Market News

First UltraTech, then Adani Group – why business giants are foraying into cables and wires sector

6 min read | Updated on March 26, 2025, 10:53 IST

SUMMARY

Stock market today: The India wire and cable market size is estimated at $21.22 billion in 2025 and is expected to reach $32.85 billion by 2030, at a compound annual growth rate (CAGR) of 9.14%

Stock list

A significant driver for the cable and wire industry is the housing sector in India. | Image: Freepik

In its exchange filing, the company said that Kutch Copper Limited (“KCL”), its wholly owned subsidiary, has completed the incorporation process of a joint venture company, namely “Praneetha Ecocables Limited” (“PEL”), on March 19, 2025, with Praneetha Ventures Private Limited. KCL shall hold 50% equity share capital of PEL.

Following the announcement, existing players in the C&W space came under heavy selling pressure due to the fear of increased competition in the sector. At the market close on Thursday, KEI Industries shares stood at ₹2,870, down 12.59% on the NSE, while Polycab India slipped 6.19% to ₹5,102. Finolex Cables shares ended at ₹829.75 apiece, down 4.46%, while Havells India's share price ended at ₹1,500, down 3.72%.

The announcement came less than a month after cement giant UltraTech Cement said in February that it was entering the space. The Aditya Birla Group firm said it would invest ₹1,800 crore to set up a plant in Gujarat over the next two years to expand its footprint in the construction value chain.

Interestingly, two business conglomerates announced their entry into the cables and wires sector in less than a month. So, what are the key reasons behind the heightened interest in the space?

We will try to answer here.

The Indian wire and cable market is experiencing significant growth due to multiple tailwinds, such as growing renewable energy production, increased reserves in smart grid technology, industrialisation, and government initiatives. This sector, vital for electricity distribution and telecommunications, is expanding at an impressive rate and is expected to continue on this trajectory in the coming years.

The India wire and cable market size is estimated at $21.22 billion in 2025 and is expected to reach $32.85 billion by 2030, at a compound annual growth rate (CAGR) of 9.14% during 2025-2030, according to a report by Mordor Intelligence, a research firm.

Fortune Business Insights, another market researcher, notes that India has observed a substantial rise in the demand for wires and cables due to the country's ambitious renewable energy goals and the growing awareness of the potential of renewable energy, such as solar and wind power. In solar power plants, photovoltaic (PV) projects require a high-quality cabling system that connects all electrical components with minimal energy loss.

The significant growth of solar panels in India is creating a considerable demand for solar cables. According to industry standards, a 1 MW solar project will use about 50 km of solar cable. Considering the Indian government's target of 100 GW of installed solar capacity by 2022, India's solar cable requirement alone is more than 5 million kilometres.

Another significant driver for the cable and wire industry is the housing sector in India.

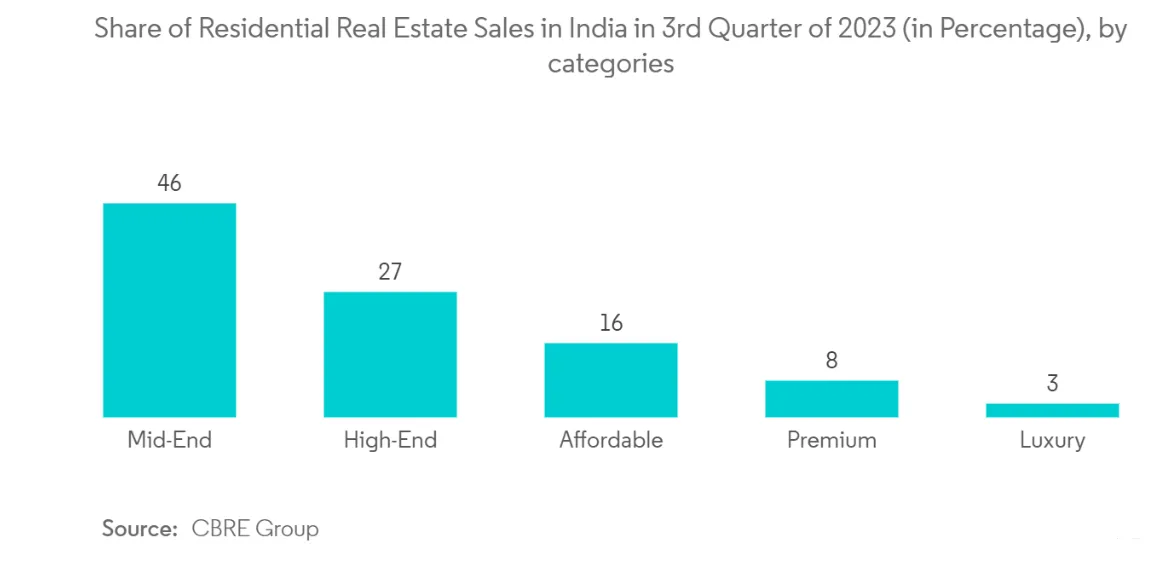

India's housing sector is witnessing a significant increase, boosted by swift urbanisation, government policies, and an expanding middle class. With this growth, the demand for housing wire is continuously growing, as it is one of the most important elements in residential electrical setups. This demand directly results from several interlinked factors, highlighting the dynamic changes occurring in India's housing and construction industries.

