Market News

Trade setup for August 26: NIFTY50 approaches all-time high, aims to fill second bearish gap

.png)

5 min read | Updated on August 26, 2024, 07:47 IST

SUMMARY

The NIFTY50 index has formed a bullish candle on the weekly chart, in support of the continuation of the upward trend. However, traders should be wary of profit-taking as the index approaches its all-time high zone. Immediate support for the index is at 24,500, while resistance remains at 25,100.

Stock list

The NIFTY50 index extended the winning streak to the seventh day in a row and ended the Friday’s session in green, above 24,800 mark.

Asian markets update at 7 am

The GIFT NIFTY is up 0.3%, pointing to a positive start for the NIFTY50 today. Meanwhile, other Asian markets are trading mixed. Japan's Nikkei 225 is down over 1%, while Hong Kong's Hang Seng Index is up 1%.

U.S. market update

- Dow Jones: 41,175 (▲1.1%)

- S&P 500: 5,634 (▲1.1%)

- Nasdaq Composite: 17,877 (▲1.4%)

U.S. indices ended the Friday’s session in green after the Federal Reseve Chair Jerome Powell said that the time has come for monetary policy to adjust. In his speech at Jackson Hole Symposium, the Fed chair said that the pace of the policy change in the coming months will depend on the risks that revolve around jobs, not inflation.

The Fed chair added that its seems unlikely that the labour market will be a source of elevated inflationary pressures and we do not seek or welcome further cooling in labour market.

NIFTY50

- August Futures: 24,840 (▲0.1%)

- Open Interest: 4,22,240 (▼1.5%)

The NIFTY50 index extended the winning streak to the seventh day in a row and ended the Friday’s session in green, above 24,800 mark. The index sustained its gains at the higher levels and consolidated at the lower end of the second bearish gap, formed on 2 August on the daily chart.

The index is currently trading above all the key moving averages and has immediate support around the 24,500 zone. With the broader trend remaining positive, the index will react to the Fed Chairman Jeorme Powell’s Jackson Hole speech today and may attempt to fill the second bearish gap. Experts believe that the uptrend could continue if the index closes above 25,100.

However, as the index approaches its previous all-time high, traders should be cautious of potential profit booking. So far, the NIFTY50 has maintained its recent rebound by protecting the previous day’s low on a closing basis and has not formed any reversal signals.

