Personal Finance News

Gold Vs Equity: Which performed better after 1 year of buying on Muhurat trading over the last three years?

.png)

3 min read | Updated on October 27, 2024, 12:19 IST

SUMMARY

Over the past three Muhurat trading sessions, the Gold BeES ETF has consistently outperformed the Nifty 50 BeES ETF, driven by rising safe-haven demand and favourable macroeconomic factors.

For the past three years, the Gold BeES ETF has consistently outperformed the Nifty 50 BeES ETF.

As Diwali approaches, besides the auspicious Laxmi Pujan, market participants eagerly anticipate Muhurat trading. This year, on November 1, Muhurat trading will occur from 6:00 PM to 7:00 PM. Apart from trading in stocks, one popular choice across households is gold. Let's see how you can diversify this time by looking at some simple data insights.

In 2024, NIFTY50 delivered a return of about 10.7% as of October 25. Despite this, Nifty 50 has corrected over the past four weeks, dropping over 8% from a peak of 26,277. Meanwhile, gold prices, which started the year around ₹65,000 per 10 gm, have now risen to approximately ₹80,000 per 10 gm.

Here is an analysis of what performed better in the past 3 years between gold and equities. For better comparisons, we have considered ETFs of NIFTY50 and Gold i.e Nifty 50 BeES and Gold BeES

Muhurat trading dates from the last three years:

- Diwali 2021: November 4, 2021

- Diwali 2022: October 24, 2022

- Diwali 2023: November 12, 2023

Year 2021

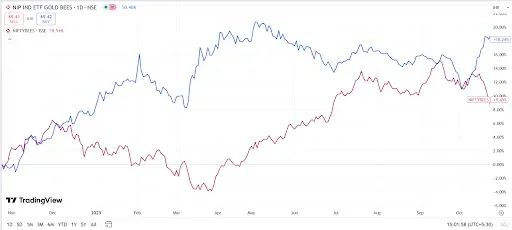

In 2021, Muhurat Trading was on November 4. According to the data below, over one year, the Gold Bees ETF outperformed the Nifty Bees ETF, yielding a return of 4.67% compared to Nifty Bees' 2.30%.

Year 2022

In 2022, Muhurat Trading occurred on October 24. The Gold Bees ETF once again outperformed, delivering a return of 18.24% against Nifty Bees' 9.45%.

Year 2023

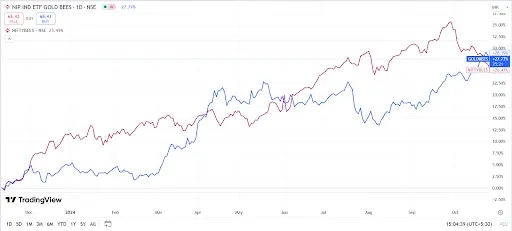

Last year, Muhurat Trading took place on November 12. The Gold Bees ETF continued its outperformance, returning 28.39% versus Nifty Bees’ 26.47%.

Observations

For the past three years, the Gold Bees ETF has consistently outperformed the Nifty Bees ETF. Both ETFs have generated positive returns during this period. However, it is essential to note that the past three years have not seen a major market correction, except in the NIFTY50, which has brought down the benchmark index 8% from its recent high.

Factors for rally in gold

There are multiple reasons for this rally. Geopolitical uncertainties—such as the Israel-Hamas conflict, with Hezbollah threatening further escalation—have heightened the demand for safe-haven assets like gold.

Additionally, concerns over the U.S. economy and potential rate cuts have made gold, a non-yielding asset, more attractive in a low-interest-rate environment. The global shift toward a looser monetary policy, as central banks consider rate cuts, has further supported gold prices.

This comparison of the Gold Bees ETF and Nifty Bees ETF over the last three years highlights how macroeconomic factors have favoured gold’s performance. While gold shows no signs of slowing down, investors should approach cautiously. Given the current global landscape, this precious metal remains a favoured hedge for investors.

About The Author

Next Story