Upstox Originals

Here’s how India’s food industry is cooking up a storm

.png)

6 min read | Updated on March 06, 2025, 13:21 IST

SUMMARY

India’s restaurant industry is booming, set to nearly double to $79.7 billion by 2028. Social media, cloud kitchens, and QSR are reshaping the market, attracting major investments. Premium dining and plant-based trends are gaining momentum, catering to health-conscious and high-end consumers. With 7+ million jobs and a major role in tourism and tax revenue, the industry isn’t just about food—it’s a powerhouse for growth.

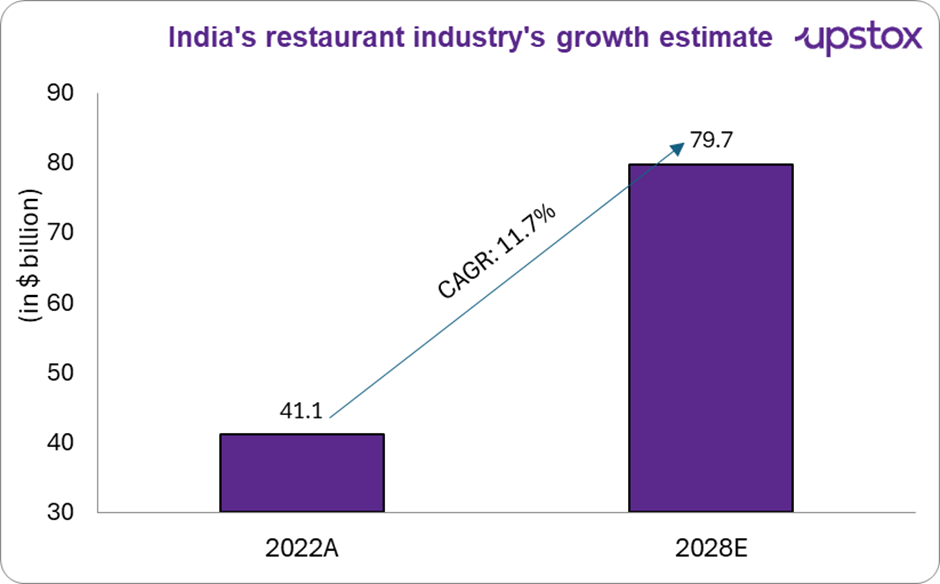

According to the IBEF, the restaurant industry is growing at a CAGR of 11.7% and is expected to reach $79.7 billion by 2028

India's restaurant industry has undergone significant transformation, evolving from humble dhabas to sophisticated fine-dining establishments. According to the IBEF, the industry is growing at a CAGR of 11.7%, and was valued at approximately $41.1 billion in 2022 and is expected to reach $79.7 billion by 2028, driven by shifting consumer preferences, technological advancements, and the growing middle class.

Source: India Brand Equity Foundation (IBEF); A= Actual & E = Estimate

Key trends shaping the industry

As the restaurant industry in India evolves, several trends are influencing its trajectory:

Social media influence

Social media platforms, particularly Instagram and TikTok, have become essential marketing tools for restaurants. By showcasing visually appealing dishes and engaging with customers, restaurants can build brand awareness and attract new diners through influencer partnerships and user-generated content.

Cloud kitchens

While not new, cloud kitchens, delivery-only kitchens, has revolutionised the industry, offering a model with lower overheads compared to traditional dining spaces. Investors are particularly attracted to the scalability of cloud kitchens, which can expand rapidly without the need for physical dine-in spaces.

Rebel Foods, an Indian cloud kitchen startup, has secured significant funding of ~$450 million from major venture capital firms like Sequoia Capital and Lightrock India. The company's ability to scale rapidly across multiple markets and its focus on building a strong digital presence has made it an attractive investment option. Rebel Foods operates several well-known food brands such as Faasos, Behrouz Biryani, and Oven Story Pizza, which have contributed to its significant growth.

