Market News

Trade setup for Feb 19: NIFTY50 resists breakdown, bounces off January lows for the fifth time

.png)

4 min read | Updated on February 19, 2025, 07:22 IST

SUMMARY

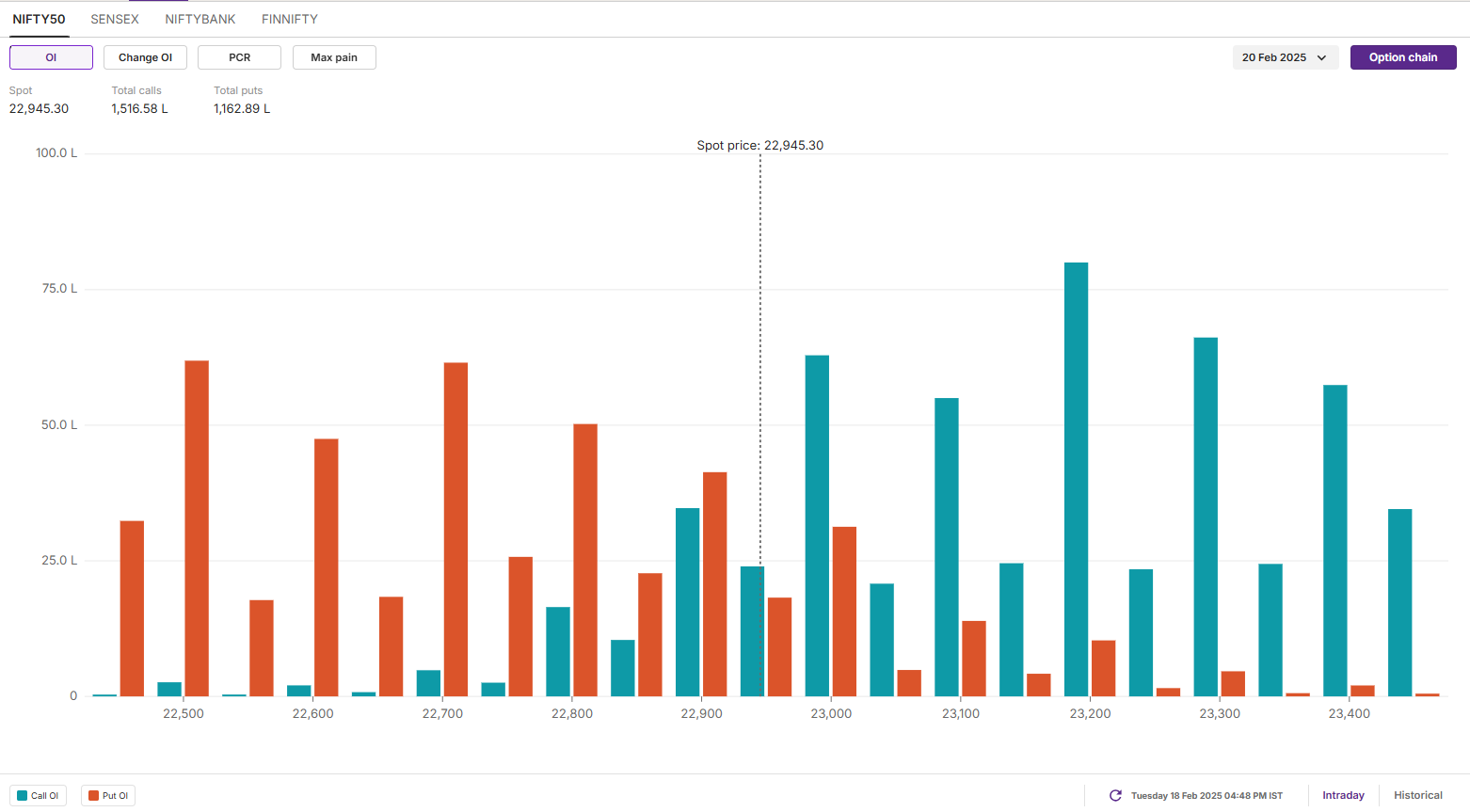

Options data for February 20 expiry shows a strong call build-up at the 23,200 strike, indicating resistance around this level for the NIFTY50 index. Meanwhile, a significant put base at the 22,700 strike suggests support in that zone.

Stock list

After a volatile first half, the NIFTY50 Index rebounded from the day's low to end February 18 session on a flat note. | Image: Shutterstock

Asian markets @ 7 am

- GIFT NIFTY: 22,961 (+0.09%)

- Nikkei 225: 39,125 (-0.37%)

- Hang Seng: 22,763 (-1.38%)

U.S. market update

- Dow Jones: 44,556 (▲0.0%)

- S&P 500: 6,129 (▲0.2%)

- Nasdaq Composite: 20,041(▲0.0%)

U.S. indices were mixed on Tuesday in a holiday-shortened week, with investors awaiting the Federal Open Market Committee meeting minutes. The S&P 500 edged up 0.2%, reaching a new record high late in the session.

Meanwhile, Russian and U.S. officials concluded their first formal meeting in years after more than four hours of discussions aimed at laying the groundwork for negotiations to end the war in Ukraine.

NIFTY50

- February Futures: 22,972 (▼0.3%)

- Open interest: 2,23,739 (▼2.4%)

After a volatile first half, the NIFTY50 Index rebounded from the day's low to end the February 18th session on a flat note. The index defended the crucial support zone of 22,700-22,800 for the fifth time on a closing basis, suggesting buying interest at current levels.

However, it is important to note that the broader trend of the index remains weak with immediate resistance around the 23,300 zone. On the flip side, sellers have repeatedly tested the January low support, making this zone vulnerable. A decisive breakdown below this level on a closing basis could extend the decline toward the 22,500 zone.

Open interest data for the February 20 expiry shows significant call option building at the 23,200 strike, suggesting resistance at this level. Meanwhile, a base of put open interest was observed at 22,500 and 22,700 strikes, suggesting firm support zones for the index.

SENSEX

The SENSEX also failed to build-on to its previous sessions gains, ending the February 18th session and weekly expiry of its options contract on a flat note. The index took support for the fifth time in the zone of 75,100- 75,600, which coincides with January lows.

The broader technical structure of the index remains weak, with immediate resistance near the 76,800 zone, which also aligns with the 20-day exponential moving average. On the downside, a decisive break below the 75,100-75,600 support zone on a closing basis could accelerate further weakness.

FII-DII activity

Foreign Institutional Investors (FIIs) turned net buyers after nine sessions, purchasing equities worth ₹4,786 crore in the cash market. However, this includes the Bharti block deal, where 5.1 crore shares changed hands at an average price of ₹1,660, totalling ₹8,485 crore. NSE data shows FIIs picked up ₹5,130 crore worth of these shares from Indian Continent Investment Limited, a Bharti Airtel promoter entity. Excluding the block deal, FIIs were net sellers, offloading ₹344 crore worth of shares.

Stock scanner

- Long build-up: Persistent Systems and Tech Mahindra

- Short build-up: AU Small Finance Bank, ABB, RBL Bank, Computer Age Management Services and Container Corporation of India

- Top traded futures contracts: ABB, HDFC Bank, Bharti Airtel, ICICI Bank and Reliance Industries

- Top traded options contracts: ABB 5500 CE, ABB 5400 CE, ABB 5200 PE, HDFC BANK 1720 CE and HAL 3400 PE

- Under F&O ban: Manappuram Financ and Deepak Nitrite

- Out of F&O ban: Deepak Nitrite

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story