Market News

Trade Setup for Sept 17: BANK NIFTY reclaims 52,000, will it sustain the bullish momentum?

.png)

4 min read | Updated on September 17, 2024, 07:40 IST

SUMMARY

The BANK NIFTY options data for the 18 September expiry showed significant put building at the 51,500 and 52,000 strikes, indicating bullish momentum. Unless the index falls below the 51,750 to 51,800 zone, the momentum could remain bullish.

Stock list

The technical structure of the NIFTY50 remains bullish as the index is currently consolidating its gains at higher levels.

Asian markets update at 7 am

The GIFT NIFTY is up 0.1%, indicating a flat-to-positive start for the Indian equities today. Meanwhile, the Asian markets are sending mixed cues. Japan’s Nikkei 225 is down 1.4%, while Hong Kong’s Hang Seng index is up 0.5%.

U.S. market update

- Dow Jones: 41,662 (▲0.5%)

- S&P 500: 5,633 (▲0.1%)

- Nasdaq Composite: 17,592 (▼0.5%)

U.S. equities ended the day mixed, with technology names coming under selling pressure ahead of the U.S. Federal Reserve meeting. Apple shares fell more than 3% on concerns over sales of the iPhone 16.

Meanwhile, investors remain concerned about how aggressively the Fed will cut rates, whether by 0.25% or 0.50%. As of Monday, traders are pricing in a 67% chance of a half-point cut, up from 30% a week ago. The odds of a 0.25% cut now stand at 37%, according to the Fed Funds Future.

NIFTY50

- September Futures: 25,442 (▲0.2%)

- Open Interest: 5,59,234 (▼2.9%)

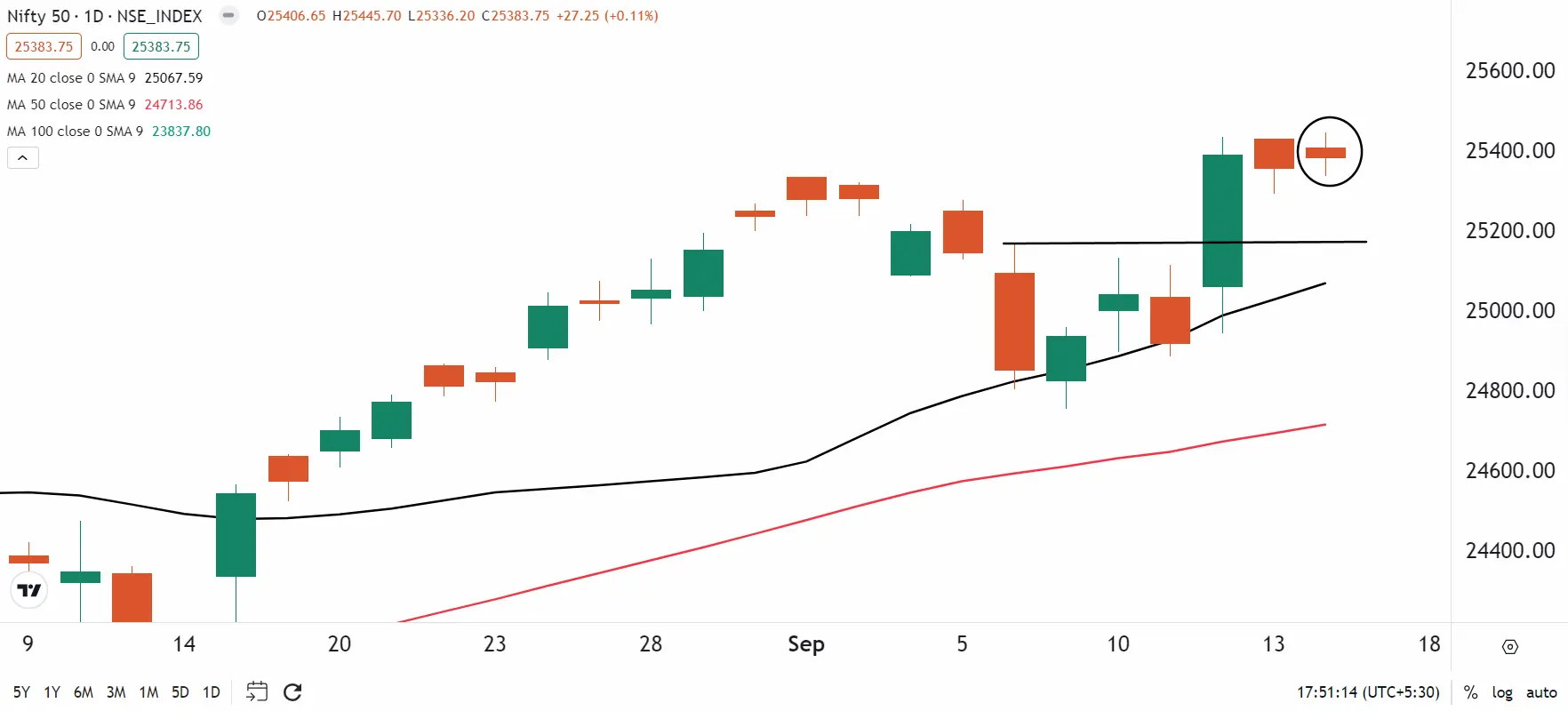

The NIFTY50 index started Monday's session on a positive note, hitting a fresh all-time high during the day. However, the index saw profit-booking at higher levels and slipped from its intraday high, forming a doji candlestick pattern on the daily chart. This indicates a pause and caution at the all-time highs.

