Market News

Trade setup for Jan 27: NIFTY50 faces resistance at 23,400, volatility spikes 6%

.png)

4 min read | Updated on January 27, 2025, 07:18 IST

SUMMARY

The NIFTY50 index encountered resistance for the fifth time at the 23,350-23,400 level, failing to close above this crucial zone. This sharp reversal from the resistance level suggests strong selling pressure in this region. Traders should exercise caution, especially with the volatility index surging 6% ahead of the Union Budget announcement.

Stock list

The NIFTY50 index reversed course on Friday, failing to extend its two-day gains. | Image: PTI

Asian markets @ 7 am

- GIFT NIFTY: 22,934 (-0.85%)

- Nikkei 225: 39,739 (-0.48%)

- Hang Seng: 20,242 (+0.88%)

U.S. market update

- Dow Jones: 44,424 (▼0.3%)

- S&P 500: 6,101 (▼0.2%)

- Nasdaq Composite: 19,954 (▼0.5%)

U.S. indices took a breather and snapped four-day winning streak with the S&P 500 closing at the record high levels. Strong stretch of earnings and better-than-expected news on the tariffs, helped indices to drive the gains.

After the sharp gains of the two weeks the investor attention will turn to fourth quarter earnings of big technology companies and U.S. Fed's interest rate decision. Meanwhile, the Fed funds futures are pricing more than 99% chance that the central bank will leave interest rates unchanged.

NIFTY50

- January Futures: 23,113 (▼0.6%)

- Open interest: 5,28,398 (▼3.1%)

The NIFTY50 index reversed course on Friday, failing to extend its two-day gains. It closed the session with losses, hovering near the critical 23,000 support level. The index formed a bearish candle on the daily chart, closing near its previous session’s low, indicating potential weakness.

As per the daily chart, the index is still facing resistance around the 23,400 zone and has failed to capture this level on a closing basis. Additionally, the index is currently trading below all its key exponential moving averages like 21, 50 and 200. Unless the index reclaims the 23,400 level on a closing basis, the trend may remain weak.

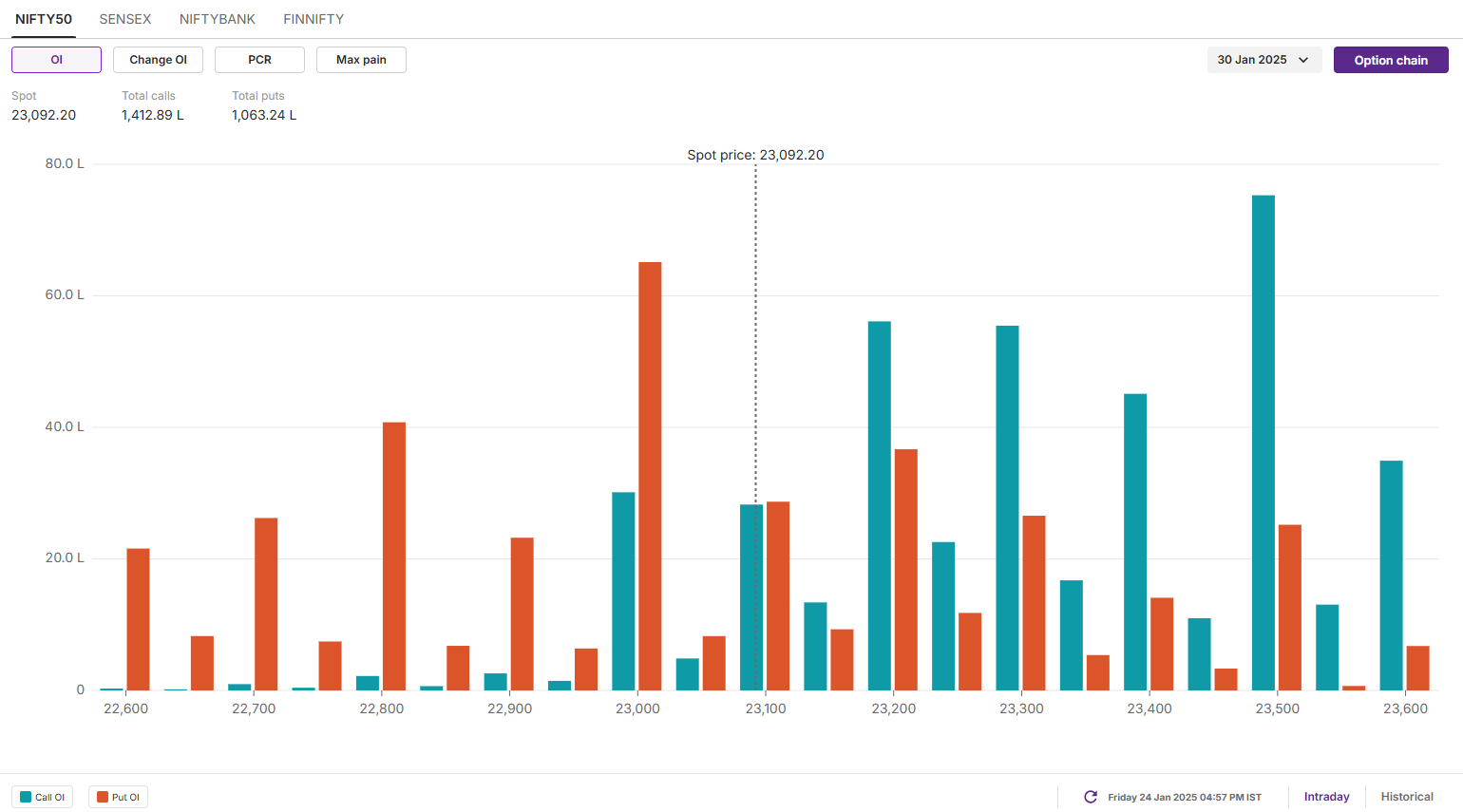

The open interest data for the monthly expiry of NIFTY50 index saw a significant call base at 23,500 strike, pointing at resistance for the index around this zone. On the flip side, the put base was seen at 23,000 strike, hinting at support around this level.

