Upstox Originals

India's position in a tariff-driven global trade landscape

.png)

9 min read | Updated on April 14, 2025, 05:28 IST

SUMMARY

The global trade landscape is shifting once again, and this time, it is the return of President Donald Trump’s aggressive tariff policy that is reshaping trade equations. With tariffs now becoming an important factor in deciding a country’s global trade future, India finds itself both under pressure and in a position of strategic opportunity.

Post Trump tariffs, India finds itself both under pressure and in a position of strategic opportunity

After a tumultuous few days, President Trump has finally announced a pause on the tariffs he announced on ‘Liberation Day.’ With the exception of China, the White House has announced a 90-day pause on all other countries. However a flat 10% tariff has still been retained.

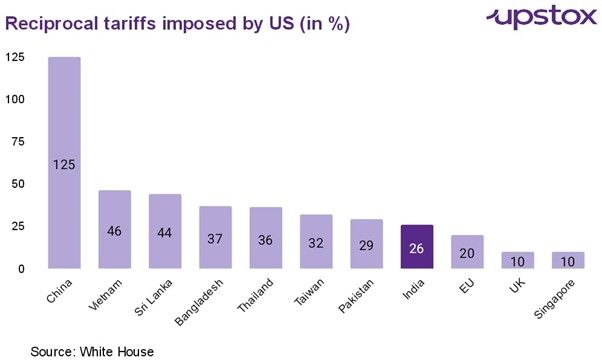

The chart below lists the announced tariffs across countries.

Tariff increase by country

At current proposed rates, India is relatively better placed to absorb the shock, especially in key sectors.

| Trading Partner | 2024 US Import ($bn) | Former tariff in 2024 (%) | Announced reciprocal tariff % |

|---|---|---|---|

| EU | 606 | 1.4 | 20.0 |

| China | 439 | 10.9 | 125.0 |

| Japan | 148 | 1.7 | 24.0 |

| Vietnam | 137 | 4.1 | 46.0 |

| Korea | 132 | 0.4 | 25.0 |

| Taiwan | 116 | 1.1 | 36.0 |

| India | 87 | 2.6 | 26.0 |

Source: White House, Department of Commerce, US International Trade Commission, WTRI.

Sectoral comparison

India's relatively lower effective tariff compared to competitors positions it well in many sectors, particularly those with high export overlap with China and Vietnam. This could provide India an edge and a potential opportunity to compete better.

Increase in average tariff %

| India | Vietnam | China | |

|---|---|---|---|

| Electronics | 25.5% | 46.0% | 124.0% |

| Jewellery | 24.2% | 46.0% | 124.0% |

| Textiles | 16.6% | 33.0% | 114.0% |

| Machinery | 24.6% | 46.0% | 124.0% |

| Metals | 24.0% | 44.0% | 122.0% |

| Chemicals | 22.2% | 43.0% | 122.0% |

Source: Source: White House, Department of Commerce, US International Trade Commission, WTRI.

Which export sectors will be impacted?

Except for textiles, most of India’s top export categories to the US will now face a 20–26% increase in tariffs.

| Product | Share in total US exports (%) | US Import duty (existing - %) | Reciprocal tariffs - % | Change - % |

|---|---|---|---|---|

| Chemicals | 5.0% | 3.8% | 26.0% | 22.2% |

| Electronics | 14.9% | 0.5% | 26.0% | 25.5% |

| Energy | 5.5% | 0.0% | 0.0% | 0.0% |

| Fertilizers | 0.0% | 0.0% | 26.0% | 26.0% |

| Jewellery | 13.0% | 1.8% | 26.0% | 24.2% |

| Machinery | 8.2% | 1.4% | 26.0% | 24.6% |

| Metals | 6.6% | 2.0% | 26.0% | 24.0% |

| Pharmaceuticals | 11.0% | 0.0% | 0.0% | 0.0% |

| Textiles | 13.0% | 9.4% | 26.0% | 16.6% |

| Automobiles | 4.3% | 0.8% | 26.0% | 25.2% |

Source: Source: White House, Department of Commerce, US International Trade Commission, WTRI

- Textile - India is slightly better off in textiles compared to China, and Vietnam due to a smaller net increase. Despite the advantage, Indian textile manufacturers may still face margin pressures, as cost hikes may not be passed on to buyers.

| Country | Share in US Textile Imports | Old US Tariff | New US Tariff | Increase in tariff |

|---|---|---|---|---|

| China | 27% | 11% | 125% | 114% |

| Vietnam | 15% | 13% | 46% | 33% |

| Bangladesh | 8% | 12% | 37% | 25% |

| India | 8% | 11% | 26% | 15% |

| Indonesia | 4% | 13% | 32% | 19% |

Source: Crisil, DGFT

-

Jewellery will be the most impacted sector, as India accounts for 14% of US jewellery imports as per Crisil, the highest among competing nations. With jewellery being a discretionary expense, the expected 2.2% inflation increase in the US (as per S&P Global) and declining disposable incomes are likely to dampen demand for Indian jewellery.

