Personal Finance News

DSP Credit Risk Fund churns the highest returns in a year among debt mutual fund category

.png)

3 min read | Updated on August 13, 2024, 18:55 IST

SUMMARY

DSP Credit Risk Fund, managed by DSP Mutual Fund has shown strong recent performance with a 15% return over the past year. Despite underperforming over longer periods, it has recently excelled in short tenures. Suitable for experienced investors seeking short-term gains with acceptable credit risk.

DSP Credit Risk Fund churns the highest returns in a year among debt mutual fund category

With a minimum investment requirement of ₹100 and an exit load of 1% on redemptions exceeding 10% within 12 months, the fund has assets worth ₹193.21 crore and an NAV of ₹40.7951 as of August 9, 2024.

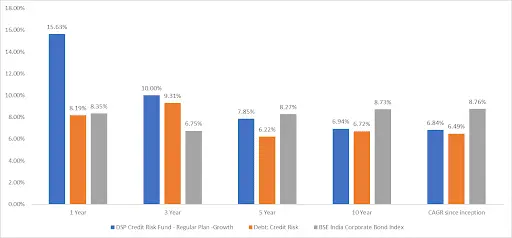

It has delivered a Compound Annual Growth Rate (CAGR) of 6.84% since inception, while its benchmark, the CRISIL Credit Risk Fund CIII Index, has returned 8.76%. The fund has shown varying performance across different periods but has recently performed well over short terms.

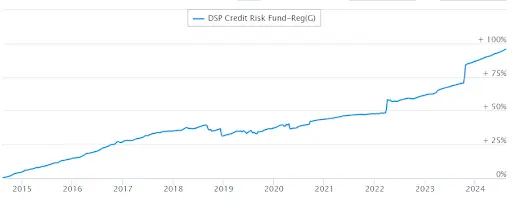

NAV Movement of the Fund in the Last 10 Years with absolute 95.02%

DSP Credit Risk Fund has outperformed benchmark and category over short tenures

The fund has outperformed the benchmark and category over short tenures. The fund underperformed in the period of 10 years and since launch. However, outperformed in shorter durations like 2 years, 3 years and 5 years. The fund has gained maximum in 1 year by accumulating more than 15% returns.

Recently in upper quartiles performer

Recently the fund featured in the top 2 quartiles in the last 2 years or since 2022. Even though it underperformed in 2017 and 2018, the fund has bounced back into the top quartile in 2022 and 2023.

A debt fund, which is considered for short-term investing, can be suitable for parking your money for a short time and having some handsome returns over it compared to bank FDs.

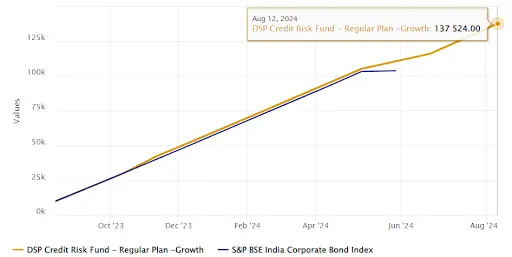

The chart below shows the growth of ₹10,000 monthly SIP in the DSP Credit Risk Fund over the last 1 year. With a cumulative investment of ₹1.2 lakh, you could have accumulated a corpus of nearly ₹1.37 lakh in a year.

DSP Credit Risk Fund – Investment Strategy

The fund invests in debt securities rated investment grade or unrated ones deemed equivalent by the Investment Manager. The investment process uses a top-down approach, considering factors such as interest rates, systemic liquidity, RBI policy, inflation, government borrowing, fiscal deficit, global rates, and currency movements.

The fund may use derivatives for risk management and enhancing returns, including interest rate swaps, futures, and forward rate agreements. Derivatives are leveraged and can lead to significant gains or losses. Their use involves risks distinct from traditional investments, and the fund manager's ability to effectively identify and execute strategies is not guaranteed.

Current Portfolio Positioning

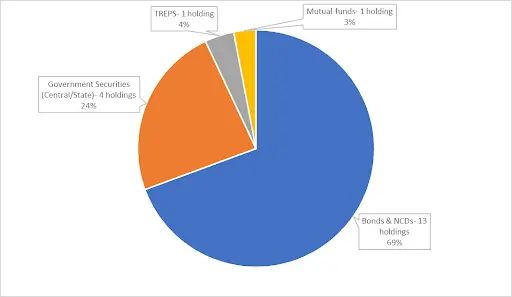

The Fund holds major investments in Bonds and NCDs of private companies with a total of 13 holdings. The top three bond holdings are Nuvoco Vistas Corporation Limited with 8.33% of the investment, Nirma Limited with 8.11%, and JSW Steel Limited with 8.06% of the investment of AUM. It also has investment in G-sec with GOI 2034, GOI 2039, GOI 2037 and GOI FRB 2028 Bonds.

The DSP Credit Risk Fund has delivered impressive 15% returns in the past year, making it a notable option for short-term debt investments despite its varied long-term performance.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story