The technical structure of the NIFTY50 remains bullish as the index is currently consolidating its gains at higher levels. However, the doji, which is a neutral candlestick pattern, is forming largely within the range of the 13th September. In this case, short-term traders can closely monitor the high and low of the 13th. A close above or below this area will provide further directional clues.

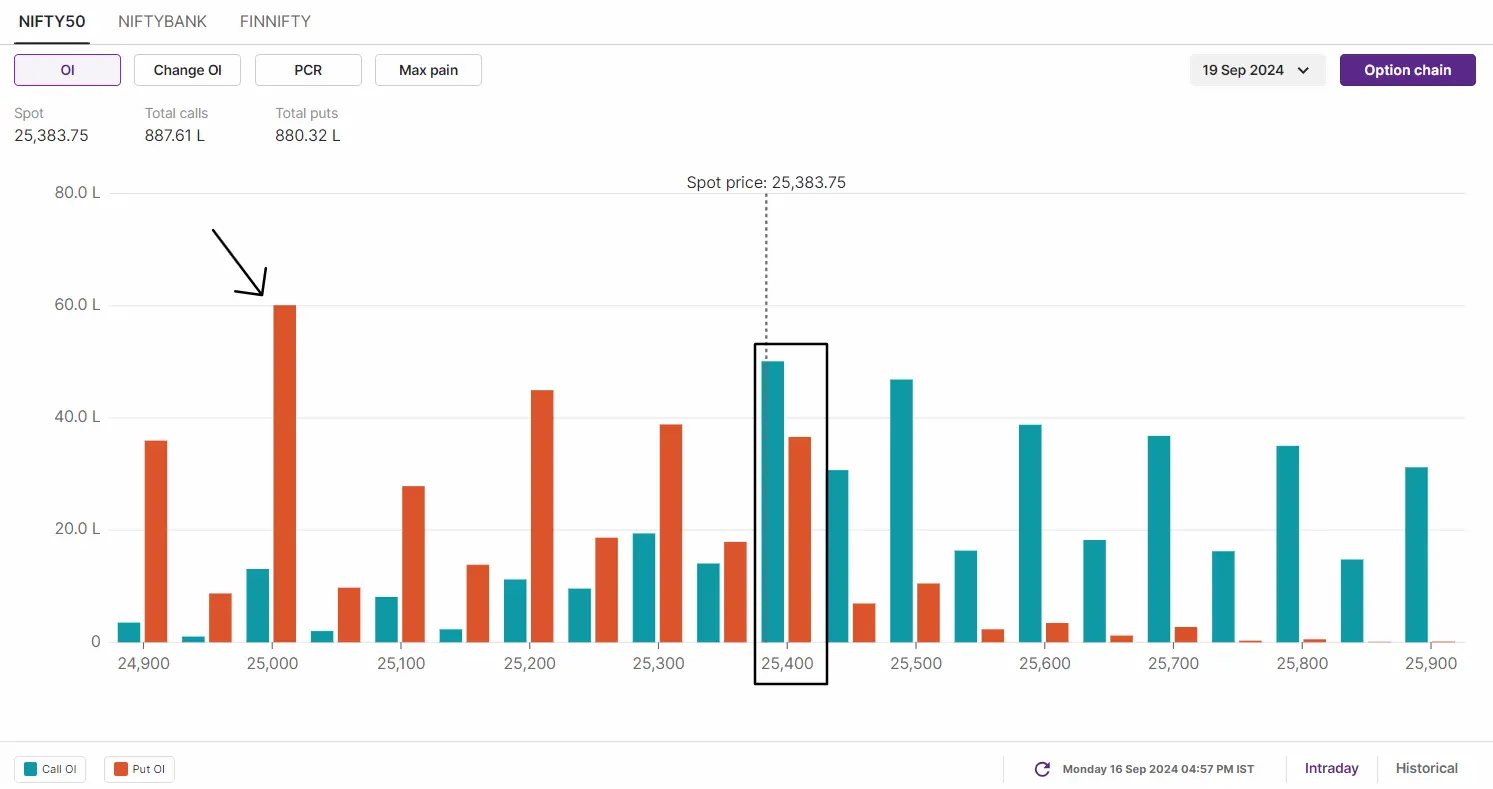

Open interest data for the 19 September expiry shows the highest put base at the 25,000 strike, making it a key support zone for the NIFTY50. However, ahead of the Fed's rate decision, the index also saw a significant build-up of call and put bases at the 25,400 strike, indicating a range-bound move and awaiting a catalyst.

