Market News

Trade setup for Jan 14: NIFTY50 at crucial support– Inverted hammer awaits confirmation

.png)

4 min read | Updated on January 14, 2025, 07:19 IST

SUMMARY

The NIFTY50 index formed an inverted hammer candlestick pattern on the daily chart as it declined to the critical support zone of 23,000. The inverted hammer is a potential reversal pattern that typically appears after a downtrend, signalling a possible shift in momentum. However, confirmation of this pattern occurs only if the subsequent candle closes above the high of the inverted hammer.

Stock list

After a gap-down start, the NIFTY50 index further extended its losses and started the week on a negative note.

Asian markets @ 7 am

- GIFT NIFTY: 23,288.00 (+0.69%)

- Nikkei 225: 38,686.30 (-1.29%)

- Hang Seng: 18,901.56 (+0.15%)

U.S. market update

- Dow Jones: 42,297 (▲0.8%)

- S&P 500: 5,836 (▲0.1%)

- Nasdaq Composite: 19,088 (▼0.3%)

U.S. indices recovered from early losses, with the Dow Jones Industrial Average leading the rebound. The indices ended on a mixed note as investors rotated out of technology stocks amid diminishing expectations of a rate cut in the Federal Reserve’s March meeting and anticipation of the inflation report set for release on January 15.

Additionally, investors are closely monitoring fourth-quarter earnings, with Citibank, Goldman Sachs, and JPMorgan Chase reporting on January 15, followed by Morgan Stanley and Bank of America on January 16.

NIFTY50

- January Futures: 23,500 (▼1.4%)

- Open interest: 5,54,677 (▲2.3%)

After a gap-down start, the NIFTY50 index further extended its losses and started the week on a negative note. The index lost over 1% and ended near the crucial support of 23,000.

As per the daily chart, the broader trend remains bearish as the NIFTY50 ended Monday’s session below the swing low November 2024 and hit a seven month low. The sharp fall was led by sharp surge in the U.S. Dollar and Crude prices.

From the technical standpoint, the index has the next crucial support zone around 22,700-22,800. If it slips below this zone on a closing basis, then the index may witness further weakness. On the other hand, the resistance remains around the 23,800, which coincides with the 200-day exponential moving average.

