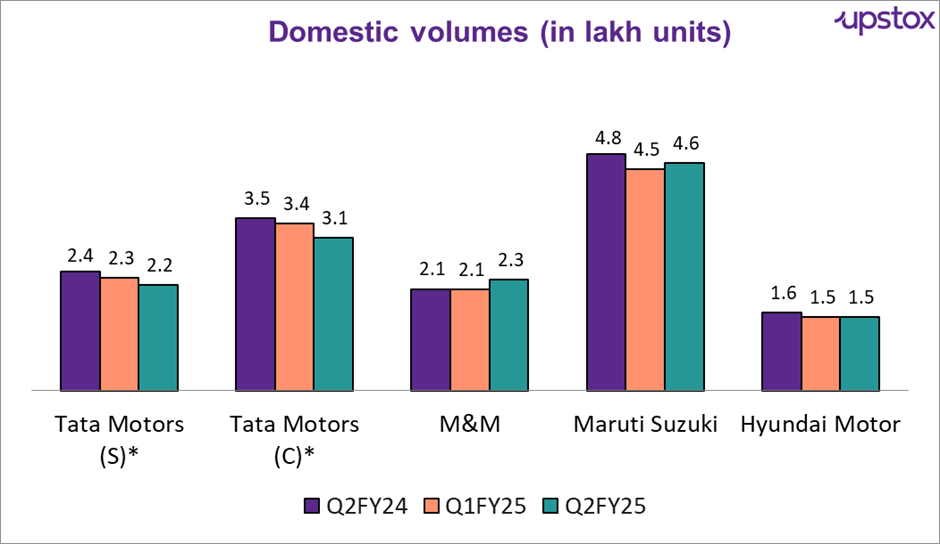

In this article, we look at the Q2FY25 performance of some of the auto majors, mainly in the passenger and commercial vehicle segment. Q2FY25 paints a bleak picture of the overall automotive industry. Most players have seen volumes decline or remain flat, highlighting demand challenges. The pace of new launches has also slowed down in the past quarter, which also explains a slowdown in volumes.

Source: Company presentations, press releases ,*Tata Motors (C ) - Consolidated (including JLR); Tata Motors (S) - Standalone business; M&M volumes also exclude tractors

Revenue performance

As you would guess, a key factor in the revenue of auto companies is the Average Selling Price (ASP) of vehicles. Given the weak volume growth and similarly weaker revenue, it seems auto OEMS have not been able to increase pricing as well, further hinting at a weak demand environment.

Trend in revenue

| Company | Q2FY24 | Q1FY25 | Q2FY25 | YoY | QoQ |

|---|---|---|---|---|---|

| Tata Motors (C)* | 1,05,129 | 1,08,048 | 1,01,450 | -3.5% | -6.1% |

| Maruti Suzuki | 37,339 | 35,779 | 37,449 | 0.3% | 4.7% |

| M&M | 34,436 | 37,218 | 37,924 | 10.1% | 1.9% |

| Hyundai Motor | 18,659 | 17,344 | 17,260 | -7.5% | -0.5% |

| Tata Motors (S)* | 18,542 | 16,862 | 15,518 | -16.3% | -8.0% |

| Total | 1,95,563 | 1,98,389 | 1,94,083 | -0.8% | -2.2% |

Source: Screener.in; *Tata Motors (C ) - Consolidated (including JLR); Tata Motors (S) - Standalone business

Revenue weakness has also dripped down to operating performance, with most companies registering a decline in absolute EBITDA. Moreover, adverse commodity prices have added further strain. We call out M&M here, whose performance is buoyed by strong performance in the tractor segment as well as strength in the auto segment driven by the continued success of the Thar and XUV700.

Trend in operating performance (EBITDA)

| Company | Q2FY24 | Q1FY25 | Q2FY25 | YoY | QoQ |

|---|---|---|---|---|---|

| Tata Motors (C)* | 23,056 | 24,447 | 20,198 | -12.4% | -17.4% |

| Maruti Suzuki | 6,689 | 6,496 | 6,428 | -3.9% | -1.0% |

| M&M | 8,704 | 10,599 | 10,652 | 22.4% | 0.5% |

| Hyundai Motor | 3,032 | 2,901 | 2,753 | -9.2% | -5.1% |

| Tata Motors (S)* | 2,923 | 2,726 | 2,398 | -18.0% | -12.0% |

| Total | 41,481 | 44,443 | 40,031 | -3.5% | -9.9% |

Source: Screener.in; *Tata Motors (C ) - Consolidated (including JLR); Tata Motors (S) - Standalone business