Quick service restaurants (QSR)

The QSR sector in India has experienced significant growth, driven by urban demand and expanding reach to smaller cities. Brands like Dominos’s, Mcdonald’s, etc. are reshaping the Indian QSR landscape, offering significant investment opportunities through their market expansions and customer-centric strategies. Here are key players:

| Company | Market Cap (₹ Cr) | EV / EBITDA | ROE (%) | Stock Price CAGR (3yr) | Net Profit CAGR (5yr) |

|---|---|---|---|---|---|

| Jubilant Foodworks | 40,241 | 25.90 | 13.0% | 6% | 5% |

| Westlife Foodworld | 10,767 | 35.88 | 12.8% | 15% | 41% |

| Restaurant Brand Asia | 3,152 | 15.80 | -30.0% | -16% | -28% |

| Sapphire Foods | 10,142 | 22.77 | 4.9% | 10% | 36% |

| Devyani International | 20,078 | 28.98 | 4.9% | 2% | 36% |

| Average | 16,876 | 25.87 | 1.1% | 3.4% | 18.0% |

Source: Screener; As of March 4th, 2025

Premiumisation and experiential dining

As India’s middle and upper-middle classes expand, the demand for premium dining experiences is rising. Restaurants are increasingly embracing luxury concepts and experiential dining, offering unique ambiances and specialised menus.

For example, Indian Accent, known for its innovative take on Indian cuisine, provides a premium dining experience that blends tradition with contemporary flair. offers a unique atmosphere and premium offerings that cater to high-end consumers seeking both quality and exclusivity.

| Restaurant | Specialty | Investors | Funded Amount($ Mn) |

|---|---|---|---|

| Burma Burma | Burmese food | Several family offices, including existing investor Negen Capital. | $2 |

| Boba Bhai | Bubble tea | Diverse group of investors, including Titan Capital, Global Growth Capital UK (Harsh Patel) | $1 |

| Subko | Specialising in artisanal coffee | Nikhil Kamath | $10 |

| Wow! Momo Foods | Tibetan delicacy | Khazanah Nasional Berhad, Malaysia's sovereign wealth fund. | $41 |

| Lahori | Beverages | Verlinvest | $15 |

| Brewdog | Premium craft beer & dining experience | Angel investors, Institutional investors including TSG Consumer Partners, | $2 |

| Blue Tokai Coffee | Cafe, Desserts | Anicut Angel Fund, the equity arm of Anicut Capital | $2 |

| Curefoods | They cater to a wide range of culinary styles, not focusing on just one specific cuisine. | InterGlobe enterprises (Private investors) | $4 |

Source: Indian Retailer

Health conscious and plant-based dining

As more consumers embrace healthier lifestyles, there’s a noticeable shift toward plant-based and nutritious dining options. This growing demand for vegetarian, gluten-free, and vegan meals is pushing many restaurants to adjust their offerings.

For instance, Sattvik in Delhi serves pure vegetarian and organic dishes, catering to health-conscious diners. The Yoga House in Mumbai offers a vegan and gluten-free menu, emphasising fresh, locally-sourced ingredients.

Another notable example is Earthplate in Bangalore, which focuses on plant-based, nutritious meals that align with the growing trend of clean eating. Venture capital interest in plant-based food startups, such as Bowl of Good and Greenr Café, is rising.

Delivery and takeout services

The rise of food delivery services, further accelerated by the pandemic, has made delivery and takeout options a central part of the restaurant business. Delivery-only kitchens and the rapid adoption of food delivery apps like Zomato and Swiggy have contributed to a new business model, which minimises overhead and focuses on catering to consumer convenience.

Economic impact of the restaurant industry in India

The restaurant industry in India is a major driver of both employment and economic growth, contributing to a wide range of jobs while fostering the development of numerous related sectors.

-

Employment generation: The restaurant industry is a major employer, employing over 7 million people in India. It is expected to directly employ around 10.3 million people by 2028, according to the NRAI. It not only creates a large number of direct jobs but also stimulates a range of ancillary sectors, supporting economic growth at multiple levels. The restaurant sector is expected to contribute around 8% of total employment by 2028 according to the National Restaurant Association of India (NRAI).

-

Catalyst for tourism: Restaurants are vital to the tourism sector, providing local and international tourists with authentic dining experiences that reflect India's diverse culinary heritage. The growth of the restaurant industry supports hotels, transport services, and related tourism businesses.

-

Contribution to national revenue: According to the NRAI, the food service industry is one of the largest contributors to indirect taxes in India, accounting for a significant portion of the GST collections from the services sector.

In summary

India’s restaurant industry stands at the crossroads of tradition and innovation, offering a dynamic blend of culinary heritage and modern dining experiences. As consumer preferences evolve, the sector is adapting to incorporate healthier eating habits, sustainability practices, and cutting-edge technologies. With its significant role in employment generation and contribution to the broader economy, the industry not only enriches India’s cultural landscape but also fuels economic growth across multiple sectors. The future of dining in India is not just about what’s on the plate, but how the industry continues to innovate, inspiring both investors and consumers alike.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story