Market News

Trade Setup for August 29: BANK NIFTY stuck between 50 and 20 DMA, forms inside candle

.png)

5 min read | Updated on August 29, 2024, 12:25 IST

SUMMARY

The BANK NIFTY index oscillated between its 50 and 20 day moving average for the fifth day in a row, forming an inside candle on the daily chart. A decisive break above or below the inside candle, coupled with a move above the 50-day or 20-day moving average, will provide clear directional clues.

Stock list

The open interest data for today’s expiry reveals the highest put base at the 25,000 strike (Image: PTI/file)

Asian markets update at 7 am

The GIFT NIFTY is down 0.2%, indicating a flat to negative start for the NIFTY50 today. Other Asian indices are also trading lower. Japan’s Nikkei 225 is down 0.4%, while the Hong Kong’s Hang Seng index also fell 0.4%.

U.S. market update

Dow Jones: 41,091 (▼0.3%) S&P 500: 5,592 (▼0.6%) Nasdaq Composite: 17,556 (▼1.1%)

U.S. indices ended the Wednesday’s session lower amid decline in technology stocks. Investors awaited the second quarter earnings of Nvidia, which were declared after market hours.

The AI juggernaut's results beat expectations on both the profit and revenue fronts, while its guidance for the current quarter also came in ahead of expectations. However, Nvidia's shares were down more than 6% in after-hours trading as an immediate reaction to the figures.

NIFTY50

August Futures: 25,048 (▲0.1%) Open Interest: 2,33,507 (▼27.3%)

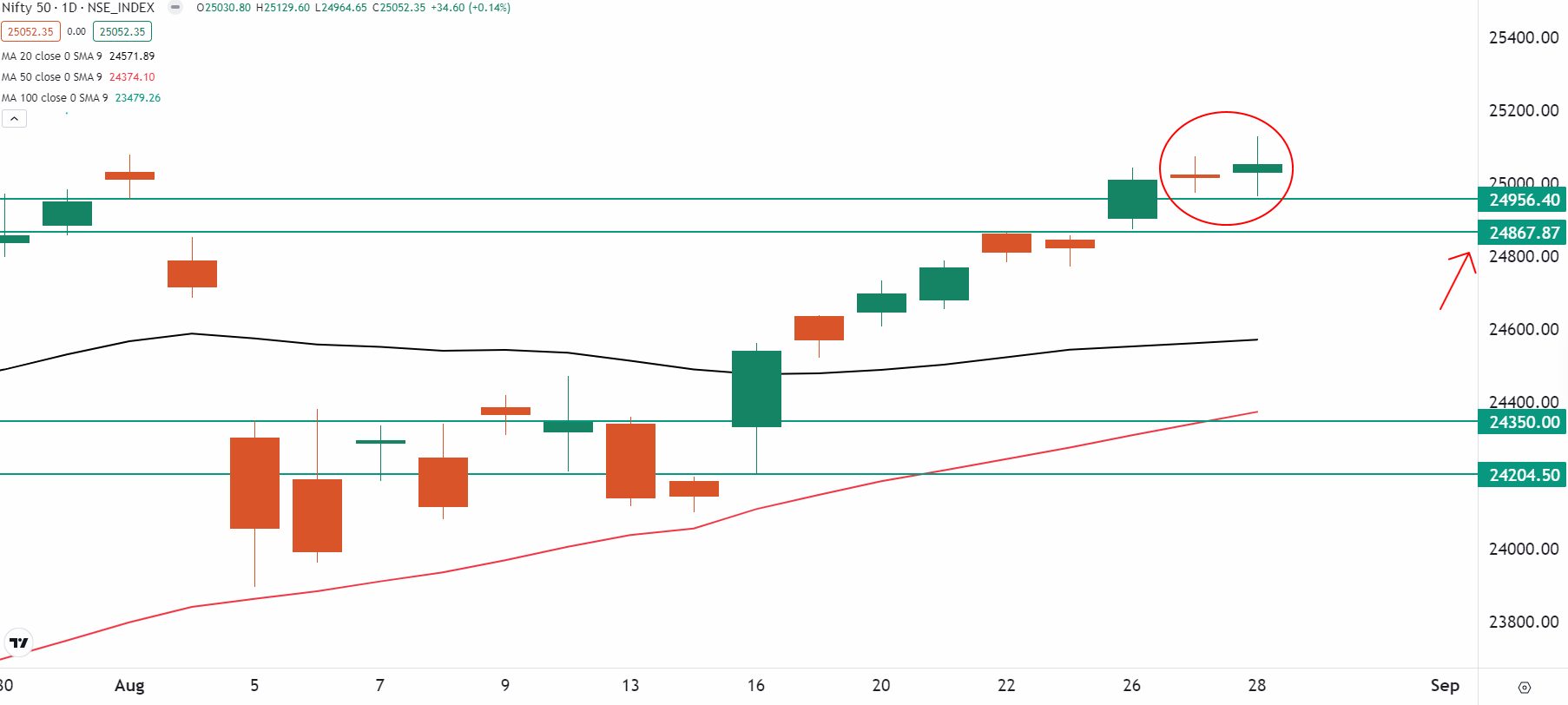

The NIFTY50 index extended its winning streak for the tenth consecutive day, reaching a fresh record high. Despite the sharp rebound, the index encountered strong resistance near its previous all-time high (25,078), failing to close above this critical level.

On the daily chart, the index formed its second consecutive doji candle, signalling ongoing indecision and a lack of strong at these elevated levels. As highlighted in our previous analysis, a decisive close above the previous all-time high could further fuel the bullish momentum. However, the index now has immediate support around the 24,800 zone. A close below this support zone may indicate a potential shift in trend, suggesting the possibility of emerging weakness.

For today's expiry, we've identified a critical range for our readers on the 15-minute chart of the NIFTY50. The index is currently trading between 25,100 and 24,950. Given the monthly expiry, we could see a lot of volatility in both directions. However, traders are advised not to commit to any directional strategies until the index decisively breaks this range on a closing basis within the 15-minute timeframe. A break above or below this area will provide clearer directional signals.

The open interest data for today’s expiry reveals the highest put base at the 25,000 strike, indicating strong support for the NIFTY50 within the 24,900 to 25,000 zone. Conversely, the call base is concentrated at the 25,100 and 25,500 strikes, signaling potential resistance around these levels. Based on this data, traders are expecting NIFTY50 to hover around the 25,100 mark.

It's also important to note that the market could be influenced by the annual general meeting of index heavyweight Reliance Industries, especially in the second half of the session.

BANK NIFTY

September Futures: 51,428 (▼0.2%) Open Interest: 1,49,008 (▲64.8%)

The BANK NIFTY index traded in a narrow range on the expiry day and formed an inside candle on the daily chart. The index once again failed to provide the follow-through momentum after moving out of twelve day long consolidation.

In yesterday’s analysis of BANK NIFTY, we highlighted two crucial points. First, the index is currently trading above its 20-day moving average but encountering resistance near its 50-day moving average. Second, the index has successfully moved past the descending trendline drawn from its previous all-time high, suggesting a positive rebound. As a result, the index is now navigating a tight range between its 20-day and 50-day moving averages.

In the upcoming sessions, traders should monitor not only these moving averages but also the high and low of the inside candle pattern. A decisive break above or below the inside candle, in conjunction with a move beyond the 20-day or 50-day moving average, will offer clearer directional cues.

FII-DII activity

Stock scanner

Out of F&O ban: Balrampur Chini and Birlasoft

Added under F&O ban: Bandhan Ban and Granules India

Under F&O ban: Bandhan Bank, Granules India, Hindustan Copper and India Cements

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story