Upstox Originals

Agritech: The digital transformation of farming

.png)

6 min read | Updated on March 19, 2025, 15:55 IST

SUMMARY

Indian agriculture is shedding its traditional skin and embracing a tech-powered future. With 100% FDI and the Digital Agriculture Mission (DAM) 2021-2025 fuelling the revolution, data and soil are working in sync. Agritech startups are turning challenges into opportunities, making farming smarter, more efficient, and highly profitable.

The agritech industry is currently valued at ~$878.1 million and is projected to reach $6.2 billion by 2033

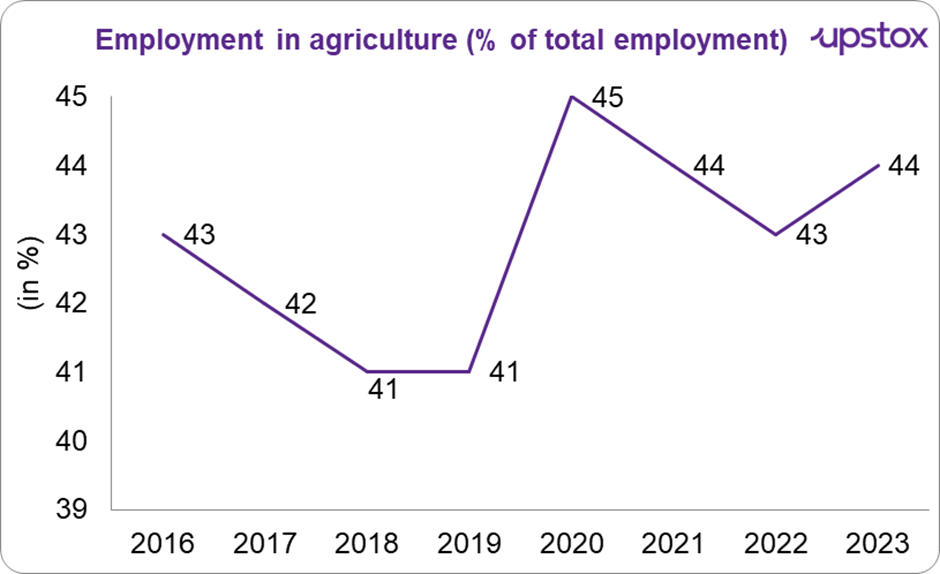

Agriculture has long been India's backbone, feeding millions and employing nearly 44% of the workforce (Reuters, 2023).

Source: Data.worldbank

The state of agriculture in India has seen changes over the years, as a growing population has necessitated innovation. With ongoing efforts driven by digital adoption, AI-driven analytics, and precision farming, the Indian agritech market is helping farmers with a range of challenges from reducing post-harvest losses to providing financing.

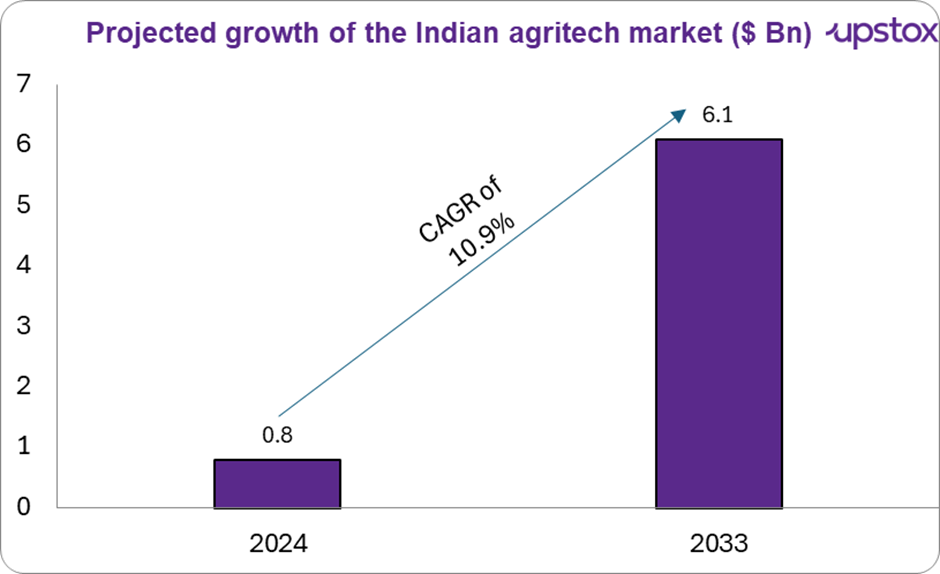

The industry is currently valued at $878.1 million in 2024 and is projected to reach $6.2 billion by 2033, growing at a CAGR of 10.9%.

