Upstox Originals

PSU banks deliver holistic growth in Q2FY25 results

.png)

9 min read | Updated on November 15, 2024, 12:03 IST

SUMMARY

The recent Q2FY25 results for India's PSU banks when compared to their private peers, present a more optimistic picture. Major players have reported steady progress despite rising interest costs and competitive deposit mobilisation challenges. Let’s break down what’s driving these gains and what can be expected in the months to come.

Stock list

PSU banks have delivered a strong performance in Q2FY25

A similar analysis of PSU banks, however, points towards a more optimistic picture. Most PSU banks have posted strong revenue and profit growth this quarter.

In the tables below, we explore this quarter's trends in revenue and profitability growth for the top 5 PSU banks, chosen based on their market capitalisation.

Both private and public banks (top 5 that we have considered), have reported an ~15-16% YoY increase in revenue.

PSU Banks: Trend in revenue performance

| Company (₹ cr) | Q2 FY24 | Q1 FY25 | Q2 FY25 | QoQ (%) | YoY (%) |

|---|---|---|---|---|---|

| SBI | 1,12,169 | 1,22,688 | 1,29,141 | 5.3 | 15.1 |

| Canara Bank | 31,473 | 34,020 | 34,721 | 2.1 | 10.3 |

| Bank Of Baroda | 18,238 | 17,219 | 20,189 | 17.3 | 10.7 |

| Punjab National Bank | 29,383 | 32,166 | 34,447 | 7.1 | 17.2 |

| Indian Overseas Bank | 6,935 | 7,568 | 8,484 | 12.1 | 22.3 |

| Total | 1,98,198 | 2,13,661 | 2,26,982 | 6.2 | 14.5 |

Source: Company filings

But what stands out is the trend in profit after tax. While private banks reported a PAT growth of ~10% YoY and flat growth QoQ, PSU banks have reported a more robust growth of ~30% YoY and ~6% QoQ.

This sector-wide growth reflects PSU banks’ success in expanding their lending portfolios while keeping costs under control—a contrast to the private sector banks' mixed performance.

PSU Banks: Profitability trend (PAT)

| Company (₹ cr) | Q2 FY24 | Q1 FY25 | Q2 FY25 | QoQ (%) | YoY (%) |

|---|---|---|---|---|---|

| SBI | 16,648 | 20,094 | 20,565 | 2.3 | 23.5 |

| Canara Bank | 3,829 | 4,098 | 4,227 | 3.1 | 10.4 |

| Bank of Baroda | 4,426 | 4,764 | 5,405 | 13.5 | 22.1 |

| Punjab National Bank | 1,756 | 3,252 | 4,303 | 32.3 | 145.1 |

| Indian Overseas Bank | 625 | 633 | 777 | 2.3 | 24.3 |

| Total | 27,518 | 33,580 | 35,713 | 6.4 | 29.8 |

Source: Company filings

Improved asset quality

But it’s not just the numbers; it’s also about quality. PSU banks are making solid progress in managing asset quality. Gross NPAs and Net NPAs have dropped across the board, a testament to their strengthened recovery processes and risk management efforts.

PSU Banks: Trend in NNPA

| Company | Q2 FY24 | Q1 FY25 | Q2 FY25 | QoQ (%) | YoY (%) |

|---|---|---|---|---|---|

| SBI | 0.5% | 0.6% | 0.6% | 0.1 | 0.1 |

| Canara Bank | 1.4% | 1.1% | 1.0% | (0.2) | (0.4) |

| Bank Of Baroda | 0.8% | 0.7% | 0.6% | (0.1) | (0.2) |

| Punjab National Bank | 1.5% | 0.6% | 0.5% | (0.1) | (1.0) |

| Indian Overseas Bank | 0.7% | 0.5% | 0.5% | 0.0 | (0.2) |

Source: Company filings

Navigating the margin challenge

It's encouraging to note that Net Interest Margins (NIMs) have remained broadly stable.

| NIM (%) | Q2 FY24 | Q1 FY25 | Q2 FY25 | QoQ (%) | YoY (%) |

|---|---|---|---|---|---|

| State Bank of India | 3.3% | 3.2% | 3.1% | (0.1) | (0.2) |

| Canara Bank | 3.0% | 2.9% | 2.9% | 0.0 | (0.1) |

| Bank Of Baroda | 3.1% | 3.2% | 3.1% | (0.1) | 0.0 |

| Punjab National Bank | 3.1% | 3.1% | 2.9% | (0.2) | (0.2) |

| Indian Overseas Bank | 3.1% | 3.1% | 3.1% | 0.0 | 0.0 |

Source: Company filings

Capital boosts

To keep up with growth, PSU banks are actively shoring up their capital. PNB recently raised ₹5 billion through a QIP, while Canara Bank’s board approved raising ₹85 billion via AT1 and Tier II bonds.

These moves not only bolster their capital adequacy ratios but also ensure they have the funds to meet expanding loan demands and regulatory requirements. Bank of Baroda also took steps to maintain its capital adequacy, which will help sustain growth initiatives and withstand potential headwinds in asset quality

