Market News

NIFTY50 holds 25,000 support as focus shifts to US jobs report

.png)

3 min read | Updated on September 05, 2024, 18:49 IST

SUMMARY

According to options data for the 26 September expiry, the NIFTY50 index has the highest put open interest at the 25,000 strike, indicating strong support at this level. However, traders should keep a close eye on the U.S. August jobs report, which will be released tomorrow after market hours, as it could impact market sentiment.

Stock list

NIFTY50 holds 25,000 support as focus shifts to U.S. jobs report

Markets extended the losses for the second day in a row and ended the range-bound session on a negative note. The NIFTY50 index failed to sustain the opening gains and remained range-bound on the weekly expiry of its options contracts.

Among the sectors, Consumer Discretionary (+0.6%) and IT (+0.4%) were the biggest gainers, while Automobiles (-0.3%) and Oil & Gas (-0.3%) were the biggest losers.

Despite a gap-up start, the NIFTY50 index saw profit-booking at higher levels. It is currently consolidating in the 25,000-25,350 range, awaiting a catalyst to break out of this zone.

On the global front, the Friday's jobs report will be in the spotlight. Markets are expecting that the U.S. economy added 1,61,000 jobs in August, up from 1,14,000 in July, and that the unemployment rate fell to 4.2%. A weaker-than-expected jobs report could have a negative impact on equities, as witnessed on 5 August following the release of July jobs report.

-

Top gainer and loser in NIFTY50: Titan (+3.1%) and Cipla (-1.4%)

-

The broader markets rebounded from yesterday’s losses, hitting fresh all-time highs and outperforming the benchmark indices. The NIFTY Midcap 100 index gained 0.3%, while the Smallcap 100 index surged over 1%.

-

Top gainer and loser in NIFTY Midcap 100: Bombay Stock Exchange (+4.4%) and Mazagon Dock Shipbuilders (-4.5%)

-

Top gainer and loser in NIFTY Smallcap 100: KEC International (+6.0%) and Raymond (-2.5%)

Key highlights of the day

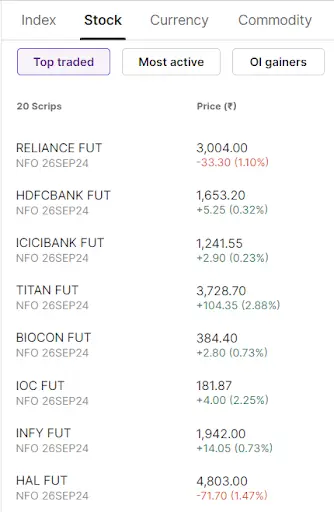

Top traded futures contracts

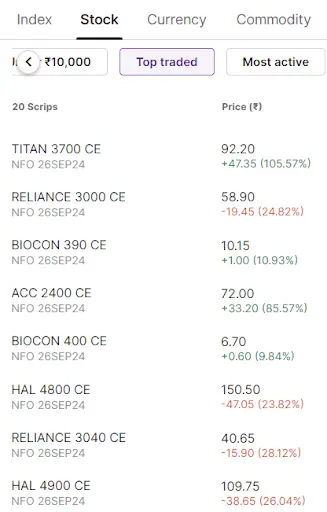

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): ICICI Prudential, Max Financial Services, Coal India, Havells India and United Spirits

📈Open=Low (Bull power): Bombay Stock Exchange, Gujarat Gas, Petronet LNG, SRF and Tata Steel

🏗️Fresh 52 week-high: Avenue Supermarts (DMART), Fortis Healthcare, Cholamandalam Investment, Syngene International and Laurus Labs

⚠️Fresh 52-week-low: N/A

See you tomorrow!

About The Author

Next Story