SENSEX

- Max call OI: 78,000

- Max put OI: 76,000

- (Expiry: 28 Jan)

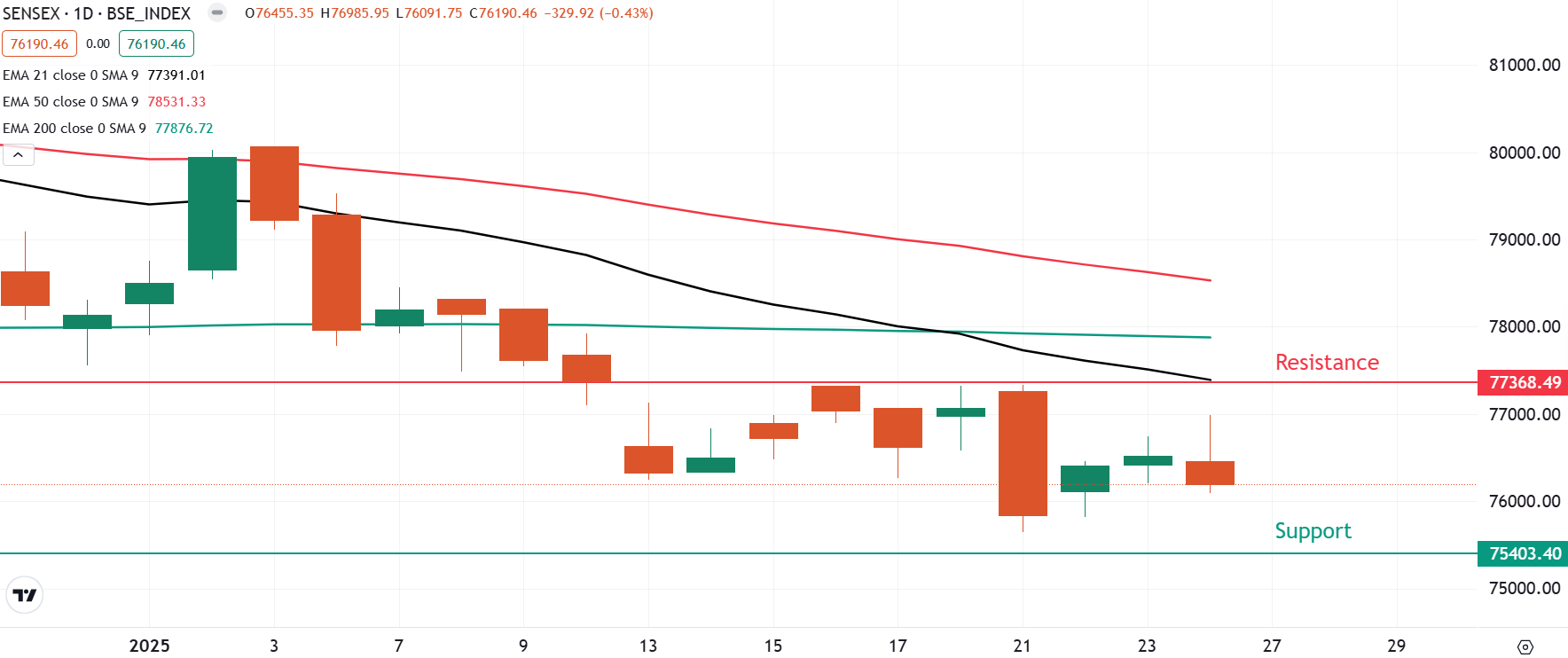

The SENSEX failed to extend its two-day rally on Friday, ending the session with losses. The broader trend for the index remains bearish, characterised by lower highs and lower lows on the daily chart.

From a technical perspective, immediate resistance for the index is at 77,300, which is also the 21-day exponential moving average (EMA). A decisive close above this level is crucial to strengthen the bullish outlook. Conversely, a breach of the critical swing low at 75,641 could trigger further weakness, possibly extending towards the 75,400 support zone.

The open interest data for the 28 January saw significant call build-up at 77,000 strike, marking it as immediate resistance for the index around this area. On the other hand, the put base was seen at 76,000 strike but with a relatively low volume.

FII-DII activity

- Long build-up: Mphasis and Britannia

- Short build-up: Cyient, Polycab, Jio Financial Services, Sona BLW Precision, Hindustan Petroleum and Trent

- Under F&O ban: Aditya Birla Fashion and Retail, Bandhan Bank, Can Fin Homes, Dixon Technologies, IndiaMART InterMESH, L&T Finance, Manappuram Finance, Mahanagar Gas and Punjab National Bank

- Out of F&O ban: Nil

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story