Personal Finance News

Understanding the rise of factor-based index funds: A smart beta investment strategy in India's growing passive investment market

.png)

5 min read | Updated on June 19, 2024, 23:15 IST

SUMMARY

Investors are attracted to factor-based index or smart beta funds due to their ability to boost returns and offerings. This means that factor-based indices smart beta funds aim to improve investors’ financial situation through improved profit margins.

Understanding the rise of factor-based index funds: A smart beta investment strategy in India's growing passive investment market

Recent years have seen a rise in the popularity of index funds in India, particularly after the onset of the COVID-19 pandemic. There has been a huge increase in the amount of money poured into these funds over the last four years. Despite a growing number of retail investors showing interest in passive funds, the majority narrowly consider deploying their capital in Nifty or Sensex. We are here to discuss factor-based index funds that can yield more profit than these main indexes.

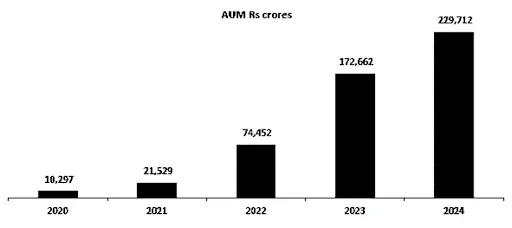

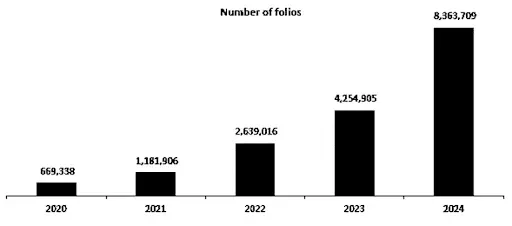

Rising inflow of index funds

Over the past five years, the assets under management (AUM) in index funds have skyrocketed, increasing 22 times from around ₹10,000 crores to ₹2.3 lakh crores. Additionally, the number of investor accounts (folios) has grown 14 times during the same period. Many of these investors are new or young, having started investing in mutual funds after the initial COVID-19 outbreak.

Index funds that are based on factors are a fresh kind of investment that was introduced in recent months. They have a lot of interest in developed countries. For instance, within the United States, smart beta ETFs or factor-based products have $2 trillion in assets out of all ETFs’ total of $10 trillion. Nonetheless, their popularity has not caught on in other parts of the world, but there seems to be a bright future for them, particularly on the Indian subcontinent.

What is a factor index fund?

Factor-based index funds, also known as smart beta funds, are a type of investment fund that focuses on specific factors or attributes to enhance returns and manage risks. Instead of simply tracking a market index like traditional index funds, these funds select stocks based on factors such as value, momentum, size, quality, or low volatility. By targeting these specific characteristics, factor-based index funds aim to outperform the broader market or provide a more tailored risk-return profile.

In the Indian context, factor-based index funds are gaining attention as investors seek more sophisticated investment options. For example, the ICICI Prudential Alpha Low Vol 30 ETF focuses on selecting stocks with high alpha and low volatility, aiming to provide better risk-adjusted returns. Another example is the Nippon India ETF NV20, which targets stocks with high-value scores based on metrics like earnings yield and return on equity. As the Indian market matures and investors become more aware of these products, factor-based index funds are expected to play a significant role in portfolio diversification and performance enhancement.

Factors used in factor-based index funds

Factor-based indices, also known as strategy indices, use specific criteria to select stocks. These criteria, or factors, help in identifying stocks that might perform better or carry lower risk. Here are some common factors used:

Single-factor indices focus on one of these factors, while multi-factor indices combine several factors. For example, the Nifty 100 Alpha 30 index picks 30 stocks with the highest alpha from the Nifty 100, while the Nifty 200 Alpha 30 selects from the Nifty 200.

Characteristics

Factor-based index funds are a relatively new type of investment. Many of these funds have been around for less than three years, and some for less than a year. Despite their newness, there are good reasons to consider including them in your portfolio of passive investments.

These funds have the potential to outperform broader market indices like the Nifty 50 or Nifty 500. Over the past year, for example, factor-based index funds returned an average of 44.57%, compared to the 25.41% return from the Nifty 50 as of June 19, 2024.

The returns from these funds ranged from 33% to over 90%, with even the lowest-performing fund outpacing the Nifty 50, which is the most widely used index in equity passive funds.

Factor indices can cater to various investment goals, styles, and risk levels. By understanding the different factors that these indices are based on, you can make more informed investment choices.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story