Market News

Market highlights|NIFTY50 hits new all-time high, forms shooting star pattern on daily chart

.png)

3 min read | Updated on September 19, 2024, 17:58 IST

SUMMARY

According to monthly options data expiring on the 26 September, the NIFTY50 index has maximum put open interest at the 25,000 strike, indicating support for the index around this area.

Stock list

NIFTY50 hits new all-time high, forms shooting star pattern on daily chart

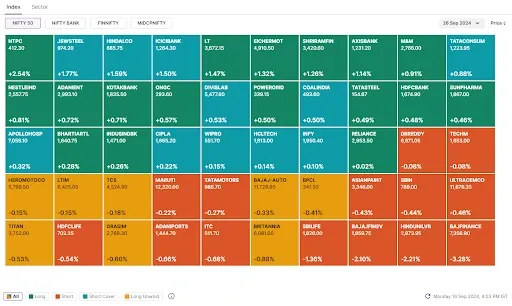

Markets hit a fresh all-time high and ended the day in the green after US Federal Reseve reduced the interest rates by 0.5%. The NIFTY50 index erased all its opening gains and ended the day below its opening price, suggesting profit-booking at higher levels.

Sectorally, FMCG (+0.5%) and Automobiles (+0.4%) advanced the most, while Oil & Gas (-1.3%) and PSU Banks (-0.6%) were the top laggards.

On the daily chart, the NIFTY50 index has formed a shooting star candlestick pattern, which is a bearish reversal pattern. A shooting star is a pattern that signals a potential reversal in an uptrend. It features a small red body and a long upper shadow, indicating that buyers pushed the price higher, but sellers took control before the close.

However, it is important to note that the pattern will only be confirmed if the following candle closes lower than the reversal pattern. In the meantime, immediate support for the index is at 25,200. As long as the index holds above this level on a daily closing basis, the trend is likely to remain bullish, with possible consolidation at higher levels.

-

Top gainer and loser in NIFTY50: NTPC (+2.3%) and Bharat Petroleum (-3.4%)

-

Top gainer and loser in NIFTY Midcap 100: AU Small Finance Bank (+3.5%) and Indus Towers (-8.2%)

-

Top gainer and loser in NIFTY Smallcap 100: Century Textiles (+4.3%) and Chambal Fertilisers (-7.9%)

Key highlights of the day

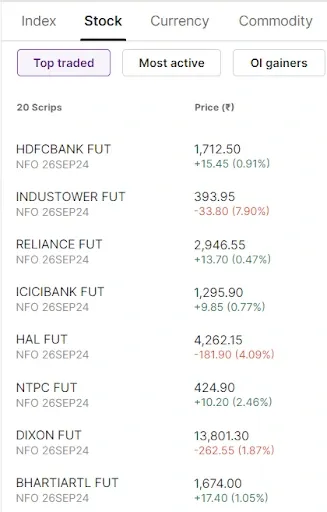

Top traded futures contracts

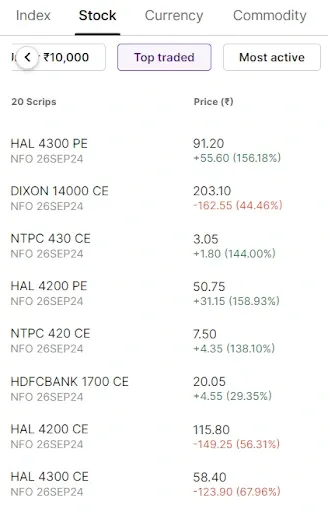

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): Trent, Bank of India, HCL Technologies, Ambuja Cements and Zydus Lifesciences

📈Open=Low (Bull power): Bajaj-Auto and Bharti Airtel

🏗️Fresh 52 week-high: Policy Bazaar, Jubilant FoodWorks, NTPC, Max Healthcare and Voltas

⚠️Fresh 52-week-low: Vodafone-Idea

See you tomorrow!

About The Author

Next Story