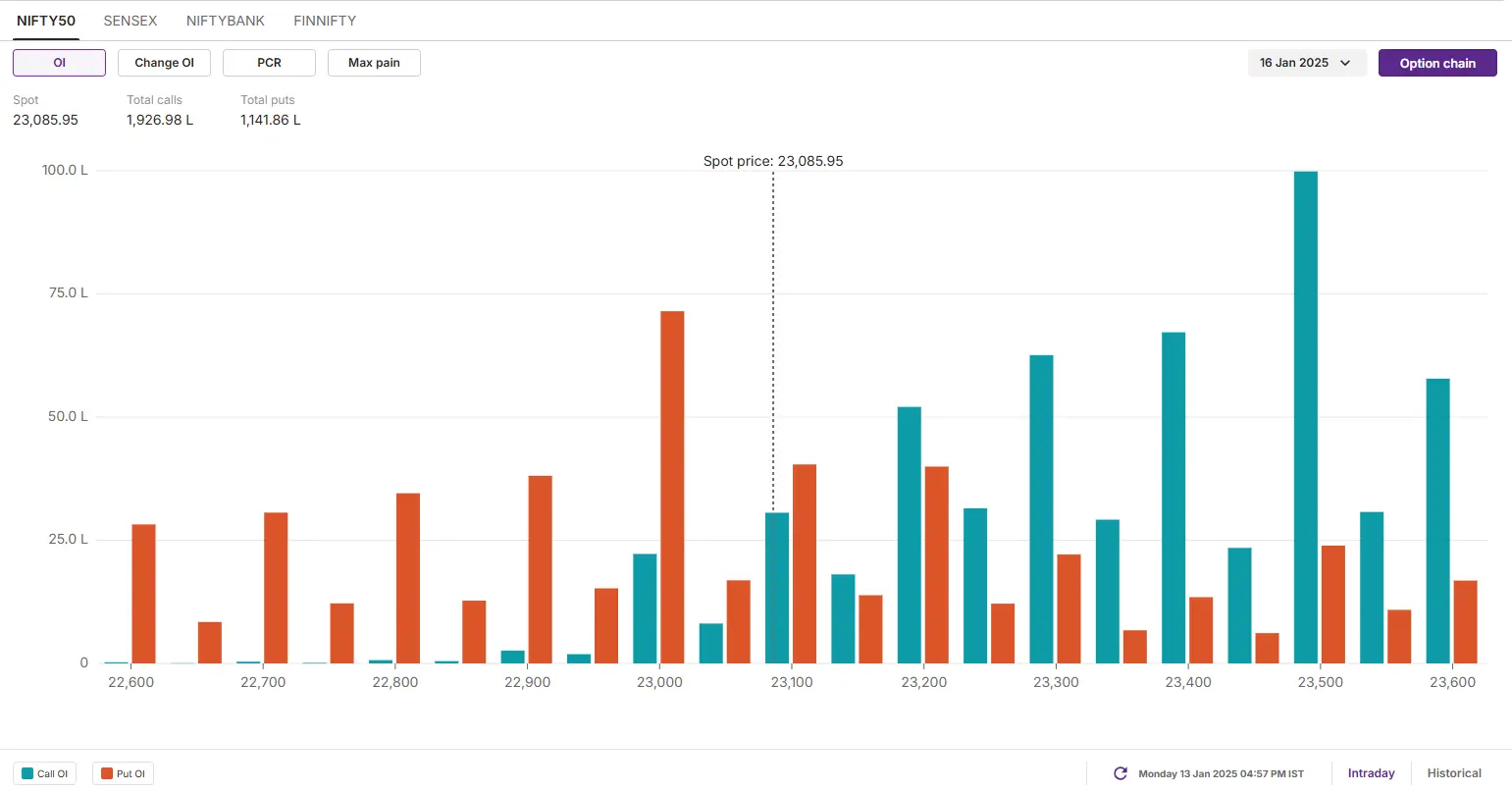

The open interest data for the 16 January expiry saw significant call build-up at 23,500 strike, suggesting that the index may face resistance around this zone. On the flip side, the put base was seen at 23,000 strike, suggesting support for the index around this zone.

SENSEX

- Max call OI: 78,000

- Max put OI: 76,000

- (Expiry: 14 Jan)

The SENSEX also started Monday's session on a negative note and extended the losing streak to the fourth consecutive day. The index surrendered the swing low of November 2024, indicating further weakness.

However, it is important to note that the SENSEX formed an inverted hammer candlestick pattern on the daily chart at the crucial support of 76,000. It is a pattern that forms at the end of a downtrend, with a small body near the day's low and a long upper shadow, indicating potential trend reversal to the upside. The pattern gets confirmed if the close of the subsequent candle is above the high of the reversal pattern.

As per the daily chart, the broader trend of the index remains weak with next crucial support around the 75,000 zone. If the index surrenders this zone on a closing basis, then it may further extend the bearish sentiment. On the other hand, the resistance is around 78,000, which also coincides with its 200 EMA.

For today’s expiry, the significant call base for the SENSEX was seen at 78,000 zones. This suggests that the index may face resistance around this zone. Conversely, the put base was seen at 76,000 and 75,000, pointing at support for the index around these levels.

FII-DII activity

Stock scanner

- Long build-up: Nil

- Short build-up: PB Fintech (Policy Baazar), CG Power, Avenue Supermarts (DMART), Shriram Finance and Zomato

- Under F&O ban: Aarti Industries, Bandhan Bank, Hindustan Copper, Manappuram Finance, L&T Finance and RBL - Bank

- Added under F&O ban: Aarti Industries

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story