Market News

FMCG stocks: Comparing Tata Consumer, HUL and Godrej Consumer on market and financial performance and market outlook

.png)

4 min read | Updated on December 03, 2024, 13:35 IST

SUMMARY

Despite NIFTY’s 20% surge, NIFTY FMCG rose 10.18% in the last year due to a slowdown in demand. However, demand has an uptick in Q2, with the FMCG sector growing 5.7% by value and 4.1% in volume during the period, driven by rural demand. The large players have demonstrated strong performance against mid- and small players. Here’s a brief comparison of large FMCG stocks of Tata Consumers, Godrej Consumers and HUL.

Stock list

FMCG stocks: Comparing Tata Consumers, HUL and Godrej Consumers on market and financial performance amid rural demand revival

NIFTY FMCG gained 5.98% in the past year, underperforming the broader markets, as NIFTY50 rose over 18%. In previous quarters FMCG companies faced margin pressure due to rising input costs and a slowdown in demand. However, after a favourable monsoon season, the rural demand is witnessing an uptick, while urban demand remained steady in Q2. Now, the sector's demand outlook remains optimistic.

According to NielsenIQ, a consumer intelligence firm India’s fast-moving consumer goods (FMCG) sector grew 5.7% by value and 4.1% by volume in the Q2FY25 driven by rural demand. Rural demand grew twice as fast as urban demand during this period. The deep pocket large FMCG players have continued to demonstrate stronger performance compared to small and mid players.

Here's a comparison of 3 leading FMCG companies of the sector - Tata Consumer Product, Hindustan Unilever Ltd (HUL), and Godrej Consumer.

HUL is flourishing in Home Care, Beauty & Personal Care and Foods & Refreshment segments. Godrej Consumer is strong in personal care and household care. Tata Consumer, is a Tata Group company with a diverse food and beverage portfolio in India and globally.

Valuation

| Stocks | Tata Consumer | HUL | Godrej Consumer |

|---|---|---|---|

| Market Cap | ₹94,295 crore | ₹5,82,898 crore | ₹1,25,850 crore |

| EV/EBITDA Multiple | 35.6x | 37.1x | 38.8x |

| P/E Ratio | 69.1x | 56.1x | 69x |

| ROE | 8.32% | 20.2% | (-)56% |

(Source - Screener.in)

In terms of the P/E ratio, HUL trades at a lower valuation of 57.1x, while Godrej Consumer and Tata Consumer trade at a premium with a P/E multiple of 70.4x and 69.1x, respectively.

The Tata consumer’s RoE of 8.32% is moderate, indicating stable profitability, while HUL’s RoE of 20.2% is much better. Godrej Consumer RoE is negative, largely affected by an exceptional accounting charge worth ₹2,378 crore during the Q4FY24 that impacted its bottom line.

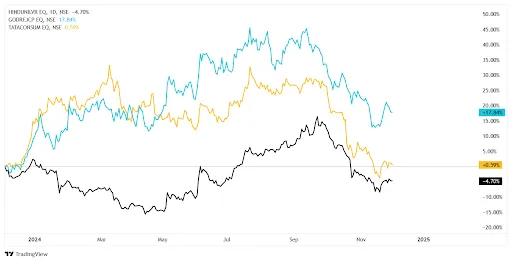

Share Price Performance

In the last one year Tata Consumer has delivered 0.59% return, Godrej Consumer 17.8%, and HUL negative (-4.7%) return.

(Source:Tradingview)

(Source:Tradingview)H1FY25 Financials

| Stocks | Tata Consumer | HUL | Godrej Consumer |

|---|---|---|---|

| Sales | ₹8,566 crore | ₹31,633 crore | ₹6,998 crore |

| EBITDA | ₹1,293 crore | ₹7,529 crore | ₹1,484 crore |

| Profit After Tax (PAT) | ₹656 crore | ₹5,207 crore | ₹942crore |

(Source- Screener.in)

In H1FY25, Godrej Consumer sales declined to ₹6,998 crore, displaying (-) 0.75% YoY change trailing HUL’s sales of ₹31,633 crore with growth of 1.65% YoY and Tata Consumer’s sales of ₹8,566 crore with 14.6% YoY growth.

HUL’s profitability was led by an EBITDA margin of 23.8%, resulting in a PAT margin of 22.35%. Godrej displayed strong growth in PAT YoY of 25.27% due to its EBITDA margin of 21.21% with a PAT margin of 25.27%. Tata Consumer showed strong sales growth with an EBITDA margin of 15% but reported a weaker PAT margin of 9.86% due to higher interest expense.

Q2 FY25 Business Performance

Asset Utilisation

HUL leads in efficiency with the highest return on capital employed (ROCE) of 27.2% and Return on Assets (ROA) of 13.6%, representing better capital utilisation. Godrej Consumer has a strong ROCE of 19% but struggles with a negative ROA of (-)41.3%. Tata Consumer lags with a modest ROCE of 10.6% and ROA of 5.61%.

Conclusion

The FMCG sector remains resilient, with rural demand driving growth. HUL leads with superior margin efficiency and a well-diversified portfolio. Godrej Consumer shows strong PAT growth and home care expansion but faces profitability issues. Tata Consumer demonstrates robust sales but weaker margins. With sectoral tailwinds in favour, FMCG stocks will have an optimistic outlook.

About The Author

Next Story