Upstox Originals

India’s car market and what lies ahead

11 min read | Updated on October 22, 2024, 13:24 IST

SUMMARY

Launched in 1983, Maruti 800 was a symbol of modernity and aspiration for millions of Indians. It became a gateway to car ownership in the Indian automotive landscape. By 2017-18, SUVs started to steal the spotlight. Join us as we dive into the shift that has transformed India’s car market, reflecting evolving tastes and new trends

carthumb.jpg

Launched in 1983, Maruti 800 was a symbol of modernity and aspiration for millions of Indians. It became a gateway to car ownership in the Indian automotive landscape.

For years, small cars like it were the heartbeat of the market, shaping personal mobility for a growing middle class. Yet, as the years rolled on, the scene began to shift.

By 2017-18, SUVs started to steal the spotlight. Today, models like the Tata Punch and Hyundai Creta are leading the sales charts.

….

Hatchback vs SUV vs Sedan

To better understand the car market, let’s first explore the differences between various body styles:

….

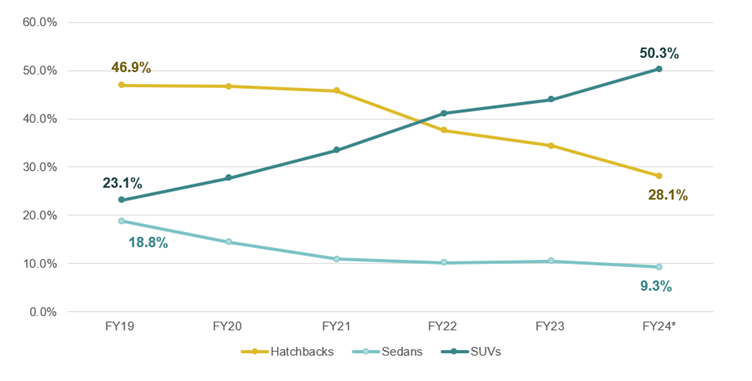

Rise of SUVs in India

Check out this chart illustrating the surge in SUV sales since FY19, contrasted with the decline in sedan and hatchback volumes.

Segment-wise trends in overall PV sales volume

Source: SIAM- Society of Indian Automobile Manufacturers, CRISIL MI&A; *April 2023- Feb 2024 period; Volume for Tata Motors is not reported for Jan and Feb 2024

….

Why Small Cars Are Making Way for SUVs

Changing Customer Preferences

Shift in Emission Norms

Bharat Stage (BS) norms are India's vehicle emission standards, similar to international Euro norms, aimed at reducing air pollution by limiting the amount of pollutants vehicles can emit.

To address severe Delhi NCR pollution, the government skipped BS V and advanced BS VI implementation from 2022.

New Mandatory Safety Norms Drive Up Vehicle Costs

Then came the Government’s mandate to compulsorily install ABS (Anti-lock Braking System for safer braking) in all cars from April 2019. Then driver airbags in April 2020, and dual front airbags from January 2022.

….

Together the stricter emissions and safety regulations have driven up entry-level car costs, squeezing margins for manufacturers and making competition in this segment even more challenging.

Rising consumer expectations now require advanced features, making basic models less appealing. ….