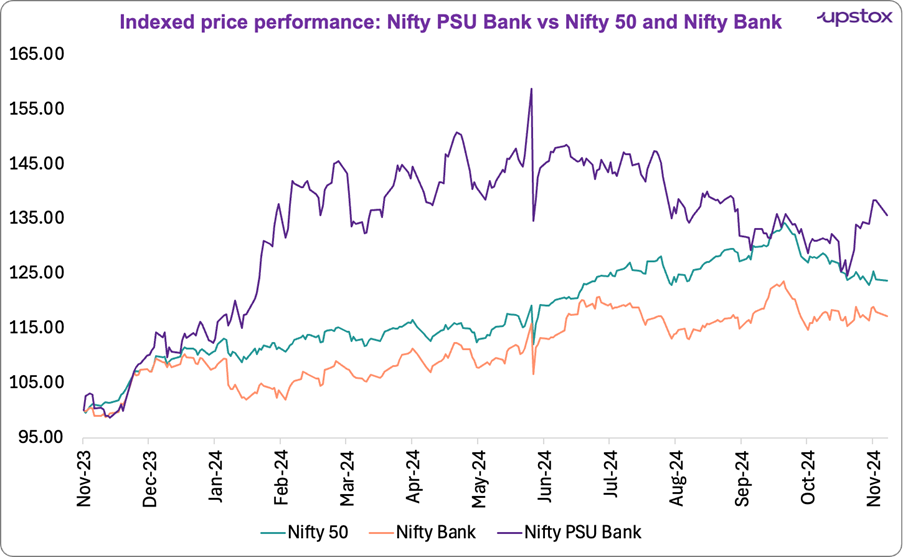

Impact on performance

Source: NSE

Results - Expectations versus actuals

Let’s analyse how the companies performed in Q2FY25 compared to their expectations.

| Company | Expectation | Actuals |

|---|---|---|

| SBI | NIMs expected to deteriorate further and cost of deposits will normalize; profit would increase. | In line with expectations |

| Canara Bank | Asset quality expected to improve while the margin may remain tight due to expectation of increase in cost of funds. | In line with expectations |

| Bank of Baroda | Growth and margins expected to remain steady. | In line with expectations, but margins saw minor contraction. |

| Punjab National Bank | NIMs expected to be in range bound. | In line with expectations |

Source: Press release, news articles

What does the future hold: Management guidance

State Bank of India

- Expects loan growth of 14-16% and home loan growth of 13-14% for FY25.

- Forecasts double-digit growth in deposits, aiming to retain market share.

- Targets credit cost of 0.5% and RoA at 1.0% for FY25. NIMs expected to stay moderate.

Canara Bank

- Targets 11% YoY credit growth and <1% credit cost for FY25.

- Aim for ~12% growth in the RAM (Retail, Agriculture, MSME) book.

- Expect credit costs to stay below 1% through FY25.

Bank of Baroda

- Revised FY25 growth guidance: deposit growth at 9-11%, credit growth at 11-13%.

- Aim to maintain NIM at 3.15% for FY25.

- RoA guidance is steady at 1.1% for the fiscal year.

Punjab National Bank

- Projects GNPA at 3.5-3.75% and NNPA below 0.5% by FY25.

- Plans to raise RAM to 58% by FY25 and 60-61% within 2-3 years.

- Credit cost guidance is 0.25-0.3% with credit growth of 11-12% and RoA of 0.9-1% for FY25.

Key risks

Let's look at a few key risks for PSU banks based on ICRA's projections:

-

Moderation in credit growth: With credit growth projected at 11.6-12.5% for FY25, down from 16% in FY24, PSU banks may face challenges in sustaining momentum. Slower loan growth could impact overall revenue and pressure margins.

-

NIM pressure: Lending rates may ease, but deposit rates are unlikely to decline at the same pace due to the need to attract deposits. This disparity could compress NIMs, affecting profitability.

-

Asset quality risks: While gross NPAs are projected to be stable, a slower economy or higher borrowing costs may put pressure on asset quality.

-

Liquidity constraints due to LCR norms: New Liquidity Coverage Ratio (LCR) requirements mean banks need to set aside more funds, reducing resources available for lending. This could slow credit growth, and banks may need to rely more on bond issuances to meet funding needs.

The table below highlights the performance of key PSU bank stocks over the past three years.

| # | Name | Market cap (₹ Cr) | 3Y Profit Growth (%) (FY21-24) | 3Y Stock return (%) (FY21-24) | P/B | ROA(%) |

|---|---|---|---|---|---|---|

| 1 | SBI | 7,59,351 | 44.0 | 18.0 | 1.8 | 1.1 |

| 2 | Bank of Baroda | 1,33,861 | 144.0 | 36.0 | 1.1 | 1.2 |

| 3 | Punjab National Bank | 1,21,572 | 52.0 | 37.0 | 1.0 | 0.6 |

| 4 | Indian Overseas Bank | 1,00,636 | 47.0 | 36.0 | 3.6 | 0.8 |

| 5 | Canara Bank | 95,151 | 75.0 | 31.0 | 1.0 | 1.1 |

| 6 | Union Bank of India | 90,916 | 69.0 | 33.0 | 0.9 | 1.0 |

| 7 | Indian Bank | 76,508 | 39.0 | 49.0 | 1.3 | 1.1 |

| 8 | Uco Bank | 53,969 | 190.0 | 48.0 | 2.0 | 0.5 |

| 9 | Bank of India | 51,764 | 48.0 | 22.0 | 0.7 | 0.8 |

| 10 | Central Bank of India | 48,605 | 68.0 | 37.0 | 1.5 | 0.6 |

| Average | 1,53,233 | 77.6 | 34.7 | 1 | 0.8 |

Source: Screener; *Data as on November 11, 2024

Conclusion: Staying competitive in a challenging environment

As India’s economy continues to grow, PSU banks are well-positioned to capitalise on the rising demand for credit. However, challenges such as higher deposit costs and increasing competition for market share may impact profitability. The sector’s commitment to maintaining asset quality and improving operational efficiencies should provide a cushion against these pressures.

Looking forward, the focus will likely remain on stable growth in the RAM segments (retail, agriculture, and micro, small, and medium enterprises), balanced capital deployment, and a strategic approach to cost management. With this momentum, PSU banks are expected to maintain strong performance, but caution remains due to the evolving interest rate environment and competitive deposit market.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story