Market News

Budget 2024: NIFTY50 historical trends and options strategies to consider on July 23

.png)

4 min read | Updated on July 22, 2024, 09:38 IST

SUMMARY

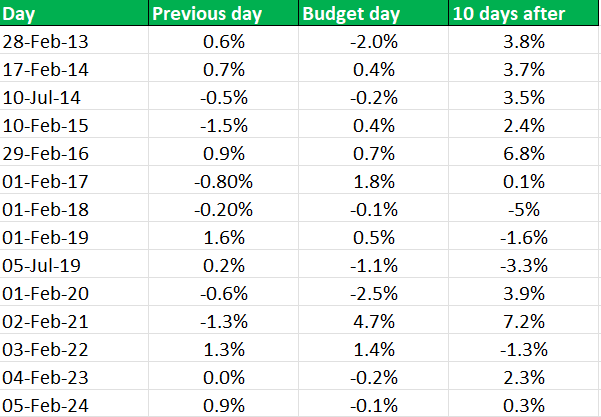

In terms of returns, the average move of the NIFTY50 over the last 14 budget sessions is around 0.3%. During this period, the NIFTY50 typically closed within a range of -2% to +2% on Budget Day in 12 out of 14 sessions. However, the exceptions to this trend occurred in 2020 and 2021, when the NIFTY50 moved outside this range.

Stock list

NIFTY50 Budget Day strategy: Unlock historical trends and options strategies for the budget day

As we approach the budget day, market participants are keenly watching the performance of the NIFTY50 index. Since the outcome of the general elections on June 4, the NIFTY50 index has rallied over 15%, reflecting investors' optimism. During this period, the index has declined more than 1% on only three occasions.

However, historical data suggests that there are significant movements around budget announcements, so understanding past trends can help in planning future strategies.

NIFTY50’s historical performance on Budget Day

Looking at the past performance of the NIFTY50 index on budget day reveals interesting patterns. Historically, the index has shown mixed reactions to Budget announcements. In 7 out of the last 14 budget sessions, the index has ended in the green on budget day. This suggests a mixed trend, though not without exceptions.

- During the previous 14 budget sessions, average return of the NIFTY50 is approximately 0.3%.

- Historical data suggests that NIFTY50 typically closed within a range of -2% to +2% on budget day in 12 out of 14 sessions. This suggests that a range of 4% is well-defined for budget day movements.

- Exceptions to this trend occurred in 2020 and 2021, when the NIFTY50 moved outside this range.

- On 10 out of 14 occasions, the NIFTY50 posted positive returns 10 days after budget day.

- The average return of the index 10 days after Budget Day is around 1.6%.