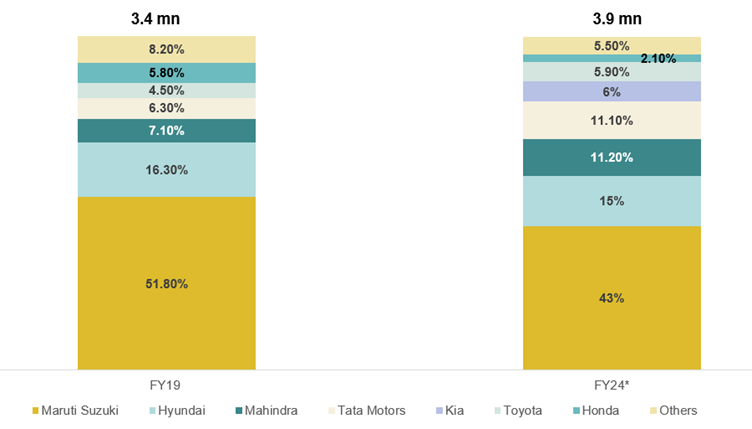

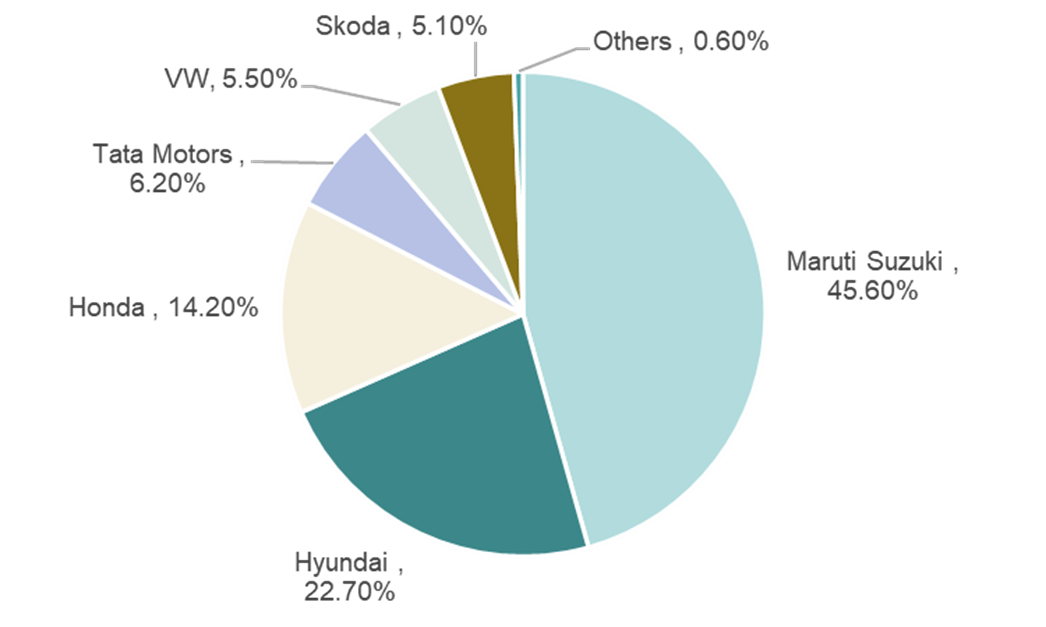

Key Players in the SUV Surge: Who Led and Who Lagged?

The SUV market in India has seen a dramatic shift, with some automakers leading the charge while others struggled to keep pace.

Overall Passenger Vehicle (PV) Market Share by OEMs (FY19-FY24)

Source: SIAM- Society of Indian Automobile Manufacturers, CRISIL MI&A; *April 2023- Feb 2024 period; Volume for Tata Motors are not reported for months of Jan and Feb 2024

Maruti Suzuki

Once dominating with a 51% market share in FY19, Maruti's share dropped to 43% in FY24 as it entered the SUV game late. Models like Brezza, Grand Vitara, and Ertiga helped recover some ground.

Hyundai

The second-largest player in PV sales since FY09, Hyundai has stayed strong with regular upgrades to popular models like the i10, i20, Creta, Verna, and Venue.

Tata Motors

Tata gained momentum in the last five years, thanks to the success of SUVs like the Nexon and Punch. Its dominance in the EV market has also boosted overall sales.

Mahindra & Mahindra (M&M)

Expanded its portfolio with models like the XUV300, XUV700, and Scorpio N, helping increase its market share.

Kia

A relatively new entrant, Kia quickly grabbed a 6% market share, riding high on the success of the Seltos and Sonet.

Toyota

Maintaining a 4-6% market share, Toyota continued to thrive with the flagship Innova, while models like Glanza, Urban Cruiser, and Hyryder added support.

Honda

Facing stiff competition, Honda's market share shrank from 6% in FY19 to just 2% in FY24, struggling to keep up with the SUV demand.

….

