Market News

Tata Mutual Fund launches its next Fixed Maturity Plan Series 61 Scheme C (91 Days); details inside

.png)

4 min read | Updated on June 10, 2024, 19:22 IST

SUMMARY

Tata Mutual Fund launches Tata Fixed Maturity Plan Series 61 Scheme C (91 days), a close-ended scheme investing in fixed-income instruments maturing within 91 days. Open from June 10 to 12, 2024, with a minimum investment of ₹5,000, the scheme offers low-risk, predictable returns, benchmarking against CRISIL Liquid Debt A-I Index, and managed by Akhil Mittal.

Tata Mutual Fund launches its next Fixed Maturity Plan Series 61 Scheme C (91 Days)

If you are looking for a low-risk investment option with a short tenure? Tata Mutual Fund's Tata Fixed Maturity Plan Series 61 Scheme C (91 days) might be a good fit. This close-ended scheme aims to generate income by investing in fixed-income instruments that mature within 91 days. There's no guarantee of returns, but the scheme invests in securities with similar maturity to minimize interest rate risk. The investment window is open from today, June 10, 2024, until June 12th, 2024, with a minimum investment of ₹5,000 and no entry or exit load.

Low interest rate risk since securities will be held at maturity, as explained above. Higher predictability of returns since securities will be held till maturity and no redemptions are allowed. If a scheme holds securities till maturity, the return of the scheme will be close to the yield to maturity of the scheme portfolio adjusted for scheme expenses (TER).

FMP tenures are usually 3 years or longer. Over 3 years or longer maturity periods, investors enjoy the advantage of long-term capital gains taxation. Long-term capital gains from debt funds are taxed at 20% after allowing for indexation benefits.

Tata Fixed Maturity Plan Series 61 Scheme C (91 Days)

The investment objective of the Tata Fixed Maturity Plan Series 61 Scheme C (91 days) is to generate income and capital appreciation by investing in fixed-income instruments with maturity in line with the scheme's maturity. The maturity of all investments shall be equal to or less than the maturity of the scheme. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns.

Tata Fixed Maturity Plan Series 61 Scheme C (91 days) will benchmark against the CRISIL Liquid Debt A-I Index.

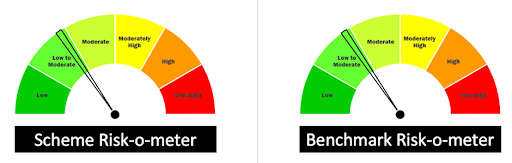

Potential Risk Class: it’s a close-ended scheme, with a relatively low interest rate risk and relatively moderate credit risk (B - I).

Potential Risk Class: it’s a close-ended scheme, with a relatively low interest rate risk and relatively moderate credit risk (B - I).This investment portfolio allows for an allocation between 0% and 100% of your assets to be invested in debt and money market instruments, including government securities. This strategy targets a low to medium risk profile, suitable for investors seeking capital preservation and steady returns.

Tata Fixed Maturity Plan Series 61 Scheme C (91 days) makes it appropriate for investors interested in generating revenue with an inclination towards capital gains throughout the life of the fund by subscribing to Debt, Money market instruments & Government Securities.

Akhil Mittal is 44 years old and possesses a B. Com degree and an MBA. He serves as Senior Fund Manager, a position he assumed in June 2014 for Tata Asset Management Pvt. Ltd. Before that he worked between March 2011 and June 2014 at Canara Robeco Asset Management Ltd. as well as serving there as a Senior Fund Manager. At present he reports to the Head of Fixed Income utilizing his broad exposure in bond markets the person holding this post is responsible for leveraging extensive expertise in fund management concerning fixed income securities.

| Funds | 1Y Returns | 3Y Returns | 5Y Returns | Since Inception |

|---|---|---|---|---|

| Nippon India Interval Fund-Monthly Interval Fund-Series-I- Direct Plan | 6.30% | 5.40% | 4.80% | 6.50% |

Tata Fixed Maturity Plan Series 61 Scheme C (91 days) is ideal for investors seeking low-risk, short-term investment options with predictable returns. The fund, managed by experienced professionals, offers capital preservation through investments in debt and money market instruments, making it a reliable choice for cautious investors.

About The Author

Next Story