Market News

Stock Market Weekly Recap: NIFTY, SENSEX decline for 7th week as poor Q2 results trigger selling

.png)

5 min read | Updated on November 16, 2024, 09:46 IST

SUMMARY

Benchmark indices, SENSEX and NIFTY, fell for the seventh week as muted corporate earnings, a firm US dollar and selling by foreign investors hit market sentiment. NIFTY declined by 592 points, or 2.5%, while SENSEX lost 1,906 points, or 2.44%, in the holiday-shortened week.

Stock list

- SENSEX and NIFTY have plunged more than 10% from their record high levels hit on September 26, 2024.

- NIFTY settled at 23,532.7 on November 14, extending losses for the sixth straight day.

- FIIs have sold shares worth over ₹29,500 crore on a net basis in November so far in the cash segment.

Hey there! We are back with a quick recap of the markets in a holiday-truncated week marked by sharp fluctuations. Benchmark indices, SENSEX and NIFTY, fell for the seventh week as muted corporate earnings, a firm US dollar and selling by foreign investors hit market sentiment. NIFTY declined by 592 points, or 2.5%, while SENSEX lost 1,906 points, or 2.44%, in the holiday-shortened week.

The week also marked the end of the quarterly results season for the second quarter of the current fiscal (Q2FY25).

Losses in consumer goods, auto, and FMCG shares dragged down the barometers for the seventh week since September 27. Muted revenue growth, a fall in profit and margins, and EPS downgrades triggered selling across sectors.

Corporate results have lagged behind expectations leading to a cautious approach by investors. Muted results in the first half of this fiscal have raised the scope of further downgrades in FY25 NIFTY EPS estimates. Experts project a 2% to 3% downward revision in the FY25 NIFTY EPS estimate.

Continuing the corrective mode, stock indices SENSEX and NIFTY opened the week on a mixed note. After see-saw trade SENSEX closed marginally up while NIFTY closed lower for the third straight session on Monday.

SENSEX and NIFTY tanked more than 1% on Tuesday amid the release of consumer inflation data for October. NIFTY fell below the 23,900 mark, while SENSEX retreated to 78,600 levels. Inflation rising to a 14-month high of 6.21%, above the RBI’s comfort level, hit rate-sensitive stocks.

Stock markets continued their slide on Wednesday with the indices correcting more than 1% due to increased FII selling. NIFTY fell below 23,600 level tanking 324 points while SENSEX closed lower by 984 points.

SENSEX and NIFTY closed lower on Thursday as well after a volatile trade. Banking, media and realty shares helped cut losses while FMCG and PSU banks were the major drags on indices.

SENSEX closed the week at 77,580.31. NIFTY settled at 23,532.7, which was its sixth day of losses.

