Market News

Trade setup for 30 July: NIFTY50 consolidates around 24,800, BANK NIFTY hits 20-DMA resistance

.png)

5 min read | Updated on July 30, 2024, 07:46 IST

SUMMARY

The BANK NIFTY is currently trading between its 20 and 50 day moving averages. In response to the positive earnings announcement from ICICI Bank, the index moved towards its 20 DMA but was met with a sharp rejection. Until the index breaks out of this range, it is likely to remain volatile and range-bound.

Stock list

The BANK NIFTY experienced extreme volatility on Monday, plummeting over 1,000 points intraday within just 15 minutes.

Asian markets update at 7 am

The GIFT NIFTY fell by 0.3%, suggesting a flat-to-negative start for the Indian equities today. The sentiment across Asia is similarly subdued, with Japan’s Nikkei 225 declining by 0.2% and Hong Kong’s Hang Seng index dropping by 0.5%.

U.S. market update

- Dow Jones: 40,539 (▼0.1%)

- S&P 500: 5,463 (▲0.0%)

- Nasdaq Composite: 17,370 (▲0.0%)

U.S. indices started the week on a positive note but ended the choppy session flat. A busy week of corporate earnings and the Fed's policy announcement on 31 July kept volatility elevated.

Meanwhile, the next three days will bring earnings from Microsoft (Tuesday), Meta Platforms (Wednesday) and Apple and Amazon (both on Thursday). The Street will be looking for commentary on the future of AI and related spending.

NIFTY50

- August Futures: 24,910 (▲0.0%)

- Open Interest: 5,73,144 (▲0.4%)

After a positive start, the NIFTY50 index approached the psychologically crucial 25,000 mark, reaching an intraday high of 24,999. However, the index faced profit booking just below the 25,000 threshold, resulting in loss of all its opening gains.

With the loss of momentum and the formation of a neutral candlestick pattern at its all-time high, the NIFTY50 index may consolidate its gains around the 24,800 mark. As you shown in the chart below, the immediate support for the NIFTY50 is at the 20-day moving average (DMA).

Additionally, if the index dips into the 24,600 to 24,700 zone, traders should watch for price action and emergence of fresh buyers in this area. Weakness on the index will only be confirmed if it closes below its 20-DMA.

