Market News

BSE Ltd stock price scales above ₹5,000 mark, giving 110% returns in six months; here’s what is driving the rally

.png)

3 min read | Updated on December 10, 2024, 08:33 IST

SUMMARY

BSE Ltd stock soared past ₹5,000, gaining 101% in six months and 144% YTD, driven by F&O expansion, strong growth, SEBI rule changes boosting Sensex derivatives, and excitement over NSE's IPO and potential BSE re-rating.

Stock list

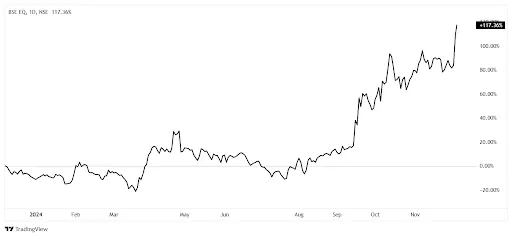

BSE Ltd stock price scales above ₹5,000 mark, giving 101% returns in six months - here’s what is driving the stock growth

On Friday, December 9, 2024, BSE shares were priced at ₹5,467 on the NSE and remained positive. The stock climbed 4.2% to reach its all-time high but quickly pulled back.

Chart of BSE Ltd

Source: Upstox Pro

Why is BSE Ltd. rising?

BSE has announced the launch of futures and options (F&O) contracts for 43 additional stocks, set to begin trading on December 13. This is viewed as a crucial advancement to expand BSE's presence in the derivatives market, which has been outpaced by the National Stock Exchange (NSE).

Market participants hope introducing these contracts will boost trading volumes on the BSE, leading to increased revenue. The coming IPO of NSE has raised hopes for a re-rating of BSE’s stock value. If NSE proceeds with its market debut, regulations stipulate that it must list on a competing exchange, positioning BSE as the primary platform. This outlook has generated enthusiasm for potential synergies and greater visibility for BSE.

Major stocks in the F&O segment feature well-known names such as Adani Green Energy, Paytm, Yes Bank, DMart (Avenue Supermarts), LIC, Zomato, and Jio Financial Services. Public sector firms like the Bank of India, HUDCO, NHPC, Oil India, and IRFC have been incorporated, indicating a diverse mix of private and government-backed stocks.

SEBI proposed tightening regulations for derivatives trading. The new rules are expected to have a smaller impact on BSE, which has a relatively lower exposure to the derivatives segment compared to the National Stock Exchange of India.

BSE has decided to retain weekly derivative contracts linked to the Sensex following SEBI's announcement of stricter regulations for equity derivatives. The Sensex contracts have significantly larger trading volumes than Bankex, making it practical to maintain weekly expiries for the more actively traded contracts.

In Q2 FY24, the exchange achieved its highest-ever quarterly revenues of ₹813 crore on a consolidated basis, up 123% YoY. Operational revenues increased by 137% to ₹746.3 crore from ₹314.5 crore. Transaction charges surged by 284% to ₹507.1 crore from ₹132.2 crore.

Net profit attributable to shareholders rose to ₹346.8 crore, up from ₹120.5 crore, marking a growth of 188%. Operating EBITDA margin surpassed 50% for the first time, reaching 52%. BSE StAR MF reported record revenues of ₹58.7 crore, up 100% YoY. Total transactions of the mutual fund segment processed grew by 68% to ₹16.28 crore in Q2 FY2025.

Challenges and Outlook

Management acknowledges challenges in gaining traction for individual stock options due to the technological readiness of brokers. Regulatory changes may impact trading volumes in the derivatives market; however, the management is optimistic about the growth potential of Sensex products. Continuous engagement with market participants to enhance product offerings and market liquidity.

Management expresses confidence in the sustainability of revenue growth, attributing it to diversified income sources, including equity, derivatives, and mutual funds. Emphasis on enhancing market vibrancy, resilience, and competitiveness through continuous product expansion and infrastructure investment.

About The Author

Next Story