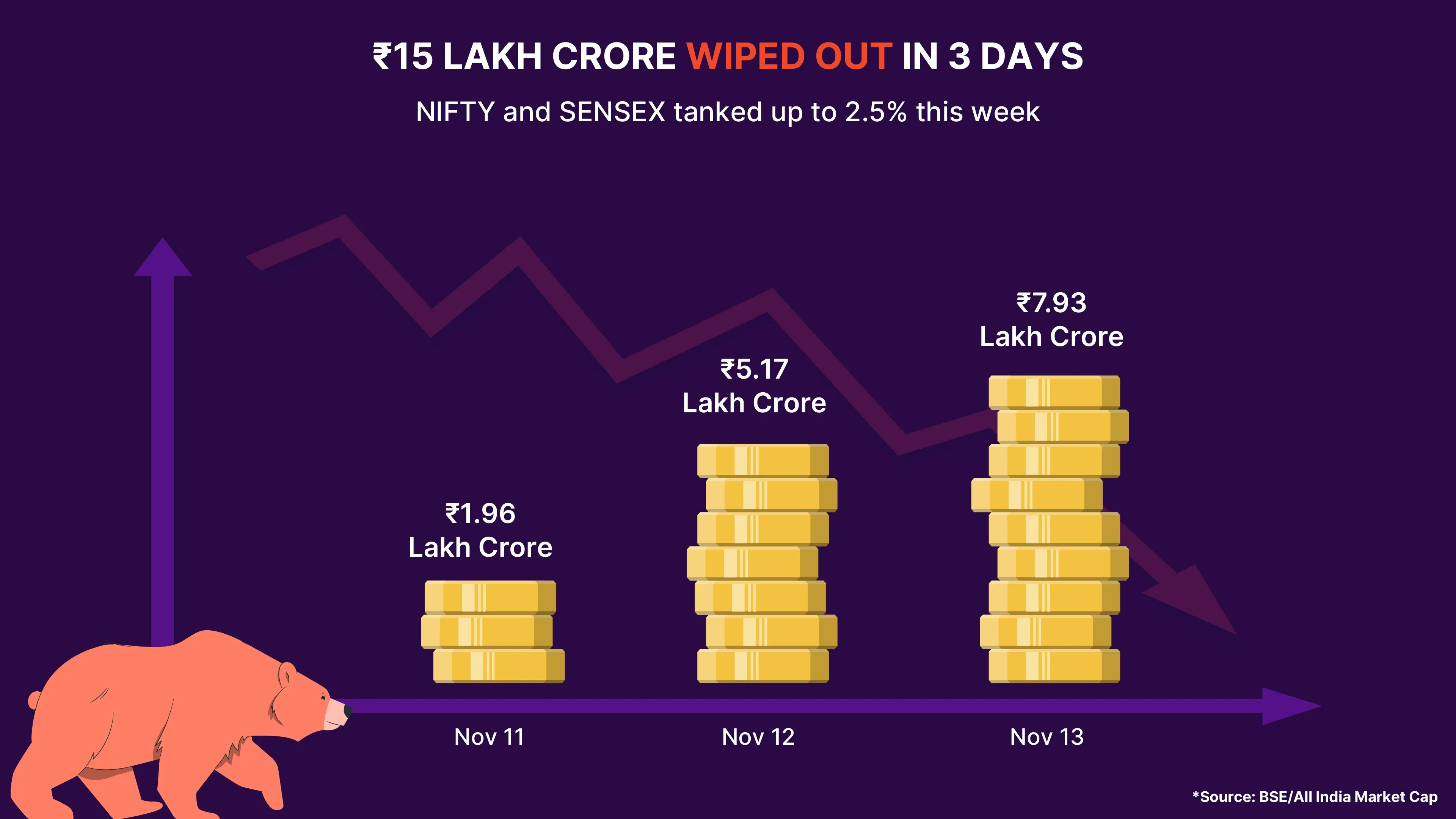

Investors lost ₹15 lakh crore this week, ₹46 lakh crore since Sept-end

The equity investors took a hit of ₹15 lakh crore in the first three days of this week as stock markets declined up to 2.5%. Market wealth saw a recovery of around ₹1.18 lakh crore on Thursday even as key stock indices closed lower.

Benchmark indices, SENSEX and NIFTY, have plunged more than 10% from their record high levels hit on September 26, 2024. Stock investors have lost a whopping ₹46.33 lakh crore of wealth during this period as the market valuation of BSE listed companies declined from an all-time high of ₹477.93 lakh crore on September 27 to ₹430.6 lakh crore on November 14.

FII outflows remain a concern

The Foreign Institutional Investors (FIIs) withdrew more than ₹9,680 crore in the cash segment on net basis in just four sessions between November 11 and November 14.

FIIs have sold shares worth over ₹29,500 crore on net basis in November so far in the cash segment.

Firming US bond yields and dollar after the victory of Donald Trump in presidential polls have also been a drag on Indian equities’ appeal for foreign investors.

Trump’s win has bolstered the expectations of increased spending and tariff hikes in the US which could push up inflation and slow down rate cuts by the Federal Reserve.

Broader markets see sharp corrections

Broader markets saw sharper corrections with midcap indices closing lower up to 4% and smallcap indices down up to 5%.

All the NIFTY sectoral indices except for IT closed lower. NIFTY metal and PSU bank declined 5%, pharma, FMCG and oil & gas by 4% each and financial and consumer durables by 3% each.

Asian Paints, Britannia Industries tank up to 15% after Q2 results

Bakery major Britannia Industries tanked nearly 15% this week after Q2 results. The biscuit maker reported 42% year-on-year decline in consolidated net profit and a 5.3% drop in revenue for the September quarter.

Paints maker Asian Paints also declined more than 10% this week due to weaker Q2 results even as the stock rebounded on Thursday.

What lies ahead?

Consolidation in equities is expected to continue the next holiday-shortened week. Beaten-down shares may see some value buying but the larger market trend will be influenced by developments from the Trump administration. Policy measures may drive up inflation which could impact Fed rate cuts in future. The stock markets will remain closed on Wednesday, November 20, on account of Assembly polls in Maharashtra.

Next Story