-

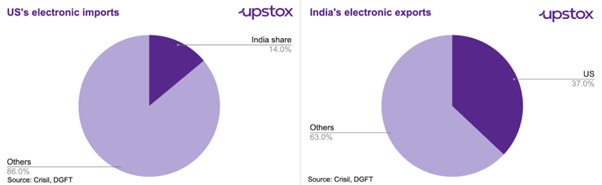

Electronics - As per a WSJ report, iPhone prices could surge by 54% if the full impact of new tariffs is passed on to consumers. In response, Apple took proactive steps, shipping five aircraft loaded with products from India to the US, according to an ET report. Moreover, Apple is exploring shifting its manufacturing from Vietnam and China to India and Brazil. This opens up significant opportunities for India. With the new tariffs, India's 14% share in US electronic imports becomes more attractive compared to Vietnam (4%) and China (80%), making Indian electronics more viable for the US market.

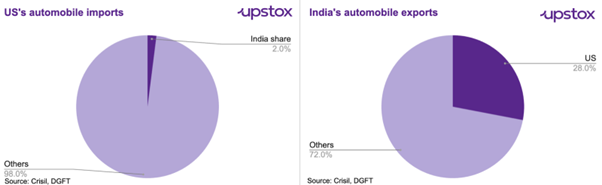

- Automobiles - The US has been the fastest-growing export market for Indian automotive components, with domestic companies gaining 700 basis points of market share over the past eight years. However, the industry’s low exposure to the US market—accounting for just 3.5% of production revenue—will provide some protection from significant damage. In the medium term, there is a risk of losing market share to Canada and Mexico, which together account for nearly half of the US automotive component imports, benefiting from the United States-Canada-Mexico Agreement (USMCA).

For now, sectors like IT services, pharmaceuticals, semiconductors, energy, and nuclear - one’s that are of strategic importance to the USA are exempted. However, the USA has already hinted at the imposition of new tariffs on those sectors.

How much does it overall impact markets and the economy?

While US exports account for 2% of India’s GDP, the total impact of reciprocal tariffs is estimated at 0.5% of GDP—manageable, but not negligible. But almost 87% of India’s exports to the US worth ~$66 billion will be at risk due to the ongoing tariff war.

Way forward

-

Negotiations: India’s approach to the tariff issue has been diplomatic and cooperative. The government has actively engaged with the USA in negotiations. India's ongoing Bilateral Trade Agreement (BTA) negotiations with the US could provide tariff relief, and leveraging the US tariff threat for mutual reductions could be beneficial. The two countries aim to finalise an agreement by the second half of 2025.

-

Reduced tariffs: In terms of concessions, India has already made significant moves to demonstrate goodwill. India has slashed tariffs on various USA products, including heavy motorcycles (from 50% to 30%), and bourbon whiskey (from 150% to 100%). In Budget 2025, India also reduced import duty on luxury cars and complex machines. Potential reduction in import duty Furthermore, India has agreed to lower tariffs on agricultural imports such as almonds and cranberries, which have been a major point of contention in trade talks. Infact, considering 87% of India’s exports are under Trump’s reciprocal tariff, Reuters report says India is planning to cut tariffs on 55% of US imports.

-

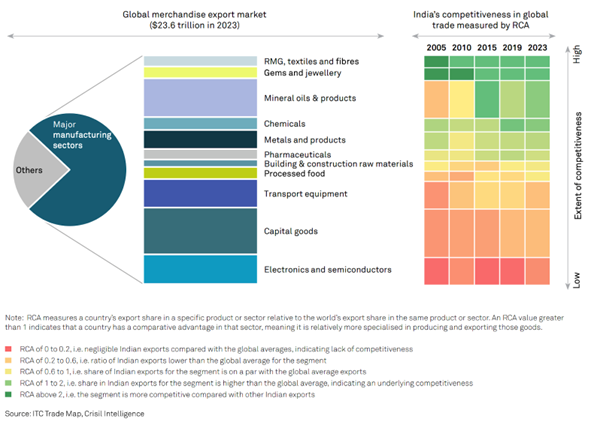

Relocation opportunity - As Apple has hinted at relocating its operations to India, the country is emerging as a key destination for multinational companies (MNCs) looking to avoid higher tariffs, particularly those imposed on China and Vietnam. India has been consistently increasing its competitive advantage in export-oriented sectors over the years to make their exports more viable for global export markets

India’s competitive advantage is improving, albeit slowly

What does this mean for investors?

