Market News

Trade setup for 25 April: NIFTY50 oscillates in a narrow range, faces hurdle at 22,500

4 min read | Updated on April 25, 2024, 02:48 IST

SUMMARY

The NIFTY50 has been trading in a range of almost 100 points for the past two days. Despite a gap-up start, the index faces resistance at 22,500. On the other hand, immediate support is at 22,350. Traders should keep a close eye on these levels as a break above or below them on a closing basis will provide further clues.

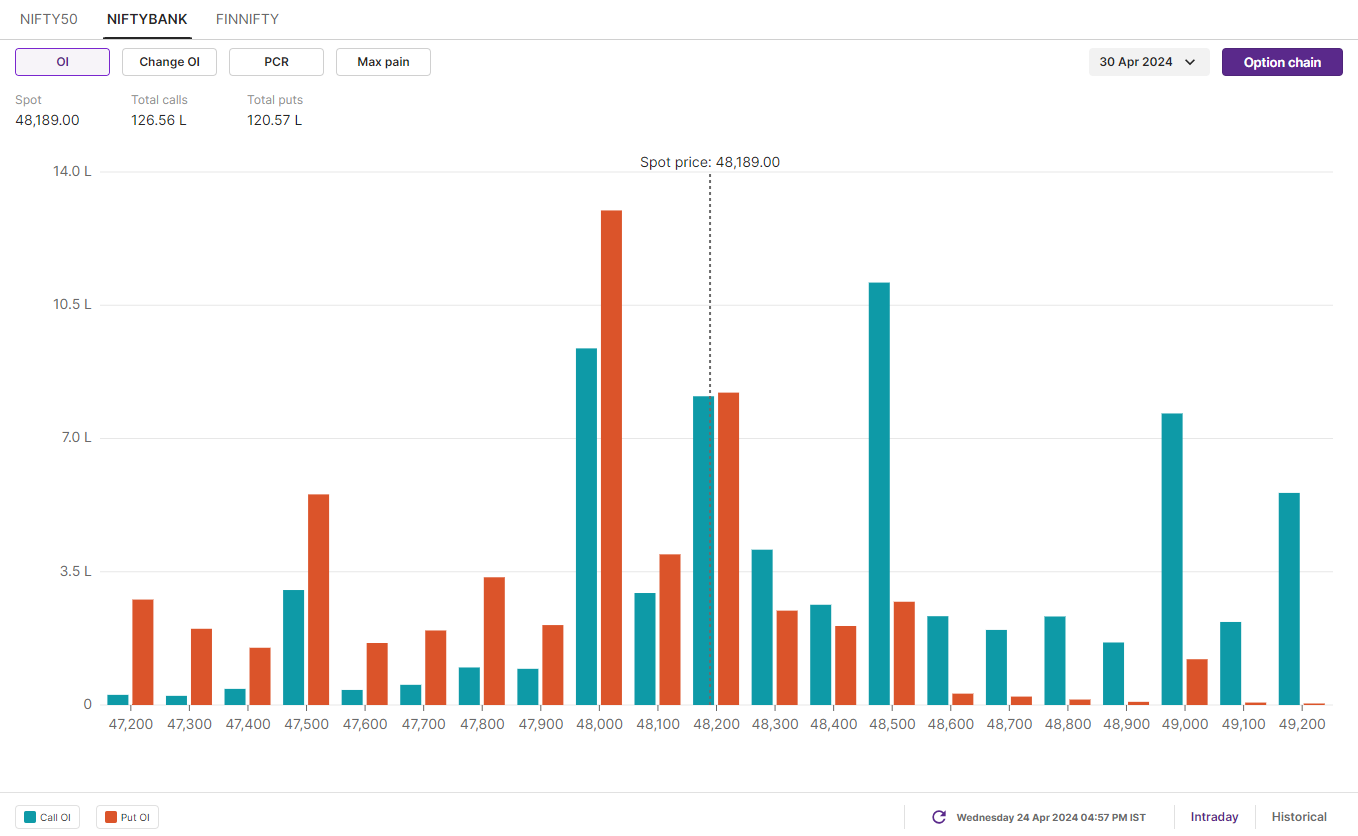

The initial open interest build-up for the 30 April expiry is scattered and has maximum call base on 48,500 strike.

Asian markets update 7 am

The GIFT NIFTY is trading lower (-0.3%) than Wednesday’s close, suggesting a negative start for the Indian equities today. Meanwhile, the Asian markets are trading mixed. Japan’s Nikkei 225 is down 1.7%, while Hong Kong’s Hang Seng index is trading flat.

U.S. market update

U.S. stocks were mixed on Wednesday as investors awaited results from big tech companies and an estimate of Q1 GDP. Meta Platforms earnings were released after the market hours. The results were in line with expectations, but the guidance was below expectations.

All the three major indices closed flat, with the Dow Jones Industrial Average closing at 38,460 (-0.1%) S&P 500 at 5, 071 (+0.0%) and the tech-heavy Nasdaq Composite advanced at 15,712 (+0.1%).

NIFTY50

After a positive handover from global equities, the NIFTY50 started the Wednesday’s session on a positive note and closed the session marginally higher. Once again, index failed to hold onto its morning gains and faced resistance between the 22,400 and 22,500 zone.

Currently, the index is oscillating between 22,500 and 22,350 zone. For today’s expiry, we have highlighted the crucial support and resistance zone on hourly timeframe in the chart below for our readers. A break of this zone on either side will provide traders further directional clues. However, India VIX hovering near the lower levels of 10, traders should remain cautious of sudden spikes and plan strategies accordingly.

Open interest build-up for today’s expiry has significant call base at 22,500 and 22,400 strikes. Conversely, the put options base is spread from 22,400 to 22,200 strike. Based on the options data, traders are expecting NIFTY50 to trade between 22,000 and 22,600.

BANK NIFTY

BANK NIFTY also traded in a narrow range on the monthly expiry of its futures and options contracts and formed an inside bar candle on the daily chart. This two-day pattern signifies consolidation, with the range constrained within the Tuesday’s (23 April) high and low. Traders should keep a close eye on the breakout above Tuesday’s high or low for potential directional clues.

The initial open interest build-up for the 30 April expiry is scattered and has maximum call base on 48,500 strike. On the flip side, the put options are accumulated on 48,000 and 48,200 strikes.

FII-DII activity

Stock scanner

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story