Upstox Originals

Market mood swings: Navigating the rollercoaster

.png)

5 min read | Updated on October 29, 2024, 14:41 IST

SUMMARY

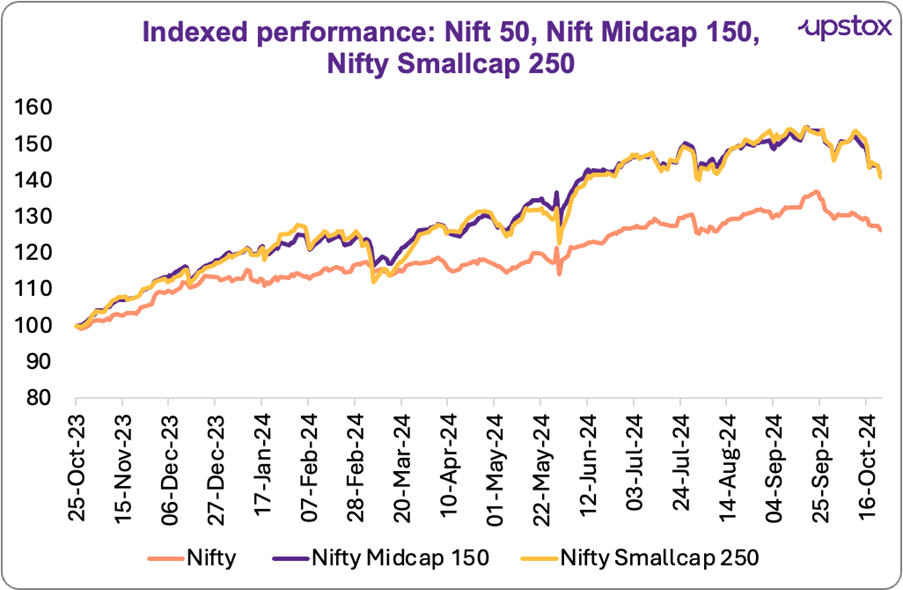

The past month has been rough for the markets, with indices pulling back after hitting all-time highs. The Nifty50 has declined ~8%, with 47 out of its 50 stocks posting negative returns. But what's behind this trend, and what do the early Q2 earnings results suggest about the future? We'll unpack the current market scenario, analyze the early earnings reports, assess valuations, and provide guidance for investors navigating these uncertain waters.

The markets have corrected ~8% from its high. What does that mean for investors?

After reaching new highs, the BSE Sensex and Nifty 50 have undergone significant corrections. From its highs towards the end of September, the Nifty50 has corrected ~8%. Similarly, Nifty Small Cap 250 and Nifty Mid Cap 150 have corrected ~8.5% from their all-time high in the past month.

Source: NSE; data is of 30/10/23 to 25/10/24

What has caused this correction - A natural rhythm, not a red flag?

Post-COVID-19, the markets have seen an unabated rally. They have overcome concerns relating to ratcheting global skirmishes, inflation worries, and even valuation concerns.

The recent drop must be seen in a slightly larger context. If we take a look back at recent history, the Nifty has seen its share of pullbacks.

In 2022, from January to June, the index dropped ~16%, followed by another ~9% decline between December 2022 and March 2023.

Even last year, around this time (September to October), there was a ~10% dip.

The recent wave of FII exits has been a major factor in the market’s downtrend. FII have pulled out ~₹88,000 crore from equities, just in the last month! Domestic Institutional Investors (DII), however, have stepped in, investing ~₹85,000-₹90,000 crore, which has helped ease the impact.

These dips are part of the market’s natural rhythm. Rather than a warning, corrections like these can be a healthy pause—a normal reset in a longer-term growth trend.

That said there are two key points to note

-

The past is a reference point - not a rule set in stone.