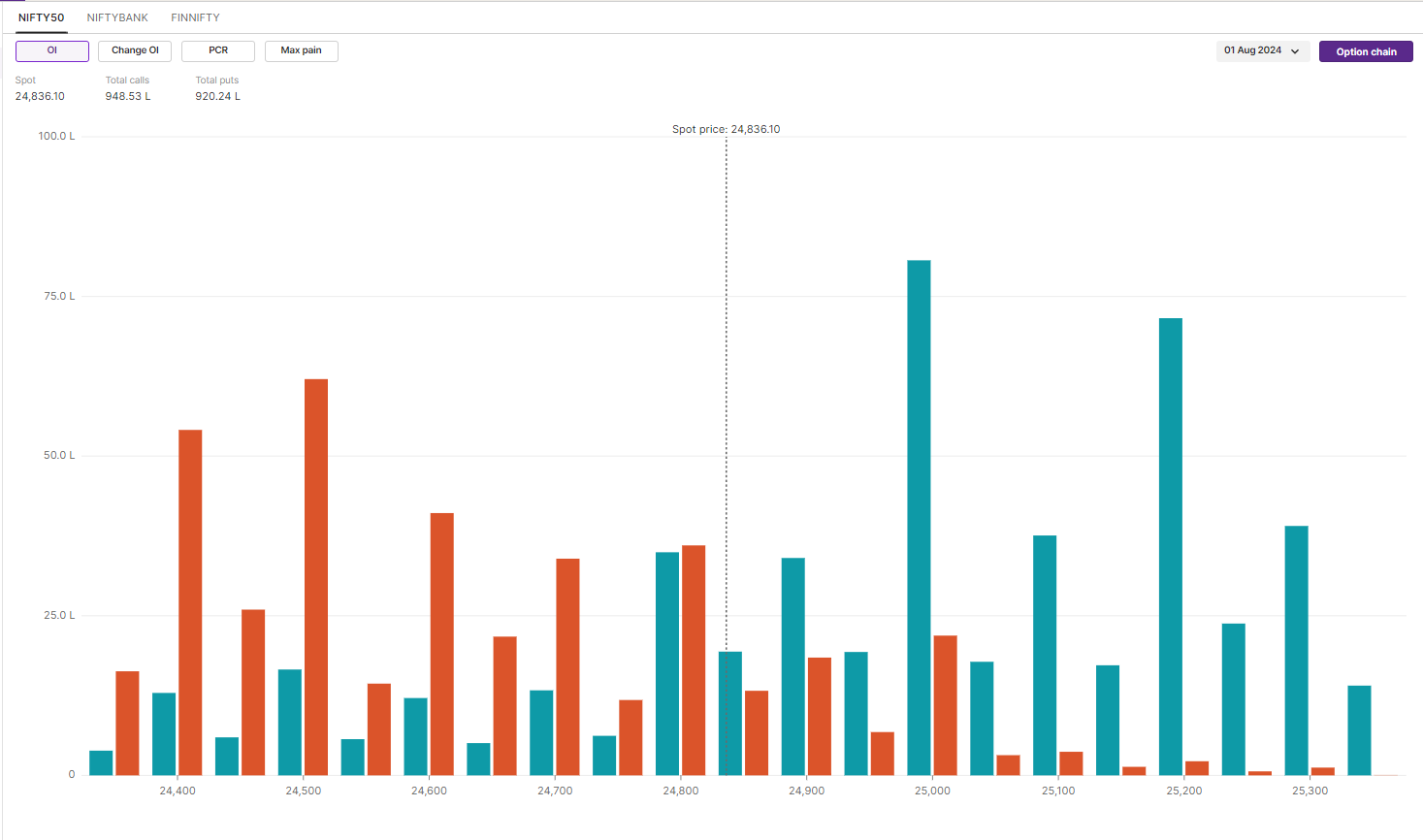

Open interest (OI) placement for the 1 August expiry has tilted in favour of the bears, with the highest call OI now at the 25,000 and 25,200 strikes. Conversely, put open interest is spread between 24,500 and 24,200, suggesting multiple supports for the index at lower levels. Meanwhile, the options market is currently anticipating NIFTY50's range between 24,550 and 25,100 for the 1 August expiry.

BANK NIFTY

- August Futures: 51,653 (▲0.2%)

- Open Interest: 1,27,775 (▼1.0%)

The BANK NIFTY experienced extreme volatility, plummeting over 1,000 points intraday within just 15 minutes. The index initially reacted positively to the first quarter results of ICICI Bank, announced over the weekend. However, a sudden sell-off caused the index to relinquish all its initial gains, ending the day with minor gains. According to our analysis from yesterday, the index breached the 20-day moving average (DMA) but failed to close above it. On July 26, the index formed a bullish engulfing pattern at the crucial support level of the 50-DMA, establishing 51,000 as a significant support zone.

With the monthly expiry of its futures and options contracts approaching, the index may experience heightened volatility and sharp swings between 20-DMA and 50-DMA. A decisive break of these levels, both intraday and on a closing basis, will offer traders further directional insights.

