Upstox Originals

Easy loans, tougher rules: Why RBI is reining in unsecured credit

.png)

4 min read | Updated on April 08, 2025, 08:48 IST

SUMMARY

The share of unsecured loans has almost doubled in the past few years. Even more worryingly NPAs from these loans are rising rapidly! With rising defaults and mounting household debt, the RBI is stepping in to prevent a financial crisis. But what does this mean for banks, borrowers, and digital lenders? Let’s break down why easy credit is getting harder to access.

Unsecured NPAs in retail loans have spiked sharply over the last few years

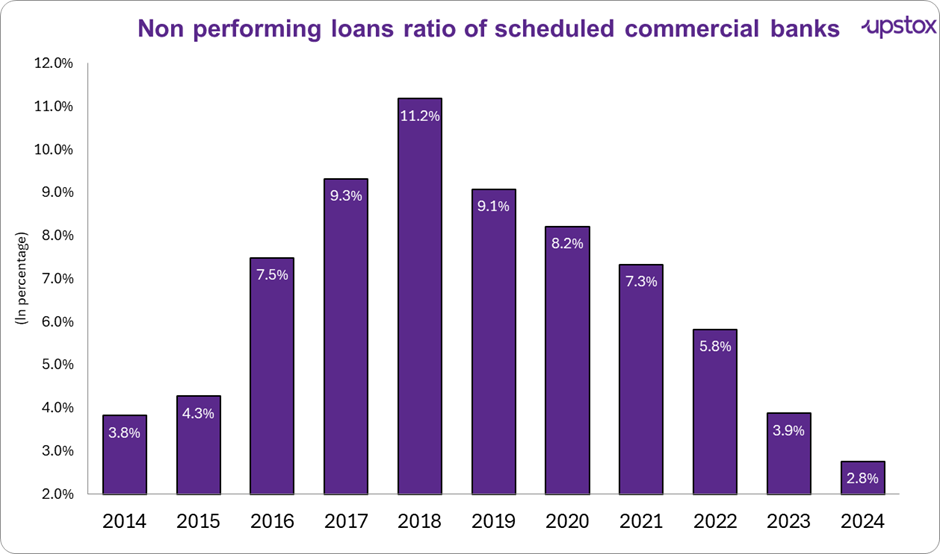

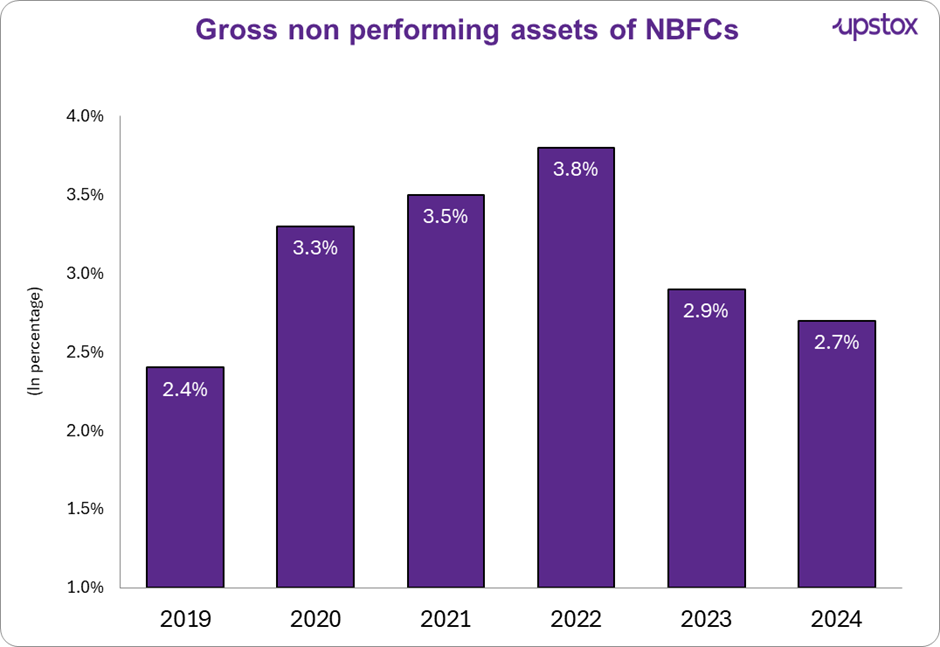

Banks and NBFCs have done a great job in bringing down overall NPAs, with banks' bad loan ratios dropping from 11.2% in 2018 to just 2.8% in 2024, and NBFCs seeing a similar improvement.

