Market News

From ₹10,000 to ₹17,530 in six months: Know the key factors behind Dixon Technologies stellar rally

.png)

5 min read | Updated on December 06, 2024, 18:44 IST

SUMMARY

After surpassing ₹10,000 mark for the first time, less than six months ago, Dixon Technologies is inching closer to ₹18,000 milestone with the stock reaching a fresh high of ₹17,530. Here are key factors driving the share price of Dixon Technologies.

Stock list

Quick rise: From ₹10,000 to ₹17,530 in six months - Know the key factors behind Dixon Technologies stellar rally

It also provides reverse logistics services such as repair and refurbishment. Panasonic, Philips Lighting, Haier, Gionee, Motorola, Xiaomi, Samsung, Itel, Airtel, Reliance Jio, Acer, Lenovo, and others are major Dixon customers.

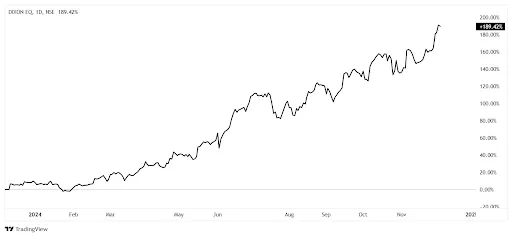

The company has a market capitalisation of ₹1,04,814. Dixon plans to add 4 lakh smartphones to its monthly capacity through its newly leased plant in Noida. Dixon’s share has delivered a return of 84% in the last six months and 188% in the past 12 months. Earlier in June this year, the company crossed the milestone of ₹10,000 mark for the first time, but in less than six months, it hit a fresh high of ₹17,530 on December 5, 2024.

Six key factors driving the share price of Dixon Technologies (India) Ltd

Source: Upstox Pro

Source: Upstox ProKey Factors

Strong Earnings

| Metrics | Q2FY25 | YoY Growth | H1FY25 | YoY Growth |

|---|---|---|---|---|

| Revenue | ₹11,538 crore | 133% | ₹18,116 crore | 120% |

| EBITDA | ₹420 crore | 110% | ₹676 crore | 102% |

| PAT | ₹412 crore | 265% | ₹551 crore | 204% |

(Source - Investors Presentation)

Dixon Technologies has given a robust performance for Q2FY25, with a consolidated net profit of ₹411.7 crore, over three times the net profit of ₹113.36 crore reported in Q2FY24. The growth was driven by the strong performance of its Mobile and EMS divisions. The company has maintained double-digit sales and profit growth for three years and triple-digit YoY growth in three of the last four quarters. With a return on capital employed (RoCE) of 38.9%, an adjusted RoE of 31%, a debt-to-equity ratio of 0.162x, and a negative three-day cash conversion cycle, Dixon has strong financial health and disciplined capital management.

Recent new client contracts

Dixon’s subsidiary, Padget Electronics, has secured significant client additions with its partnership with Compal and has commenced mass production of Google Pixel smartphones for Google's Indian arm, enhancing revenue potential. In the past six months, it has signed MoUs with Asus and HP India to manufacture notebooks, desktops, and all-in-one PCs. Presently, it has a contract with four of the top five IT hardware brands.

Collaboration and integration

Through collaboration and strategic integration, Dixon has witnessed strong growth. The acquisition of Ismartu in August 2024 and partnerships with brands like HKC, Nokia, and China’a Longcheer and Compal helped expand their capabilities. Dixon has secured a robust order book from brands like Techno, Infinix, Intel, and Nothing, while Motorola orders are consistently reaching 1 million units per month. The export orders for North America and the growth of Xiaomi and Oppo volumes also indicate its market position. New facilities in Noida and Chennai and backward production process integration are benefitting to scale operations.

Business segment performance

With Q2FY25 revenues of ₹9,444 crores (235% YoY growth) and an operating profit of ₹308 crores (231% YoY growth), the mobiles and EMS divisions have given a solid performance. Consumer electronics, including LED TVs and refrigerators, showed a strong utilisation rate, while home appliances achieved 50% YoY growth in fully automatic washing machines. Dixon’s backward integration of processes decreased imports and improved margins, while its healthy order book and capacity expansions indicate consistent growth across all its business segments.

Government support (PLI Scheme)

The Production-Linked Incentive Scheme (PLI) has helped Indian domestic manufacturers to compete against Chinese firms. As the industry moved away from China Due to PLI, Dixon Technologies, the industry leader in the EMS sector, strengthened its position by showcasing the production capabilities of domestic firms.

Sector outlook and management optimism

By FY27, the Indian Electronic Manufacturing Service (EMS) sector is projected to reach $300 billion, with smartphones being the primary growth driver. The positive demand, the launch of new segments, the acquisition of new clients, rising domestic production, import replacement, and international collaborations will likely drive substantial revenue growth. Dixon’s management is optimistic about the future with a projection of 200-250% growth in telecom through its JV with Airtel and expects mobile production to reach 20-30 million units this fiscal year, with plans to increase to 35-40 million units by FY26.

By leveraging on strategic collaboration, client acquisition and backward integration, Dixon Technologies has strengthened its position in the EMS sector. Its consistent financial growth, robust order book and expanding operation give it an edge over its peers.

Along with policy support from the government and an optimistic sectoral outlook, the stock has rewarded its shareholders.

About The Author

Next Story