Market News

Expiry trade setup: Will NIFTY50 hold the support of 23,000 on expiry day? Here's all you need to know

.png)

3 min read | Updated on April 03, 2025, 02:04 IST

SUMMARY

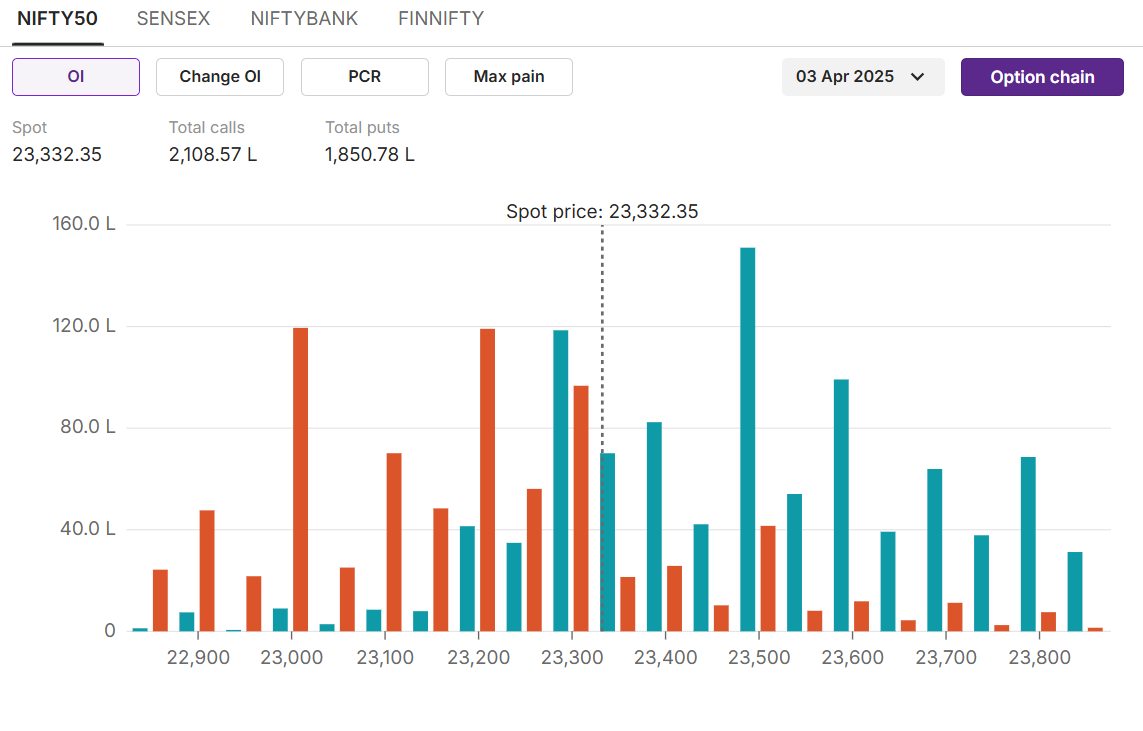

Indian markets are expected to open sharply lower on account of a barrage of reciprocal tariffs announced on all global trading partners of the US. The open interest setup for today’s expiry indicates 23,500 as resistance and 23,000 as support, with the highest open interest on the respective strike price.

NIFTY50 expected to open 300 points lower on Thursday as indicated by GIFT NIFTY. Image source: Shutterstock.

NIFTY50

Max call OI:23,500

Max put OI:23,200 (Ten strikes to the ATM, 3rd April Expiry)

NIFTY50 recouped partial losses of Tuesday by gaining nearly 170 points on Wednesday. The gains on Wednesday were primarily driven by banking and IT stocks like HDFC Bank, ICICI Bank, Infosys, Bharti Airtel and more. Despite the gains, cautiousness prevailed among investors amid uncertainty over tariff announcements.

Bullish outlook

Traders anticipating a bullish outlook for tomorrow’s expiry can consider doing a long call strategy to capitalise on the bullish trend. Buying an ATM (At the money) call option of 23,300 would set the breakeven at 23,380, which means an 0.2% upside move in the NIFTY50 on the upside could turn the strategy profitable.

Bearish outlook

Traders anticipating a bearish outlook for tomorrow’s expiry can consider doing a long put strategy. Buying an ATM put option of 23,350 would set breakeven at 23,257. This means a 0.37% downside move from the current level could turn the strategy profitable.

Conclusion

Despite the current setup tilting towards the bullish side, extreme volatility cannot be ruled out on the expiry day. Traders are advised to make a note of this.In simple terms, a long call strategy allows traders to take advantage of rising prices, while a long put takes advantage of falling prices. Options offer the flexibility to navigate different market conditions - bullish, bearish or range-bound. However, past performance isn't a guarantee of future results. Before implementing any strategy, it's important to assess the risks and have a clear plan for managing potential losses.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with it and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities or strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Make your own decision before investing.

About The Author

Next Story