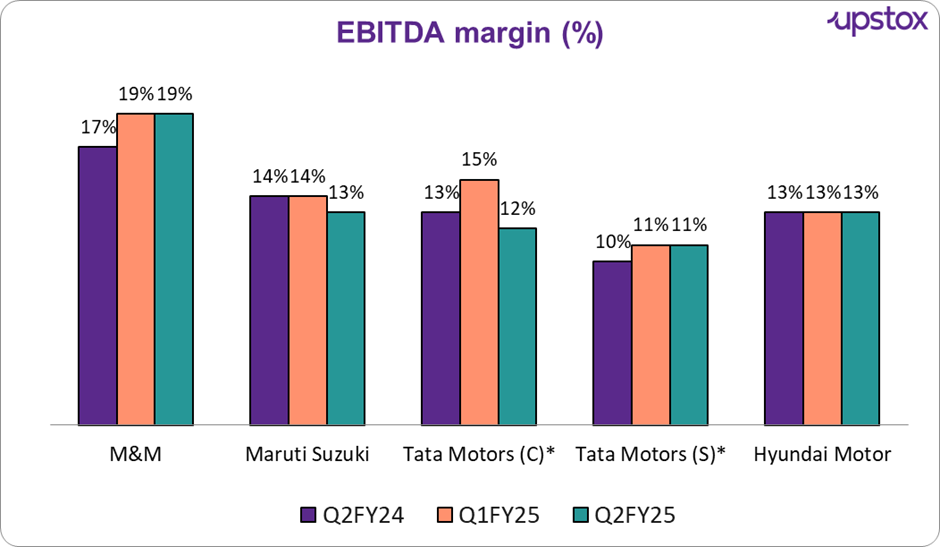

On a more positive note, we are encouraged to see that almost all of the companies have been able to maintain their EBITDA margin. Domestic Auto OEMs have been known to be very cost-conscious, which is reflected in the performance here as well. Despite an overall weakness, companies have managed to keep costs under check, which has helped stablise margins.

Source: Screener.in, *Tata Motors (C ) - Consolidated (including JLR); Tata Motors (S) - Standalone business

Finally, we look at the PAT performance, and no surprise - weak operating performance has weighed on PAT as well.

Trend in Profit After Tax (PAT)

| Company | Q2FY24 | Q1FY25 | Q2FY25 | YoY | QoQ |

|---|---|---|---|---|---|

| Tata Motors (C)* | 3,832 | 5,692 | 3,450 | -10.0% | -39.4% |

| Maruti Suzuki | 3,786 | 3,760 | 3,102 | -18.1% | -17.5% |

| M&M | 2,484 | 3,546 | 3,361 | 35.3% | -5.2% |

| Hyundai Motor | 1,628 | 1,490 | 1,375 | -15.5% | -7.7% |

| Tata Motors (S)* | 1,270 | 2,190 | 477 | -62.4% | -78.2% |

| Total | 11,730 | 14,488 | 11,288 | -3.8% | -22.1% |

Source: Screener.in; *Tata Motors (C ) - Consolidated (including JLR); Tata Motors (S) - Standalone business

Here are some other key challenges facing India's auto industry:

-

Demand fluctuations: Entry-level car sales are struggling as consumer preferences shift toward higher-end models, impacting revenues for brands like Maruti Suzuki.

-

Global market pressures: International economic conditions, especially in key regions like Europe and China, are impacting sales for brands like Tata Motors and Hyundai.

-

Supply chain constraints: Companies are dealing with supply chain bottlenecks and cost fluctuations, affecting production and profitability.

-

Increased competition: The rise of electric vehicles and new technologies demands faster adaptation and investment across the industry.

Street expectation vs reality

| Company | Market Expectations | Actual Results |

|---|---|---|

| Mahindra & Mahindra | Profit up 13% | Surpassed expectations |

| Tata Motors | Profit closer to ₹5,038 crore | Missed expectations |

| Maruti Suzuki | Profit: ₹3,525 crore | Fell short of expectations |

| Hyundai Motors | Spike in profit | Missed expectations |

Source: News articles, press releases

Management expectations

In the part below, we list some of the key management expectations, that encapsulate the current trends and expectations in this segment.

Tata Motors

-

Market dynamics: They expect continued challenges in key markets like China, with weak demand and heavy discounting impacting profitability.

-

Production and supply chain: Production issues and supply chain constraints are expected to persist, affecting volumes and sales.

-

Economic pressures: High warranty costs and increased marketing expenses are likely to continue putting pressure on profit margins.

Mahindra & Mahindra

-

Urban vs rural markets: Urban markets are facing fundamental stress, while rural markets are performing well.

-

Sustained growth: Management is optimistic about maintaining mid-high teen growth for the auto segment, helped by new launches.

-

Festive season impact: The festive season was positive for all passenger vehicle companies, though some had overstocked.

-

Higher expenses ahead: Expect higher expenses in Q3 FY25 due to new launches and marketing efforts, particularly for Born EV launches.

-

Focus on EVs: While there are no current expansion plans for the ICE segment, there's a phase 1 capacity plan of 100,000 units for the EV segment.

The table below summarizes the performance of the top stocks in the sector over the past 3 years.

| # | Name | Market Cap ₹ Cr. | P/E | EV / EBITDA | ROE % | 3-Year Stock Return % (2019-2024) | 3-Year Profit Growth % (2019-2024) |

|---|---|---|---|---|---|---|---|

| 1 | M & M | 3,47,162 | 29 | 15 | 18 | 46 | 23 |

| 2 | Maruti Suzuki | 3,45,528 | 25 | 14 | 17 | 14 | 26 |

| 3 | Tata Motors | 2,89,252 | 9 | 6 | 49 | 16 | 21 |

| 5 | Hyundai Motor | 1,39,838 | 24 | 13 | 40 | - | 19 |

| Average | 2,80,445 | 22 | 12 | 31 | 25 | 22 |

Source: Screener; Data as of 14-11-24

Conclusion

Despite recent hurdles, the auto sector shows potential for recovery, especially with anticipated demand in the festive season and strategic new launches. Brands are pivoting towards innovation and efficiency, which could bolster performance in the coming quarters.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story