The silver lining in times of global uncertainty—triggered by macroeconomic crises like the Dotcom bubble, the Global Financial Crisis, and COVID—is that global markets often experience broad-based discounts. Historical data shows this creates opportunities for savvy investors

Market Performance post-crisis

| Crisis | Period of Crisis | Maximum Drawdown (Nifty 500 TRI) | Date of Investment | Post-crisis perf - 1Y | Post-crisis perf - 3Y | Post-crisis perf - 5Y |

|---|---|---|---|---|---|---|

| Asian Financial Crisis | 1998 | -23.4% | 30-Jun-98 | 30.5% | 6.3% | 9.5% |

| Kargil War | 1999 | -10.8% | 30-Jun-99 | 35.0% | 0.2% | 11.7% |

| Attack on World Trade Center, US | 2001 | -43.2% | 30-Sep-01 | 22.1% | 40.4% | 41.9% |

| SARS Outbreak | 2002-2003 | -11.4% | 30-Jun-03 | 43.8% | 45.5% | 31.6% |

| Iraq War | 2003 | -11.4% | 30-Jun-03 | 43.8% | 45.5% | 31.6% |

| Unexpected election outcome | 2004 | -24.4% | 31-May-04 | 53.0% | 45.5% | 26.0% |

| Global Financial Crisis | 2008 | -57.7% | 31-Dec-08 | 91.0% | 17.5% | 17.8% |

| European Debt Crisis | 2011-2012 | -26.8% | 31-Dec-11 | 33.5% | 24.9% | 15.5% |

| Taper Tantrum | 2013 | -10.1% | 28-Feb-13 | 9.6% | 10.4% | 17.0% |

| BREXIT Announcement | 2016 | -11.9% | 30-Jun-16 | 20.9% | 12.8% | 15.4% |

| Covid-19 Pandemic | 2020 | -38.1% | 31-Mar-20 | 77.6% | 29.0% | 39.2% |

| Economic Slowdown / USD Strength | 2024-2025 | -14.4% | 31-Jan-25 | NA | NA | NA |

Source: Franklin Templeton Mutual Fund, Bloomberg, NSE; Post crisis performance is for Nifty Total Returns Index

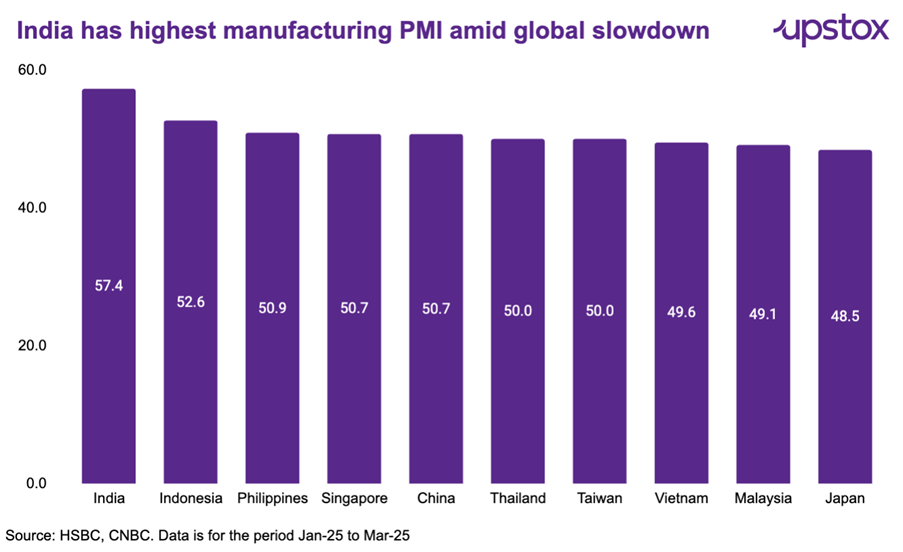

India has shown resilience amidst global uncertainty and slowdowns, as reflected in recent data from the manufacturing PMI (Purchasing Managers' Index). The PMI, a key economic indicator, provides insights into the health and direction of the manufacturing and service sectors. With India’s PMI reaching its highest levels among Asian countries, it signals strong economic expansion, as a PMI above 50 is considered a sign of growth.

In summary

Trump’s tariff policies have presented a considerable challenge for India, but they also provide an opportunity for India to strengthen its trade relationship with the U.S. through negotiations. India’s proactive approach, including tariff cuts and strategic concessions, has shown its willingness to find a mutually beneficial resolution.

USA's tariffs are expected to affect India’s key export sectors, but with continued dialogue and negotiation, India may be able to secure favourable trade terms in the coming months.

About The Author

Next Story