Source- Ceicdata

Source- Statista

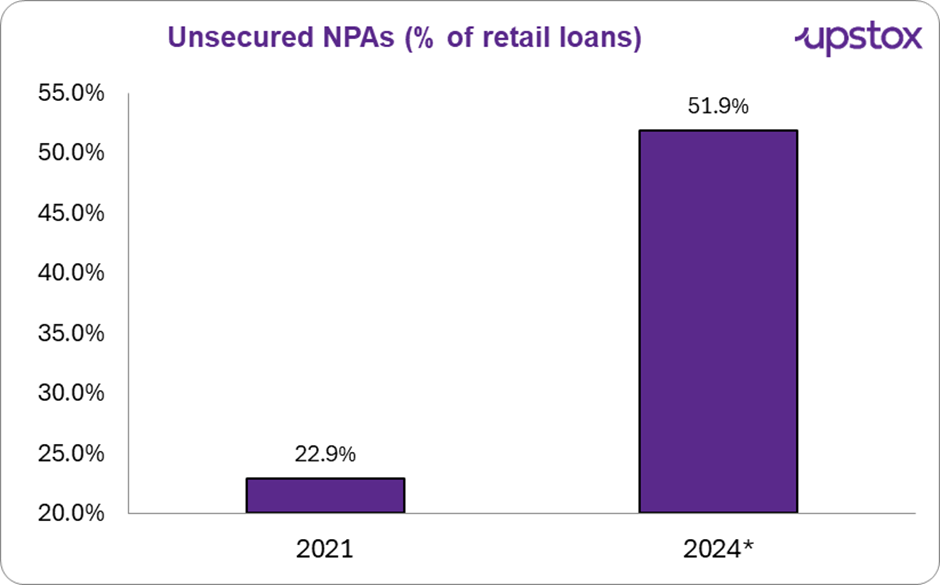

Good news, right? Well, there’s a catch. Gross NPA for the overall banking system hit a 12-year low of 2.6% in September 2024 as per the RBI’s financial stability report. However, the same report has highlihghted concerns about rising NPA in unsecured loans, as seen in the chart below

Source: RBI’s financial stability report, *2024 - Data as of September

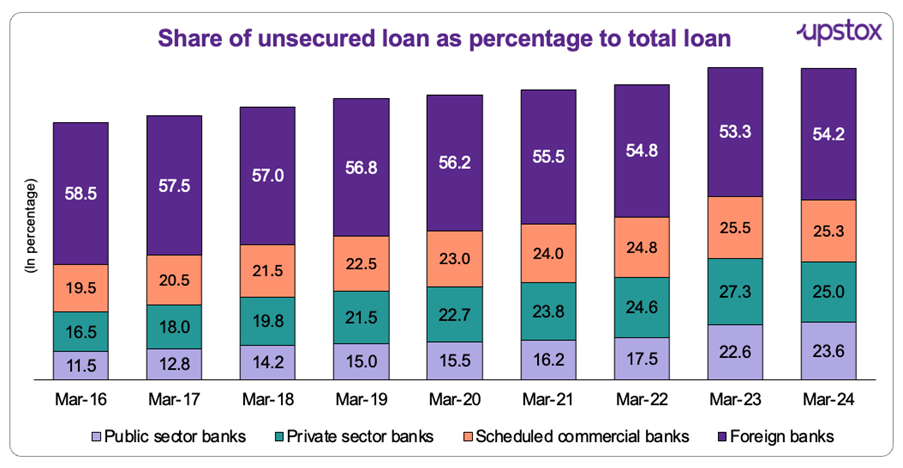

Even more worryingly the share of unsecured loans as a percent of overall loans has been rising sharply. Compared to 2016, the proportion of unsecured loans for private and public sector bank has almost doubled.

Source: Report on Trend and Progress of Banking in India 2023-24, RBI

The rising NPA plus rising share of unsecured loans has therefore raised some red flags about financial stability.

But...What's the deal with unsecured loans?

Ever swiped your credit card for a big purchase or taken out a personal loan? That’s unsecured credit - quick, easy, and hassle-free. But here’s the catch: since these loans don’t require collateral, they’re way riskier for banks. If a borrower fails to pay up, the bank has no house, car, or asset to fall back on.

With many borrowers juggling credit card bills, personal loans, and bigger loans like home or auto loans, a default on one could trigger a domino effect on others. The RBI fears that rising stress in unsecured loans could spill over to secured loans, threatening financial stability.

Borrowing has never been easier—just a few taps on your phone, and you’ve got a loan. But many fintech firms and NBFCs have been a little too eager, handing out loans without proper checks. The RBI is stepping in to bring order before things get out of hand.

In November 2023, it pulled up Bajaj Finance, ordering them to stop lending through their 'eCOM' and 'Insta EMI Card' products. The reason? They failed to provide Key Fact Statements (KFS)—a must-have for transparency in digital lending. This move sends a clear message: the RBI is cracking down on aggressive lending to protect consumers.

Banks and NBFCs are feeling the heat

Rising bad loans are forcing banks and NBFCs to tread carefully, as too many defaults could hit their profits and destabilize the banking system. In November 2024, loan growth slowed for the fifth straight month, rising 11.8% YoY, down from 16.5% in November 2023. This slowdown is largely due to higher capital requirements and cautious lending following RBI’s regulatory measures.

The impact is clear—personal loan growth dropped from 28.4% in December 2023 to 12% in December 2024, while credit to NBFCs fell from 15% to 6.7%. Banks are now being more selective to avoid piling up bad loans.

The RBI’s game plan: Tighter rules, stricter lending

To prevent a potential credit crisis, the RBI has rolled out tougher rules on unsecured loans, due to which there is a significant decline in the share of non performing assets. Here’s what’s changing:

-

Higher risk weights: The RBI raised the risk weight requirements for unsecured personal loans and credit cards by 25% points, compelling banks to allocate more capital against these loans. This curbs excessive lending and reduces default risks.

-

Stricter credit checks: Lenders must now conduct stricter credit assessments, focusing on a borrower's repayment capacity, debt-to-income ratio, and overall financial health. Banks and NBFCs are expected to tighten underwriting standards and rely more on credit bureau data, including CIBIL reports, to assess real-time credit exposure and prevent excessive debt.

-

Frequent credit reporting: From January 2025, lenders must update credit bureau records every 15 days instead of monthly, ensuring timely and accurate credit assessments.

-

Prudential norms: RBI has urged banks and NBFCs to set prudent limits on unsecured loans, advising boards to avoid aggressive lending to maintain stability.

What should borrowers do?

If you’re taking out a loan, be smart about it. Borrow only what you can comfortably repay, avoid juggling multiple loans at once, and always compare interest rates to find the lowest one. Prioritize paying off high-interest debt first to save on overall costs, and set up automatic payments to ensure you never miss a due date. Staying financially disciplined now can save you from trouble down the road.

About The Author

Next Story