BANK NIFTY

- September Futures: 52,261 (▲0.6%)

- Open Interest: 1,40,016 (▼4.2%)

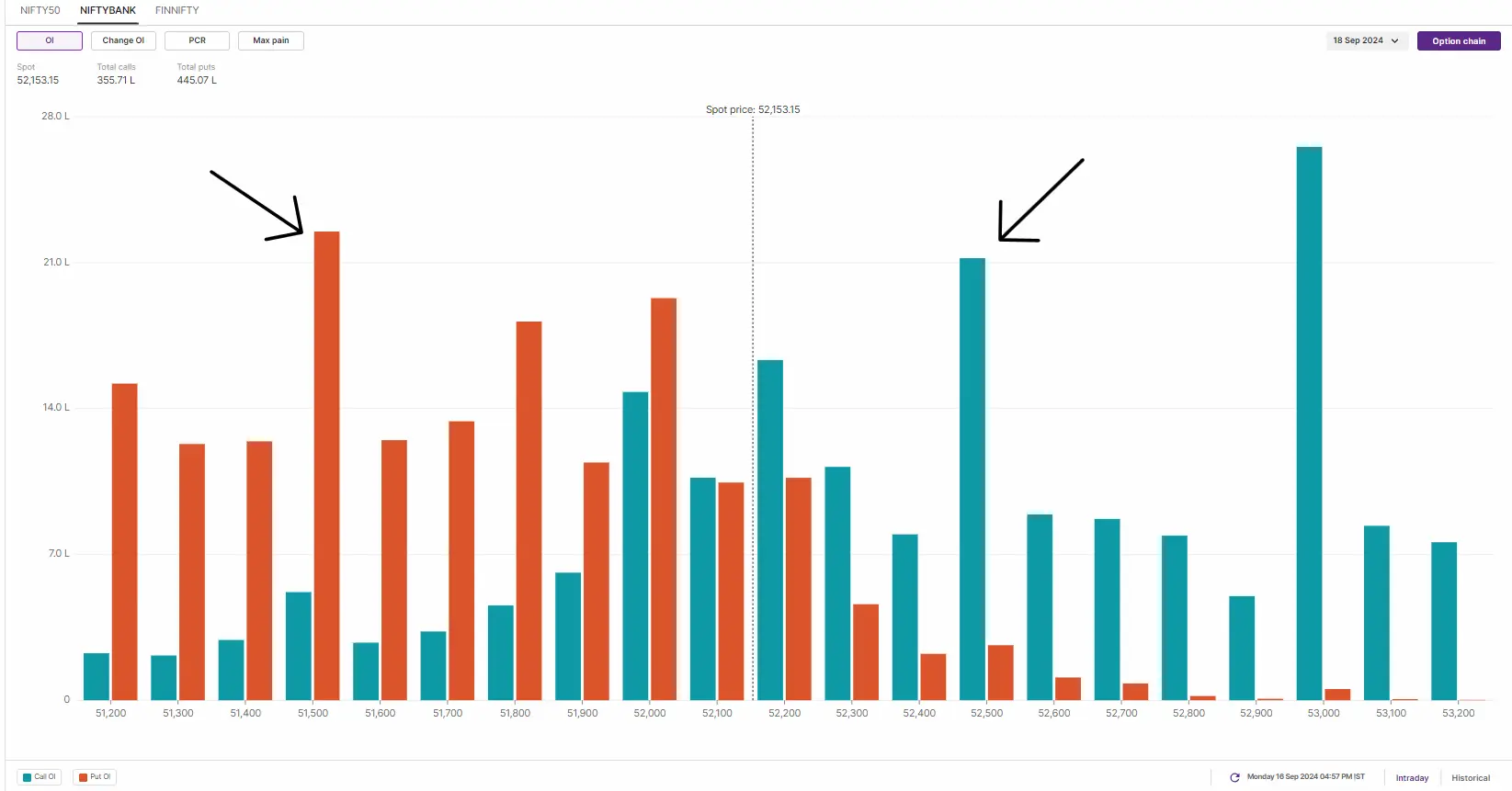

The BANK NIFTY outperformed its benchmark indices for the second consecutive day, closing above the 52,000 level for the first time in almost two months. The index formed a green candle, similar to the doji candle on the daily chart, but not the conventional one.

Technically, the index is at a crucial juncture on the daily chart. As you can see on the chart below, the index closed above the recent swing high (51,750) and is forming a higher high and higher low structure. In addition, the index has managed to close above the previous day's high for the third consecutive day, indicating bullishness with immediate support around the 51,750 zone.

Open interest data for the 18 September expiry is significant at the 51,000 and 51,500 strikes, indicating support for the index around these strikes. On the other hand, the call base shifted from the 52,000 strike to the 53,000 strike and saw a significant unwinding of call options. In addition, substantial put and call options contracts were placed at the 52,200 strike, suggesting range-bound activity .

FII-DII activity

Stock scanner

Under F&O ban: Aarti Industries,Balrampur Chini Mills, Bandhan Bank, Birlasoft, Chambal Fertilisers, Granules India, Hindustan Copper, LIC Housing Finance and RBL Bank

Added under F&O ban: Birlasoft, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) and LIC Housing Finance

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story