-

There are a few fundamental causes of concern this time around - that investors must keep in mind (highlighted later in this article)

First, let's do a quick valuation check

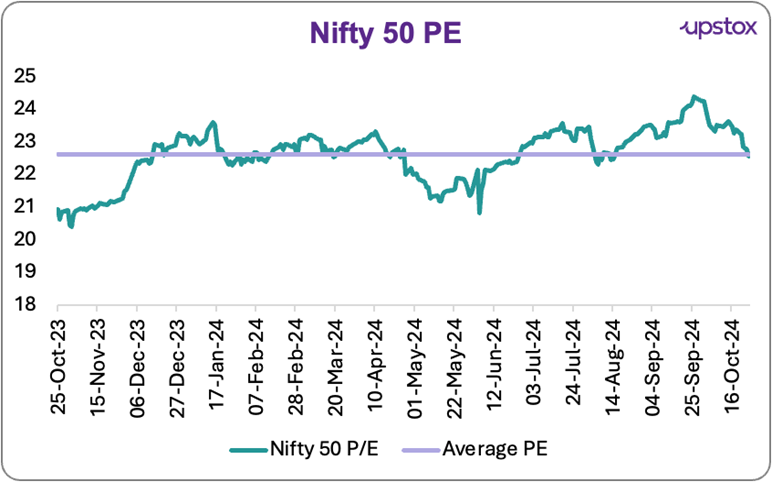

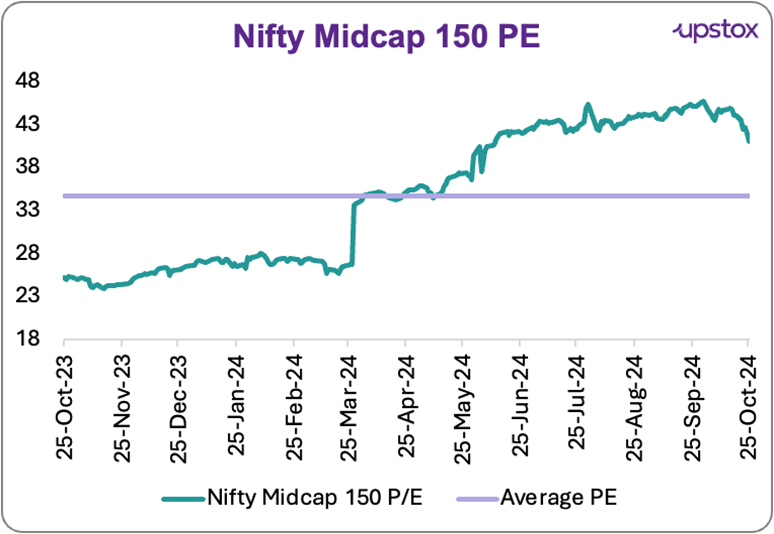

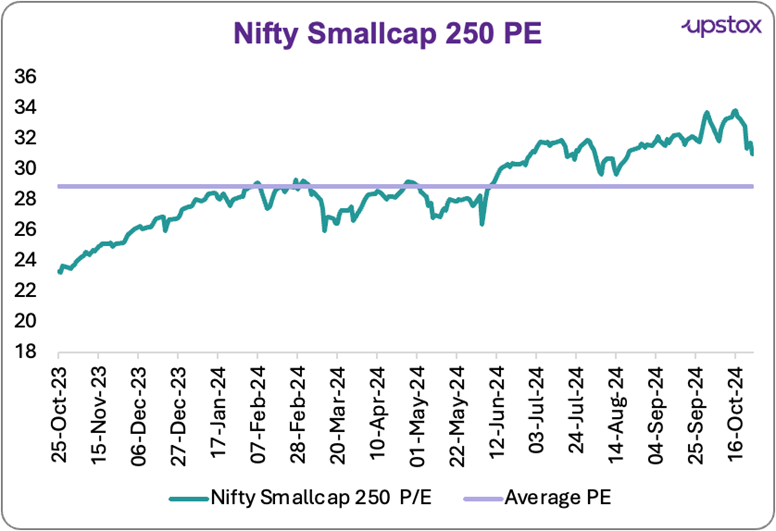

Valuations remain a key talking point. Despite the recent correction, Indian equities are still trading at premium valuations.

Mid-cap and Small-cap stocks, which surged over the past 6-7 months, are particularly vulnerable. In contrast, large caps offer more stability as investors may shift to quality stocks during uncertain times.

Source: NSE; *trailing PE

Source: NSE; *trailing PE

Source: NSE; *trailing PE

Finally, here are some reasons for staying a bit cautious.