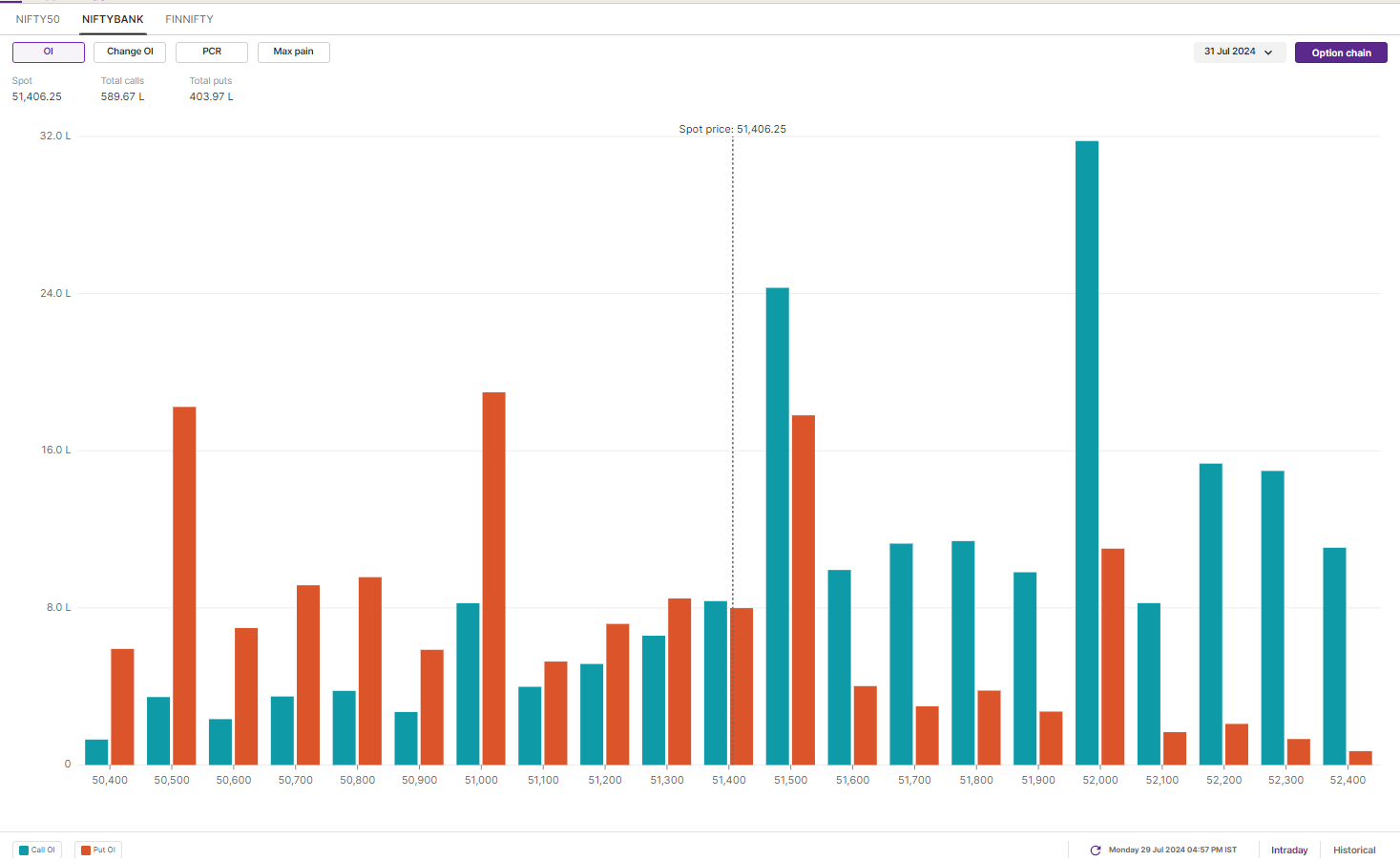

The open interest data for tomorrow’s (31 July’s) expiry has significant call placement at 52,000 and 52,500 strikes. This indicates that the index may face resistance around these levels. On the flip side, the put open interest saw its base at 51,000 and 50,500 strikes, marking these as support zones. Traders should closely monitor the unwinding and addition on 51,000 puts and 52,000 calls for further directional clues.

FII-DII activity

Stock scanner

Under F&O ban: India Cements

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story