Source: IMARC Group, 2024

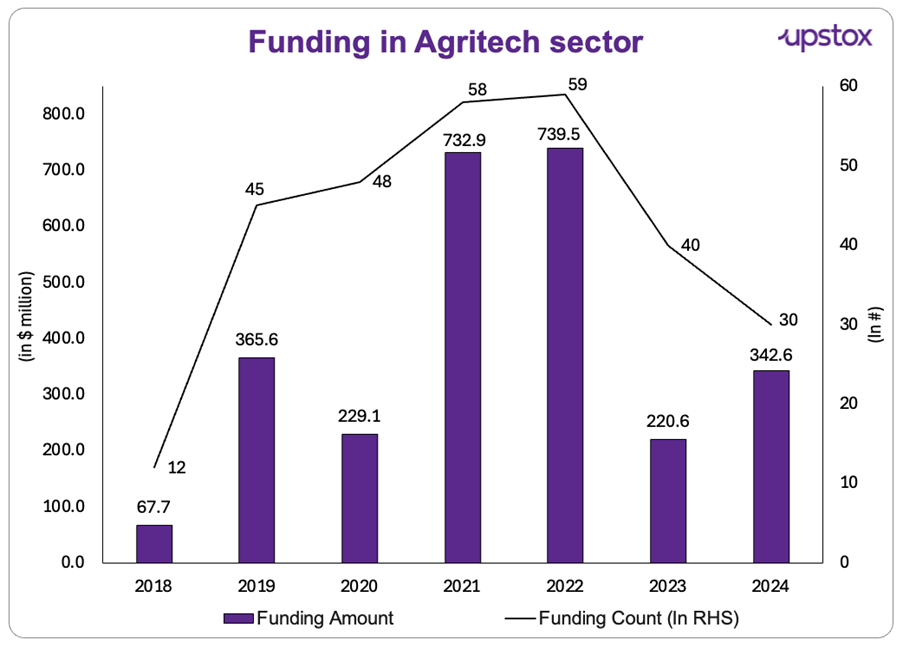

The rise of agritech startups

India has seen a surge in agritech startups, which are pivotal in modernising agriculture. As of 9 February 2024, there are 1,554 agritech startups in India, including 387 women-led ventures.

These startups are addressing key challenges such as supply chain inefficiencies, low farm productivity, and financial inclusion for smallholder farmers.

Source- Inc42

List of select Indian Agritech startups

| Startup | Description | Investors | Funding | Accomplishments |

|---|---|---|---|---|

| Ninjacart (2015) | Connects farmers directly with retailers to minimise supply chain losses. | Tiger Global, Walmart, Accel India and Trifecta Capital Advisors. | $417 Mn | Reduced post-harvest losses by 25-30% through |

| DeHaat (2012) | Provides end-to-end agricultural solutions, from input supply to market linkages. | Peak XV Partners, Sofina Ventures and other investors | $270 Mn | Provided over 1.5 million farmers with credit access and market linkages, increasing small farmers’ incomes by 40%. |

| AgroStar (2013) | Offers an app and interactive voice response-based agriculture solutions to farmers | Aavishkaar Bharat Fund, Accel India, and Bertelsmann | $111 Mn | Helped over 5 million farmers; in certain cases improved yields by 15-20%. |

| Otipy (2020) | Focused on building farmer's communities | Westbridge Capital, SIG and Omidyar Network India | $69 Mn | Enabled farmers to earn 20-30% more by leveraging a demand-driven supply chain |

| BigHaat (2015) | It offers technical guidance and accessibility to a wide range of high-quality inputs to farmers. | JM Financial, Ankur Capital and BlackSoil | $24 Mn | Digital advisory services have led to a 15-20% improvement in crop yields through optimised input recommendations. |

Source: Inc42

Next, we take a closer look at the key digital agriculture initiatives that are changing the game for farmers:

-

The Digital Agriculture Mission 2021-2025: Aims to enhance farming efficiency and sustainability through AI, remote sensing, robotics, and drones. Key components include:

- Agri stack initiative – A digital platform integrating farmer databases, crop management tools, and financial services.