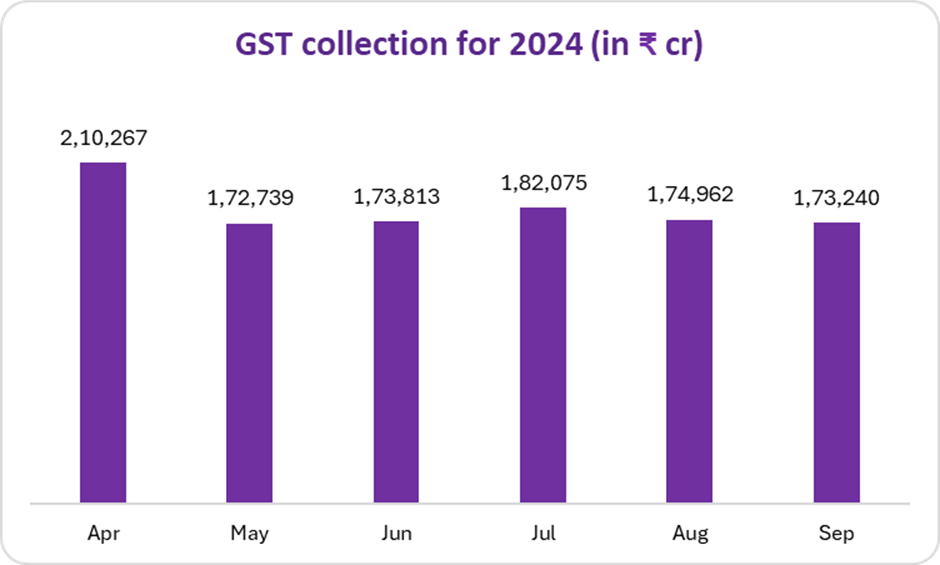

Growth in GST collections at a ~40-month low!

In September 2024, India's GST collections slowed down, generating ₹ 1.73 lakh crore, a slight drop from the previous month’s ₹ 1.75 lakh crore. The growth rate dipped to 6.5%, the lowest in almost 40 months.

This decline was mainly due to weaker collections from both domestic transactions and imports. Additionally, an increase in GST refunds, particularly for exports, impacted the net collection.

Source: The Hindu

Q2 earnings showing mixed signals

Early Q2FY25 earnings have been weak, with 167 companies showing only 5% YoY net profit growth, a sharp decline from previous quarters. While the IT sector remains resilient, other industries, particularly FMCG, retail, automotive, and cement, report flat or declining profits due to weak demand and margin pressures.

Bajaj Auto’s cautious outlook for festive sales is adding to market concerns, as the company reported weaker-than-expected Q2 motorcycle sales growth of only 1%-2%, missing the company’s own expectation of ~5%-6%.

Urban consumer demand slowing down

Companies are noting a weak consumption environment, especially in urban areas. The key question is whether this is temporary (due to monsoons and flooding) or a long-term trend. Insight from leading companies:

| Company | Comments |

|---|---|

| Nestle India | Challenging environment, muted demand, high commodity prices, shrinking middle class affecting sales |

| Tata Consumers | Urban slowdown due to flooding and food inflation |

| Hindustan Unilever | Urban slowdown tied to macroeconomic factors; possibly temporary |

| Pidilite Industries | Demand impacted by early-quarter rains |

| Diageo India | Softer-than-expected demand in a muted quarter |

Source: Press release, company reports

Upcoming elections giving the market a pause

With major state elections around the corner, there could be some market hesitation due to political uncertainty. Elections often bring a short-term sense of unpredictability, making investors cautious.

However, history shows that markets have navigated election periods without significant long-term impact. It’s better to stay focused on economic fundamentals rather than being wiped away by election-related volatility.

Conclusion

Consistent FII outflows, spurred by concerns over high valuations, mixed corporate earnings, and concerns around China’s economy, have heightened market volatility. Yet, the recent market pullback should not be viewed as a cause for alarm but as an opportunity to reassess and recalibrate their portfolios.

As always, it's essential to keep an eye on earnings reports and market fundamentals, rather than being swayed by short-term volatility or political uncertainties.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story