Market News

Dabur vs Marico: Here’s how two leading consumer goods companies stack up in India’s FMCG sector

.png)

4 min read | Updated on November 30, 2024, 11:04 IST

SUMMARY

India’s FMCG sector is revolutionising, led by a robust economy, but inflation and competitiveness are heating up the sector. Amid this, key players like Dabur India and Marico seem to leverage their market positions. Here’s a brief analysis of Dabur and Marico based on financials, operations, and stock performance.

Head to Head: Dabur vs Marico - Comparing financials, operations and outlook

Dabur’s diverse portfolio spans Hair Care, Oral Care, Health Care, Skin Care, Home Care, and Food with flagship brands like Dabur, Vatika, Hajmola, Real, and Fem.

Marico dominates in the beauty and wellness space, offering brands such as Parachute, Saffola, and Livon. Both Dabur and Marico are well-positioned to leverage demand trends, including the rapid growth of quick commerce, which positions them as leaders in India’s ever-expanding FMCG market.

| Metrics | Dabur | Marico | Remark |

|---|---|---|---|

| Market Cap | ₹93,808 crore | ₹85,578 crore | - |

| EV/EBITDA Multiple | 33x | 37.4x | Lower the better |

| P/E Ratio | 53.3x | 53.9x | Lower the better |

| ROE | 19.2% | 38.5% | Higher the better |

Currently, both Dabur India and Marico trade at similar P/E ratios, reflecting comparable market expectations for growth. However, Marico’s significantly higher ROE of 38.5% vs Dabur’s 19.2% highlights its efficiency in generating a return to shareholders.

Despite Marico having a higher EV/EBITDA multiple, its ROE justifies its premium valuation, making it more attractive in terms of profitability.

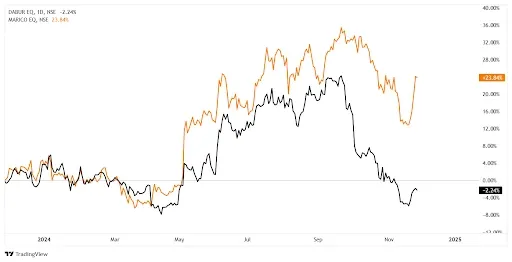

Dabur Vs Marico: Share price performance

Dabur India and Marico- One-Year Share Price Chart

(Source - Tradingview.com)

(Source - Tradingview.com)In comparison with sectoral benchmarks for the last 1 year period, Marico (23.84%) has beaten both Dabur (-2.24%) and NIFTY FMCG (9.24%) in terms of share price returns. However, both Dabur (-9.52%) and Marico (22.93%) have underperformed in the medium-term (3 years) to the benchmark NIFTY FMCG (54.90%). Similarly, in the long-term period (5 years), the NIFTY FMCG has delivered 85.23% while Marico had 81.63% and Dabur had 14.58% gains only.

Comparison based on key financial indicators - For H1FY25

The financial performance comparison between Dabur and Marico highlights key differences. Dabur posted revenues of ₹6,377.7 crore (0.7% YoY growth). Whereas, Marico reported a revenue of ₹5,307 crore (7% YoY growth), driven by steady trends across key portfolios and a sequential uptick in domestic volume.

On profitability metrics, Dabur recorded an EBITDA of ₹1,488.5 crore with a margin of 23.3%, outperforming Marico’s EBITDA of ₹1,148 crore and a margin of 21.6%. However, Dabur’s PAT declined by 5.5% to ₹925.1 crore, influenced by inventory rationalisation and profitability enhancement efforts for its General Trade (GT) channel, while Marico demonstrated a strong 14% PAT growth, reaching ₹887 crore.

Marico also shows better efficiency in capital utilisation and asset management than Dabur, with Marico’s RoCE(Return on Capital Employed) of 43.1% versus Dabur’s 22.3% and Marico’s RoA (Return on Asset) of 21.% versus 12.6%.

From a financial stability perspective, Marico displays lower leverage with a net debt-to-equity ratio of 0.11 compared to Dabur’s 0.17. Additionally, Marico’s interest coverage ratio stands higher at 33 times, indicating better debt servicing capability, whereas Dabur’s interest coverage ratio is 16.2 times.

Comparison based on cost control - For H1FY25

The material cost as a percentage of revenue is higher in Dabur (51.47%) compared to Marico's (48.5%), suggesting the impact of rising inflation. The lower material cost of Marico has also provided more room to spend on advertisement and sales promotion, incurring 10% cost on advertisement versus 7.23% of Dabur. Dabur's EBITDA margin is also significantly lower than Marico's.

Conclusion

Dabur and Marico demonstrate resilience in India’s evolving FMCG sector, leveraging strong brand portfolios. Dabur’s diverse portfolio ensures steady performance, while Marico’s superior profitability metrics and share price returns attract investors' interest.

Though the sector has an optimistic view, both companies will have to tackle sector-wide challenges such as supply chain disruption, adapting to changing customer preferences and managing raw material costs to foster growth and competitiveness in the dynamic market environment.

About The Author

Next Story