- Digital agriculture division – A specialised unit promoting digital adoption.

- Smart farming solutions – AI-driven advisory systems and IoT-enabled sensors to optimise yields.

-

AI-powered crop forecasting: NITI Aayog and IBM have developed an AI-based crop forecasting model that provides real-time insights to improve output, maintain soil health, and predict disease outbreaks.

-

Cisco’s Agricultural Digital Infrastructure (ADI): Launched in 2019, it has been instrumental in building the National Agri Stack, enhancing access to vital farming data and knowledge-sharing.

-

Jio Agri (Jio Krishi) Platform: Introduced in 2020, it digitises the agricultural supply chain, leveraging AI and big data to provide real-time, personalised farming solutions.

-

Climate-smart Farming: Farmers are adopting climate-smart practices to boost yields while reducing environmental impact. In Dhundi, Gujarat, solar-powered irrigation has cut reliance on conventional energy, lowering greenhouse gas emissions.

-

Farmer Services Interface: Microsoft and the Indian government have launched a pilot Unified Farmer Services Interface, integrating AI sensors to help small farmers manage prices, enhance yields, and increase income.

-

SENSAGRI: Sensor-based Smart Agriculture: The SENSAGRI programme uses drones and sensors for real-time data collection, providing farmers with insights on crop health and environmental conditions to optimise yields.

Key focus areas for the future

The future of agritech in India hinges on continuous innovation and strong policy support. Several critical areas are expected to drive the sector’s growth:

-

Drone Technology: Government-approved drone policies for pesticide spraying and aerial mapping boost efficiency, cut input costs, and enhance precision farming.

-

Soil Health Management: AI-driven soil testing kits optimise fertiliser use, improve yields, and enable data-driven, sustainable farming.

-

E-mandis & Digital Marketplaces: Platforms like eNAM reduce intermediaries, streamline supply chains, and ensure better prices for farmers.

-

Climate-smart Agriculture: AI-powered weather forecasting and crop advisory services help farmers manage climate risks and optimise yields.

Key challenges

Despite rapid advancements, the agritech sector in India faces several challenges:

-

Limited digital literacy: A significant proportion of farmers struggle to adopt digital solutions. Bridging this gap will be crucial for widespread adoption.

-

High initial costs: Modern technologies require considerable investment, which can be prohibitive for small-scale farmers. Affordable financing options and government subsidies can help overcome this barrier.

-

Regulatory bottlenecks: While FDI policies are supportive, bureaucratic hurdles and inconsistent regulations across states pose challenges to seamless implementation.

Listed agritech companies in India

India’s agriculture sector is driven by key players specialising in various aspects of agri-inputs, crop protection, and sustainable farming solutions.

Companies in this space focus on innovation, biotechnology, and digital advancements to support farmers. Below is a table highlighting some of the leading companies in this sector and their areas of expertise:

| Company Name | Market Cap (₹ Cr) | P|E Ratio | ROE (%) | Specialisation |

|---|---|---|---|---|

| PI Industries | 49,366 | 29.1 | 21.1% | Agri-inputs, crop protection, digital farming solutions |

| Bayer CropScience | 22,067 | 42.4 | 26.7% | Seeds, crop protection, biotech-driven solutions |

| UPL | 46,237 | N.A | -4.28% | Sustainable agriculture, digital platforms, global agri-solutions |

| Rallis India | 4,171 | 30.8 | 8.30% | Seeds, pesticides, precision farming technology |

| Godrej Agrovet | 14,301 | 36.2 | 14.9% | Animal feed, dairy, crop protection, agri-tech |

Source- Screener, As of March 10th, 2025

In summary

India’s agritech sector is transforming rapidly with digital innovation, AI-driven analytics, and precision farming. Despite challenges like high adoption costs, technology is boosting efficiency and farmer incomes.

Rising investments in agri-fintech signal long-term growth, but scalability and affordability remain key. If adoption continues, agritech could revolutionise Indian agriculture, making it more resilient and globally competitive.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story