Personal Finance News

Indexation benefit gone: Check how it will impact you

.png)

4 min read | Updated on July 26, 2024, 13:34 IST

SUMMARY

The Indian government has removed the indexation benefit for calculating long-term capital gains (LTCG) on non-financial assets, including property, and lowered the LTCG tax rate to 12.5%. This change may negatively impact investors, especially those with shorter-term investments or have properties in high-investor activity markets like NCR and Mumbai.

Indexation benefit gone, investors sound concerned about tax outgo

In case you are going to sell a house, you will probably pay additional tax on the transaction from now onwards. This comes after an important change was enacted after the union budget was presented by Finance Minister Nirmala Sitharaman.

In the India Union Budget 2024, the government has removed the indexation benefit for calculating long-term capital gain (LTCG) on non-financial assets (including property). It has also lowered the LTCG tax rate to 12.5% (from 20% previously).

This is unlikely to impact end-users who sell their existing house and reinvest in a new house, but it will impact investors who sell their house (investment) and reinvest in other asset classes. The impact of this new regime is likely to be negative for investors who hold the property for short terms and where property price appreciation is lower for less than 10 years.

What is Indexation?

Indexation is a method to adjust the price of an asset or investment to account for inflation. This adjustment uses a cost index chart. By adjusting the purchase price through indexation, the taxable returns on the investment decrease, reducing the tax liability. This reduction in tax liability results in higher net returns for the investor.

For example, you bought a house 15 years ago in March 2009 for ₹35 lakh and sold it in March 2024 for ₹1.20 crore. Your Gain on sale of the house in ₹85 lakh. However, you may think that considering the inflation has risen so much and prices of houses have gone up due to inflation, it would be unfair if you have to pay tax on ₹85 lakh. The government thus provides relief in the form of allowing you to index (increase) the purchase price of the house with inflation. A higher purchase price means lesser profits, which effectively means a lower tax.

Indexation benefit removed

The government has removed the indexation benefit for calculating long-term capital gains on non-financial assets (including property). It has also lowered the LTCG tax rate to 12.5% (from 20% previously). This is being done to rationalise the capital gains tax across all financial and nonfinancial assets. The short-term capital gains (STCG) tax rate has been left unchanged at 20%.

The government has clarified that the removal of indexation benefits will not be applicable to old properties held before 2001, which would continue to get indexation benefits. The new norms are applicable with immediate effect from July 23, 2024.

Illustration on the removal of indexation benefit

Suppose Mr. A purchased a property in March 2005-06 for ₹25 lakhs and then sells it in FY2024-25 for ₹1 crore.

Prior to the Budget Announcement

(Sale Value – Indexed Cost*) x LTCG Rate

(1,00,00,000 – 77,56,410) x 20%

LTCG Tax ₹4,48,718

Post Budget Announcement

(Sale Value – Actual Cost) x LTCG Rate

(1,00,00,000 – 25,00,000) x 12.5%

LTCG Tax ₹9,37,500

So, there is a difference of almost ₹4,48,782, where the investors will pay tax double the indexation benefit prior to the budget.

Impact of Removal of Indexation Benefit

According to CLSA, this move is unlikely to impact the end-users who sell their existing house and reinvest in a new house (LTCG is not applicable). It will impact investors who would sell their house (investment) and reinvest in other asset classes. Also, it will impact relatively shorter-term investments (10 years) and where property price appreciation is at more than 10% p.a.

Property markets like Bangalore, Hyderabad, and Pune, which are end-user-driven, will be the least impacted. Markets like NCR and Mumbai, which have higher investor activity, are likely to be adversely impacted.

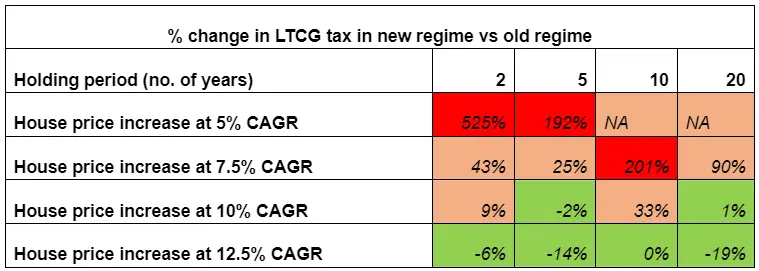

In the table below, we have assumed an acquisition cost of 100 and used the government’s Cost Inflation Index (CII) to calculate the indexed cost of acquisition for calculating LTCG in the old regime. We compare that with the new regime (no indexation) to calculate the LTCG tax at a lower rate of 12.5% (versus 20% in the old regime).

Source: CII and CLSA inputs

Source: CII and CLSA inputsThe above table estimates that under the new regime, the LTCG tax incidence is higher when the holding period is lower (10% p.a.).

Conclusion

The removal of the indexation benefit will significantly impact short-term investors, potentially doubling their tax liability, especially for shorter-term holdings and properties in high-investor markets.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story