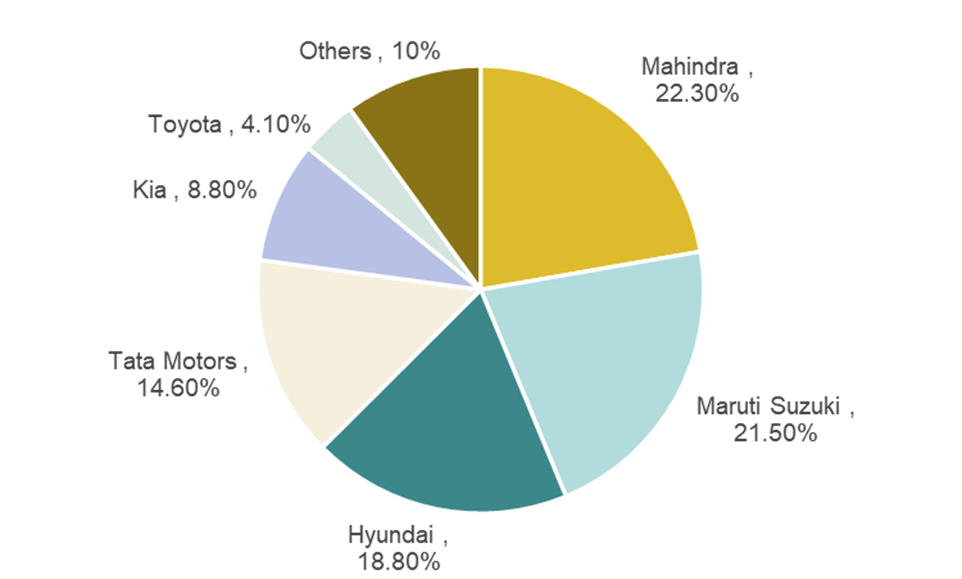

SUVs: Evolving Market Dynamics

Source: SIAM, CRISIL MI&A ; April 2023-February 2024 period

The SUV market remains fragmented without a clear leader. Mahindra & Mahindra and Maruti Suzuki have seen their market share decline over the past five years, while Hyundai and Tata Motors have gained. New entrants like Kia and MG, entering in FY2020, have quickly made their mark.

The SUV market offers diverse options. Compact SUVs (<4m) like the Maruti Brezza, M&M Bolero, Hyundai Venue, Kia Sonet, Tata Punch, and Tata Nexon combine style with affordability.

Mid-segment SUVs (4-4.4m), including the Hyundai Creta, Kia Seltos, Skoda Kushaq, Volkswagen Taigun, Mahindra XUV400, and Citroen C3 Aircross, balance space and performance.

The large SUV segment (>4.4m), led by Mahindra's Scorpio and XUV series, is rebounding strongly post-pandemic. Key models like the Mahindra Scorpio N, Mahindra XUV700, and Hyundai Alcazar highlight this segment's recovery.

….

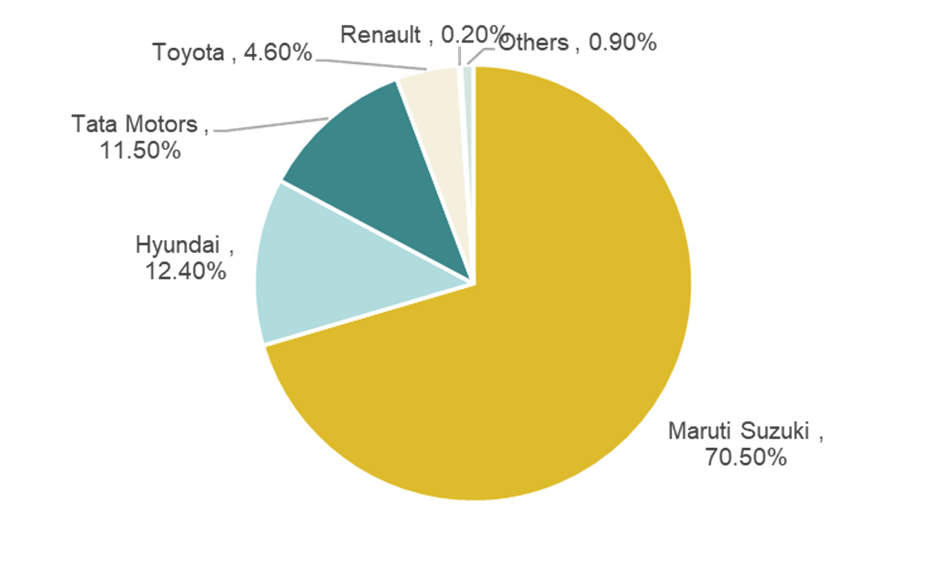

Hatchbacks: A Shrinking Segment

Source: SIAM, CRISIL MI&A ; pril 2023-February 2024 period

Once the dominant segment, hatchbacks have seen their market share shrink due to limited new model launches, frequent price hikes, and rising operating costs driven by fuel prices.

Maruti Suzuki remains the leader in the hatchback market, with strong performers like the Swift, Baleno, and WagonR in both the compact and premium segments. Hyundai, however, has faced a decline in market share following the discontinuation of the Santro and Eon, though the Grand i10 NIOS and i20 have helped cushion the impact.

Increased competition from models like the Tata Altroz and Toyota Glanza has intensified pressure in the premium hatchback segment, while Renault’s Kwid has solidified its presence in the compact category.

….

Sedans: Declining Presence

Source: SIAM, CRISIL MI&A ; April 2023-February 2024 period

Maruti Suzuki leads the sedan segment with a 40% market share, thanks to the Dzire.

Hyundai expanded its presence in FY24 with the Verna facelift and continued Aura demand.