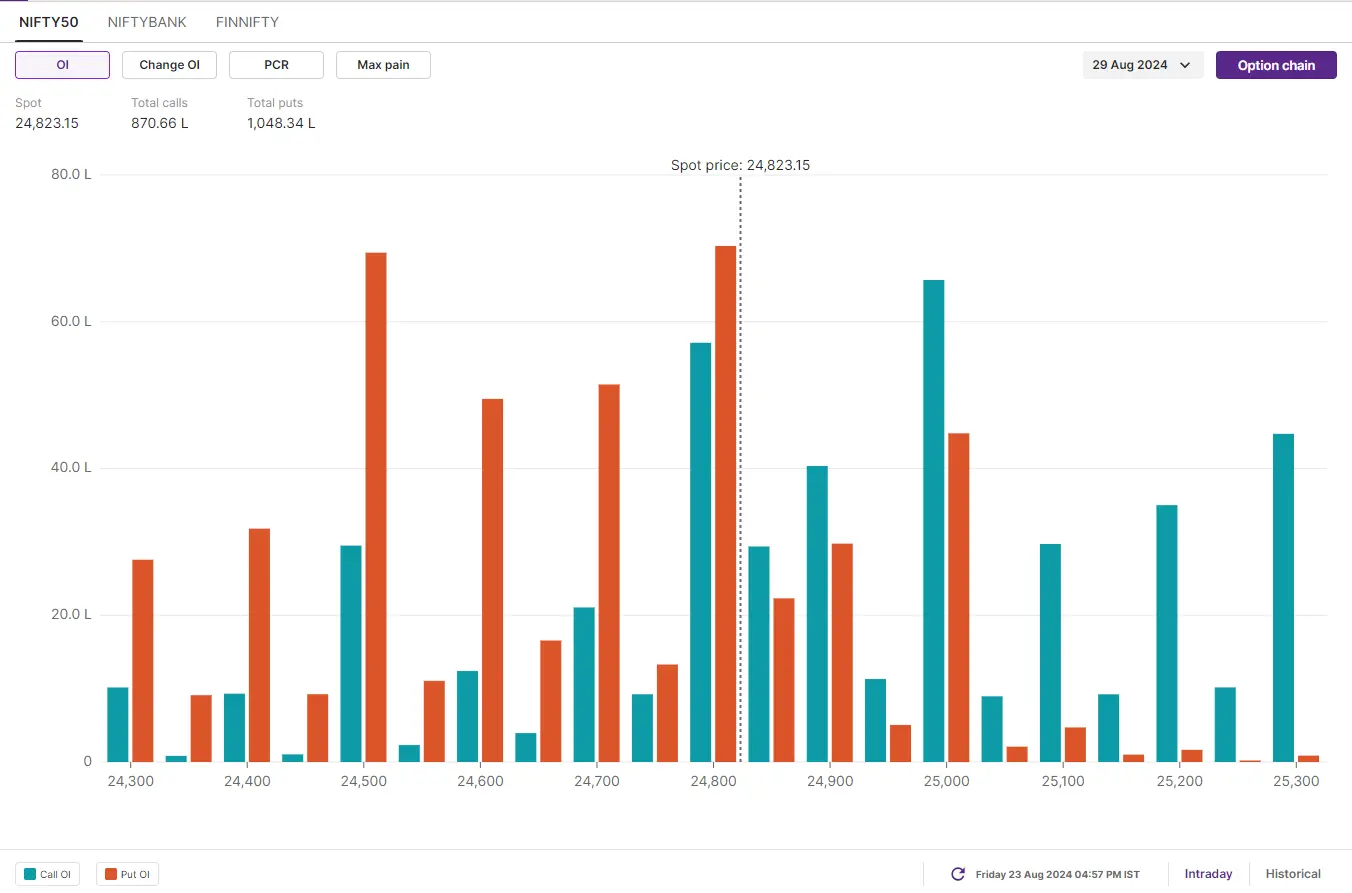

Meanwhile, the NIFTY50's open interest positioning for the monthly expiry shows immediate resistance around the 25,000 and 25,500 zones, with the highest open interest concentrated at these call option strikes. On the other hand, the put base is concentrated at 24,500 and 24,000 put option strikes, indicating support around these levels. Additionally, the index saw significant call and put build-up at 24,800 strike, indicating range-bound activity around this strike.

BANK NIFTY

- August Futures: 50,966 (▼0.1%)

- Open Interest: 1,61,808 (▼8.1%)

The BANK NIFTY index attempted to regain the 51,000 level for the second day in a row, but failed to do so on a closing basis. The index formed a small red candlestick on the daily chart, indicating indecision among investors.

According to the technical structure, the BANK NIFTY index is currently trading above its 20-day and above its 100-day moving averages. For further upside, if the index breaches 51,100 level on a closing or intraday basis, then it may attempt to regain its 50-day moving average, around 51,500. However, if the index slips below 50,300, then we may see weakness down to the 49,600 area.

