Market News

Stock Market Weekly Recap: NIFTY, SENSEX surge higher in FY25’s final week amid FII comeback

.png)

5 min read | Updated on March 29, 2025, 04:43 IST

SUMMARY

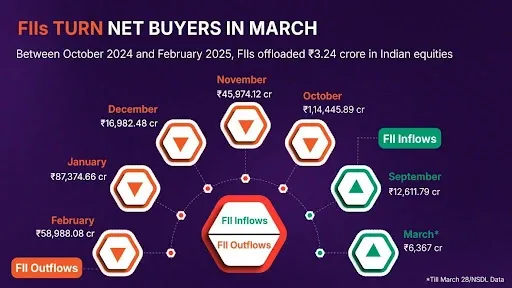

FIIs purchased ₹6,367 crore worth shares on a net basis in the cash segment in March, marking their first monthly inflows on a net basis after September 2024. FIIs had been in a selling mode since October, exiting equities worth ₹3.24 crore in Indian markets.

Stock list

Broader markets ended the week on a losing note as Midcap indices fell up to 0.5%, while Smallcap indices dropped up to 1% on a weekly basis. | Image: Pixabay

- For the financial year 2024-25, ending on March 31, benchmark indices have advanced over 5%.

- NIFTY and SENSEX gained up to 0.7% this week.

- FIIs turned net buyers for the first time since September 2024.

Hey there! We are back with a quick recap of the markets as benchmark indices extend gains in the last week of FY25.

Benchmark indices SENSEX and NIFTY edged higher this week despite profit-taking and weak global sentiment on Friday. SENSEX rose by 509 points, or 0.68%, and NIFTY ended the week higher by 168 points, or 0.73%. The benchmark indices also ended the month of March on a high note, marking their first monthly gain in six months.

For the financial year 2024-25, ending on March 31, benchmark indices have advanced over 5%.

Key indices were on a rollercoaster ride in the last week of FY 2024-25. Uncertainty around the US trade policy front kept investors on their toes, while the return of FIIs to Indian markets helped ease retail investors’ woes and also boosted their confidence.

Stock markets started the week on a high not,e with SENSEX and NIFTY closing at six-week highs. SENSEX soared 1,078.87 points, while NIFTY jumped 307.95 points, or 1.32%, to close above 23,600 for the first time since February 6. Continued FII buying and short covering ahead of the monthly F&O expiry boosted market sentiment. Expectations of US tariffs from April 2 not becoming as harsh as expected and some countries possibly getting exemptions also aided the market movements.

Markets continued the fireworks in the opening session on Tuesday but pared gains later on profit-taking in consumer durables and realty shares. SENSEX and NIFTY closed nearly flat. Profit-taking after seven straight days of gains intensified on Wednesday, dragging SENSEX and NIFTY down by nearly 1% at close. Banking and IT shares were the lead losers.

Stock indices recovered on Thursday amid selective buying in blue chips on the monthly expiry day. HDFC Bank, Bajaj Finance and Larsen & Toubro were major movers. Tata Motors shares tanked over 5% as Trump announced a 25% tariff on automobile imports. SENSEX gained 317.93 points to settle at 77,606.43, while NIFTY advanced 105.10 points to 23,591.95. FIIs supported the uptrend with net buying of ₹2,240.55 crore.

Stock markets saw high volatility on the last trading session of 2024-25 amid weak global trends. Asian and European equity markets traded lower as investors awaited the April 2 deadline for reciprocal tariffs for more clarity on Donald Trump's trade policy.

The 30-share SENSEX dropped 191.51 points to close at 77,414.92. NIFTY fell by 72.60 points to end at 23,519.35.

Broader markets ended the week on a losing note as Midcap indices fell up to 0.5%, while Smallcap indices dropped up to 1% on a weekly basis. Among sectors, NIFTY PSU, Defence and Capital Market gained the most.

FIIs return to Indian equities

FIIs purchased ₹6,367 crore worth shares on a net basis in the cash segment in March, marking their first monthly inflows on a net basis after September 2024. FIIs had been in a selling mode since October, exiting equities worth ₹3.24 crore in Indian markets. FII buying helped Indian markets outperform global peers in the week as equity markets turned volatile over possible forthcoming US tariffs. All key emerging markets, such as Brazil, the Philippines, and South Korea, witnessed FII outflows.

| Gainers | Losers |

|---|---|

| Bajaj Finserv (8%) | Zomato (-10%) |

| Kotak Bank (6%) | Mahindra (-5%) |

| Grasim (5%) | IndusInd (-5%) |

Top sectoral gainers & losers

| Gainers | Losers |

|---|---|

| NIFTY PSU (2.1%) | NIFTY PHARMA (-2.25%) |

| NIFTY PVT Bank (1.9%) | NIFTY AUTO (-2.11%) |

| NIFTY FMCG (1.1%) | NIFTY CONSUMER DURABLES (-16%) |

US markets

| Index | Change |

|---|---|

| S&P 500 | -1.56% |

| Dow Jones | -0.84% |

| Nasdaq Composite | -2.08% |

Commodities (MCX)

| Commodity | Price | Change |

|---|---|---|

| Gold | ₹88,950/10g | Up 1.35% |

| Silver | ₹101,652/kg | Down 3.86% |

Currency gainers/losers (USD, GBP)

| Currency/Index | Change |

|---|---|

| US Dollar Index | Down 0.02% |

| GBP | Up 0.57% |

IRM Energy jumps 14%

BEML shares rally 17% after ₹405-crore order win

M&M, Tata Motors fall after Trump tariffs on car imports

Home-grown auto major Mahindra & Mahindra and Tata Motors fell up to 4% this week after Trump imposed a 25% tariff on car imports from April 3. M&M is a major supplier of tractors to the US market, while Tata Motors arm JLR supplies luxury car models to the American market.

BSE shares zoom 16% after SEBI move on expiry days

BSE shares zoomed 16% on Friday after market regulator Securities and Exchange Board of India (Sebi) proposed expiries of all equity derivatives contracts across exchanges be uniformly limited to either Tuesdays or Thursdays.

What lies ahead?

Stock markets are expected to remain volatile next week due to the April 2 deadline for reciprocal tariffs. Investors will monitor the Indo-US bilateral trade meeting on Saturday for potential trade policy outcomes. Besides, US Job opening data and India’s PMI will also remain in focus for insights into economic momentum.

Related News

About The Author

Next Story