Technical and options overview

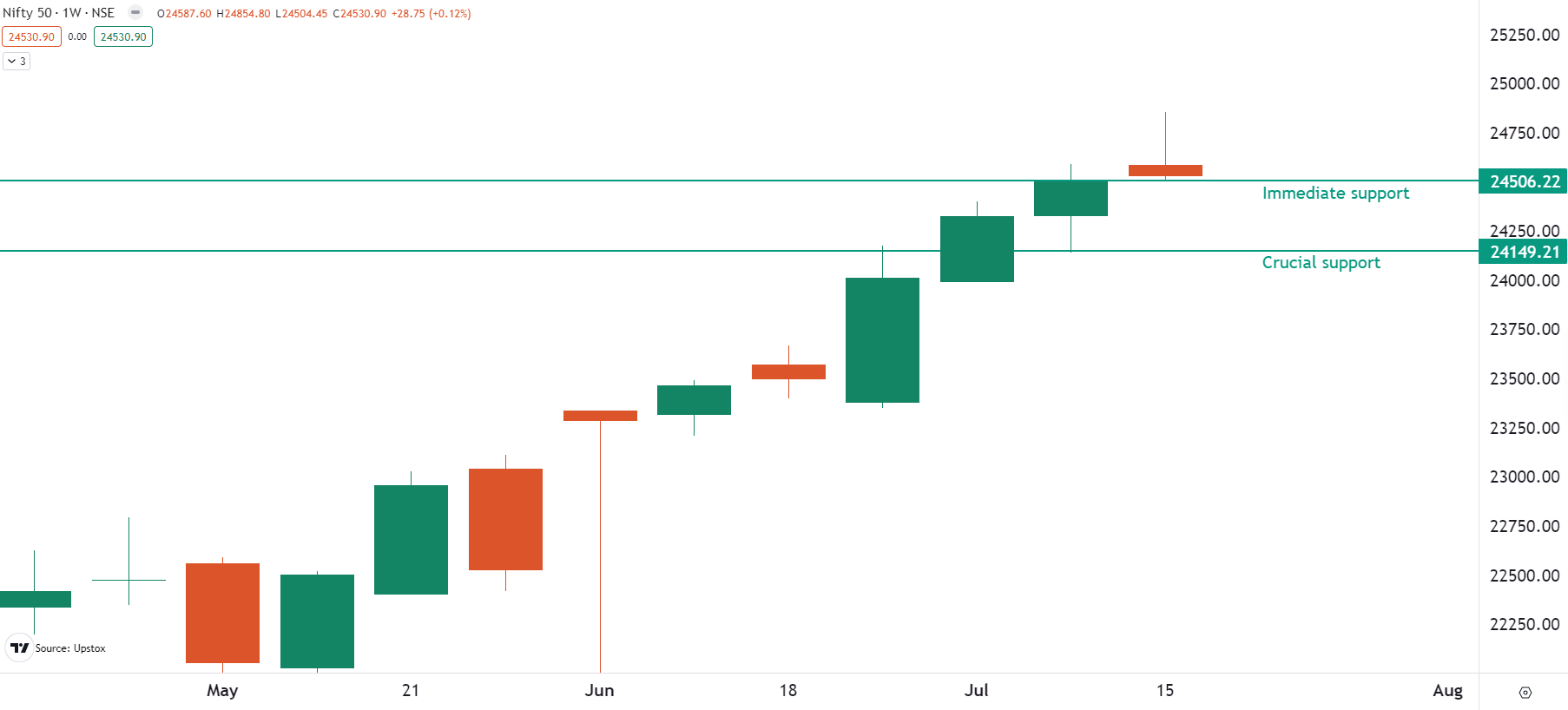

The NIFTY50 index extended its winning streak for the seventh consecutive week, ending the period in the green with minor gains of 0.1%. Interestingly, after recovering from the week of general election results, the index has managed to close above the high of the previous weeks until 19 July.

However, with over a 1% correction on Friday, 19 July, the index reversed its entire bullish structure from the previous session and failed to close above the previous week’s high. Moreover, it formed a shooting star candle, which is a bearish reversal pattern. This pattern will be confirmed if the close of the subsequent candle is lower than the reversal pattern.

Based on the implied volatility and the closing price of 19 July, market participants are anticipating a move of ±2% in the NIFTY50 index ahead of the monthly expiry of its futures and options (F&O) contracts.

The Union Budget will be announced on 23 July, and the NIFTY50 index (F&O) contracts will expire on 25 July. This suggests that the index is expected to experience sharp swings both before and after the Budget announcement.

Now that we've reviewed the historical and implied movements of the index on Budget Day, let's look at the options strategies traders can use both before and after the Budget announcement.

Options strategies before the budget day

-

Short Straddle: This strategy includes selling the at-the-money (ATM) call and put strikes of the index of the same date and expiry. This strategy captures and profits from the fall in volatility. Simply put, this strategy can be deployed if traders expect that the index will not move more than ±2% till 25 July.

-

Long Straddle: Conversely, this strategy involves buying both the at-the-money call and put options of same date and expiry. This strategy is for traders who anticipate that the index will move more than ±2% before the expiry of the F&O contracts on 25 July.

Options strategies after the budget day

-

Bull call spread: This strategy involves buying a call option at a lower strike price and selling another call option at a higher strike price. It’s a bullish strategy that results in profit if the NIFTY50 makes a significant bullish move.

-

Bear put spread: This strategy involves buying a put option at a higher strike price and selling another put option at a lower strike price. It's a bearish strategy and useful for traders who expect NIFTY50 to fall moderately.

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

About The Author

Next Story