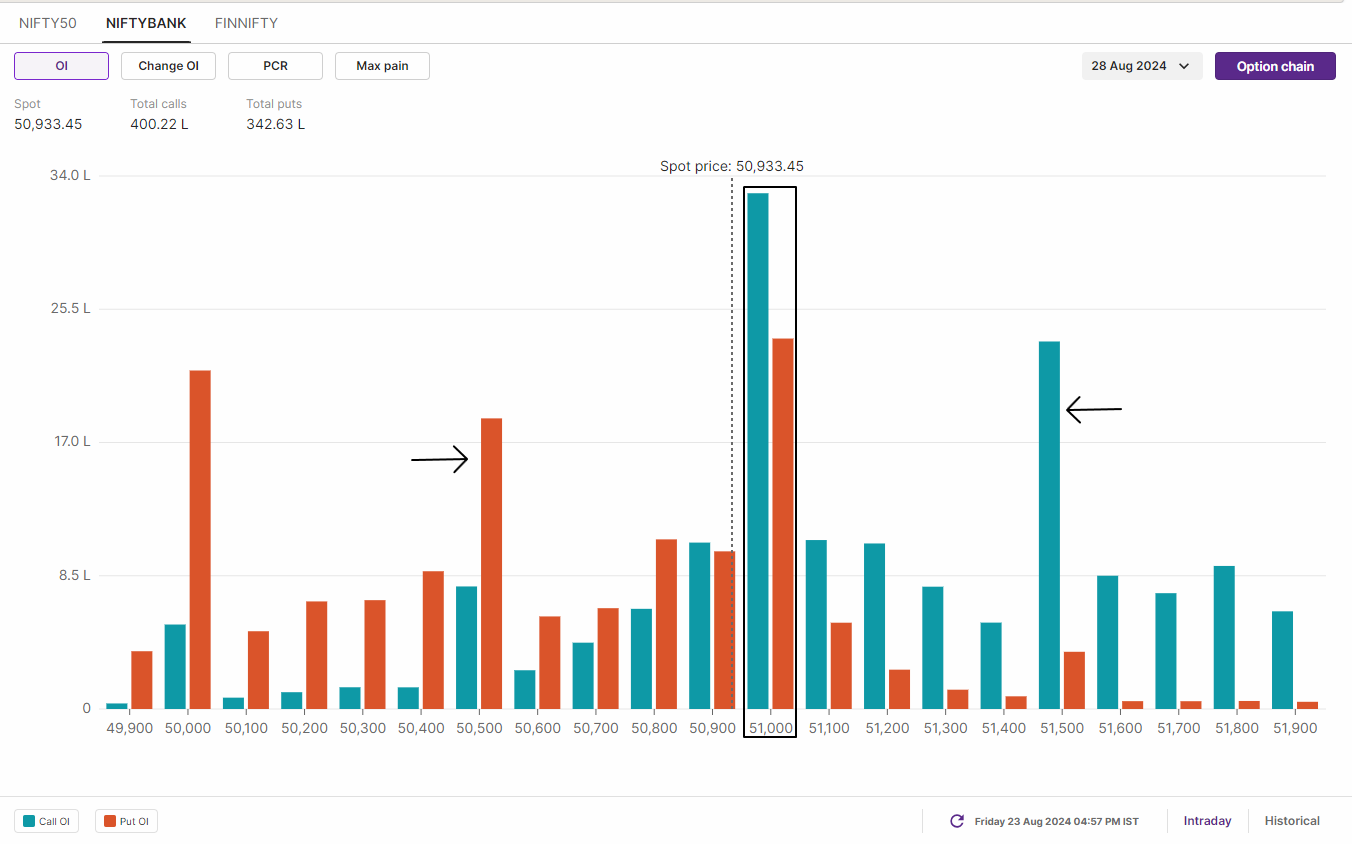

Open interest (OI) data of BANK NIFTY’s 28 August expiry has highest call and put base at 51,000 strike, indicating range-bound activity around this level. In addition, the index has also seen significant call additions at the 51,500 strike and put additions at the 50,500 strike. For the monthly expiry, traders expecting a directional move should closely monitor the additions or unwinding of OI at 51,500 call strike and 50,500 put strike.

FII-DII activity

Stock scanner

Short build-up: Deepak Nitrite, Indraprastha Gas, M&M Financial, Vedanta, Mahanagar Gas and Zydus Lifesciences

Out of F&O ban: LIC Housing Finance and Piramal Enterprises

Added under F&O ban: Balrampur Chini

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Balrampur Chini, Birlasoft, Chambal Fertilisers, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, Hindustan Copper, IEX, India Cements, National Aluminium, RBL Bank and Sun TV

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story