Market News

Infosys Q1 results| How to trade in Infosys ahead of its Q1 results?

.png)

4 min read | Updated on July 18, 2024, 10:01 IST

SUMMARY

After the TCS and HCL Tech results, the markets will react to the results of IT heavyweight Infosys. From its low on 4 June, Infosys has rallied 27% and ahead of its Q1 results, the options market is pricing in a move of ±5.3% before 25 July.

Stock list

Infosys Q1 result option strategy

According to experts, Infosys could post single-digit revenue growth of 2% to 3% on a year-on-year basis. The street is expecting the company’s revenue to be in the range of ₹38,800 crore to ₹38,900 crore, with similar revenue growth on a sequential basis.

The IT major is expected to post a net profit between ₹6,200 crore and ₹6,400 crore. This represents a decline of 21% to 22% from the previous quarter but an increase of 5% to 5.5% on a year-on-year basis. Infosys reported a net profit of ₹7,975 crore in the previous quarter and ₹5,945 crore a year earlier during the same period. Experts attribute the sequential decline in profit to lower income from other sources and the absence of income tax refunds.

During the Infosys Q1 results, investors and traders will look forward to the number of new deal wins, FY25 guidance, management commentary on BFSI, the discretionary spending environment and attrition rate.

Ahead of the results, Infosys shares are trading 0.3% higher at ₹1,731 per share on 18 July. Meanwhile, its shares are up 11% since the beginning of the year.

Technical view

The daily chart of Infosys currently shows a bullish structure with the formation of higher highs and higher lows. The stock has rallied over 27% from its recent low of the 4th of June and is trading above all of its key daily moving averages (20, 50 and 100). However, the stock is currently consolidating in the resistance zone of ₹1,693- ₹1,733. A break of this area on a closing basis will provide traders with further directional clues.

The weekly chart below shows that Infosys has previously reversed whenever it approached the highlighted resistance zone. It formed a bearish engulfing pattern in the week ending 5 December 2022 and a shooting star pattern in the week ending 5 February 2024. Both patterns are bearish reversal signals confirmed by a close below their lows. However, last week, Infosys formed a bullish Marubozu candle, indicating buyer presence at lower levels.

Options overview

The current open interest build-up for the 25 July expiry has the highest call base at the 1,700 strike, indicating that the stock may face resistance around this level. On the flip side, the put base is spread between the 1,700 and 1,600 strike. However, Infosys witnessed significant unwinding of open interest at the 1,700 and 1,720 call strikes ahead of its result announcement.

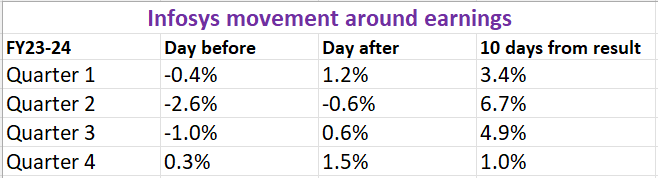

Before discussing strategies, let's review Infosys's share price movements around its earnings announcements over the last four quarters.

Planning an options trade in Infosys ahead of its results

With the options market expecting a price movement of ±5.3% before the 25 July expiry, traders can consider Long and Short Straddle strategies to capitalise on the expected volatility.

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing

About The Author

Next Story