Honda, however, faces tough competition for its City model from rivals like Volkswagen Virtus, Skoda Slavia, and the new Verna. Tata Motors, after seeing a decline in sedan sales with the Tigor and Zest, regained some ground with the launch of the Tigor EV in FY22.

….

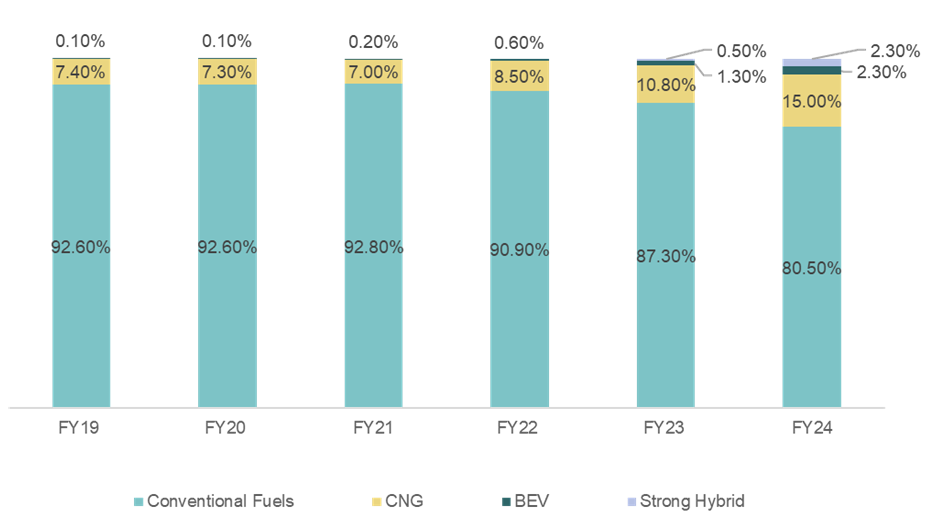

Changing Powertrain Mix in the Indian Passenger Vehicles Industry

Let’s look at the sector from another lens—the powertrain mix, which is set to have a more significant impact than body styles in the coming years.

The Indian domestic passenger vehicle industry, traditionally dominated by conventional fuels, has rapidly embraced alternative fuels over the past 2-3 years. CNG's share has doubled to 15%, while electric vehicles (EVs) and the latest addition, strong hybrids have gained 2.3% and 2.2% market shares, respectively.

Source: VAHAN; Lakshadweep and Telangana Retail data not available

Petrol to Diesel and Back to Petrol

Initially, petrol vehicles were preferred for their lower purchase price and cheaper overall ownership costs, despite diesel fuel being cheaper at the pump. However, from FY2012 to FY2014, rising petrol prices and a narrowing cost gap made diesel vehicles more attractive.

….

Surge in CNG: Record Sales and Expanding Infrastructure

On the infrastructure front, CNG stations expanded at a 34.5% CAGR from FY19 to FY23. By FY23, 21.9 thousand km of gas pipelines were operational, with 33.1 thousand km under construction, driven by City Gas Distribution (CGD) projects. Government support and CGD initiatives will further accelerate this growth.

….

Strong Hybrids: A New Powertrain Option

The recent introduction of strong hybrid variants for models such as the Maruti Suzuki Grand Vitara, Toyota Innova Hycross, and Honda City has added a valuable powertrain choice for Indian consumers.

Strong hybrid powertrain witnessed healthy traction from consumers looking for increased mileage at relatively limited higher acquisition costs.

….

Electrification in the Indian PV Industry

The Production Linked Incentive (PLI) Auto policy, approved in 2021, supports the EV supply chain with a budget of ₹25,938 crore over five years from fiscal 2023 to fiscal 2027.

….

India Auto Players riding the EV wave

Mahindra & Mahindra led the EV market until fiscal 2019, with Tata Motors gaining prominence through models like the Nexon EV, Tiago, Tigor, and Punch.

With the competition intensifying in the EV space all major OEMs have planned EV launches soon.

And, these EV plans have gained importance as India prepares for the Corporate Average Fuel Efficiency (CAFE) III norms, set to take effect in April 2027.

….

Automakers’ Expansion and Investments in India

These expansions and investments underscore India's rising role as a key automotive hub, leading the shift to cleaner and advanced mobility solutions.

….

Driving the Future: India’s Move to Sustainable Mobility

India’s automotive landscape is undergoing a dynamic transformation, with a clear momentum towards electrification and sustainable mobility. Automakers are ramping up production, unveiling innovative models, and embracing cleaner technologies like EVs and strong hybrids.

Backed by government initiatives and a shift in consumer preferences, the future of India's auto industry is poised for remarkable growth, paving the way for a greener, smarter, and more efficient transport ecosystem.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story