Moreover, infrastructure development in Tier II and Tier III cities is increasing demand. As these cities grow and upgrade, the need for new residential complexes is surging, fuelling demand for extensive electrical wiring.

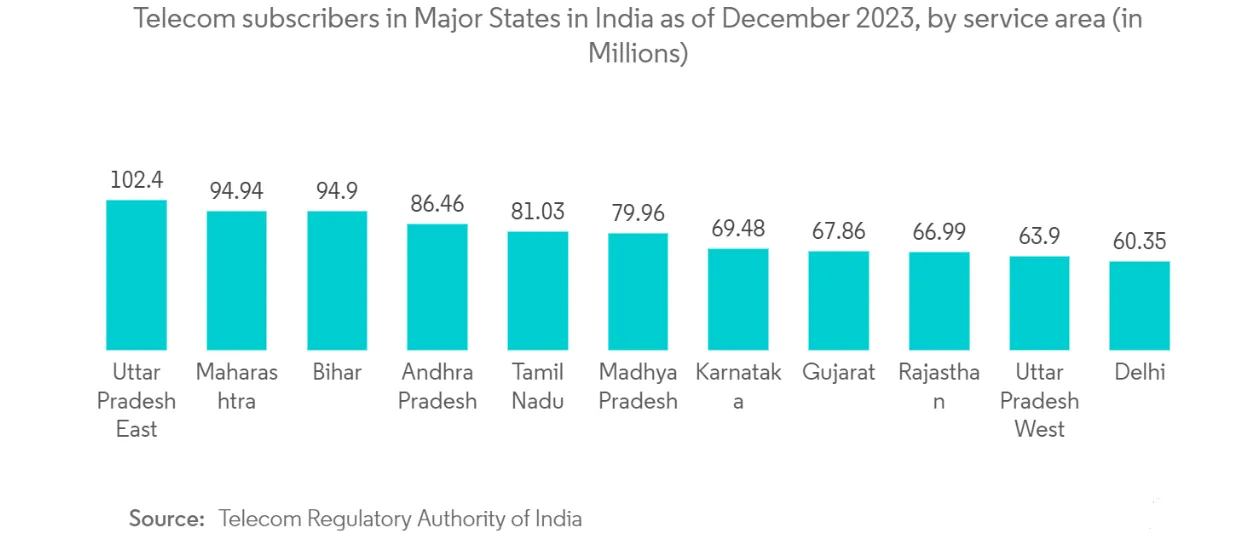

Besides this, India's IT and telecom segment has witnessed a surge in the demand for wires and cables, which is mainly driven by various factors, including expanding broadband services, the proliferation of smart devices, the implementation of 5G technology, and government initiatives like Digital India.

C&W sector: Current status

According to news reports, the cables and wires sector is fragmented, with over 400 players, and no single player has a market share of 20% or more in either segment. Polycab dominates the industry (organised + unorganised) with an 18-19% market share, followed by KEI Industries (~8%+), Havells (~8%), Finolex (~6%), RR Kabel (~5%), and other organised companies (~28%). Unorganised players account for approximately 26%.

Hence, the entry of entities such as UltraTech and Adani Enterprises will increase the market share of organised players and lead to consolidation in the sector.

Polycab India Q3 FY25 Results

Polycab India Ltd reported an 11.5% rise in consolidated net profit at ₹464.35 crore in the December quarter (Q3 FY25), aided by higher sales.

The company had posted a consolidated net profit of ₹416.51 crore in the same period last fiscal, Polycab India said in a regulatory filing.

Consolidated revenue from operations in the quarter under review stood at ₹5,226.06 crore against ₹4,340.47 crore in the October-December period a year ago, it added.

Total expenses in the third quarter were at ₹4,634.5 crore as compared to ₹3,865.06 crore in the year-ago period.

During the quarter, the wires and cables segment clocked a revenue of ₹4,384.63 crore, up from ₹3,904.1 crore in the same period last fiscal year, the company said.

FMEG (fast-moving electric goods) had a revenue of ₹423.18 crore over ₹296.18 crore in the year-ago period, it added.

KEI Industries Q3 FY25 Results

The cable maker reported a 9.4% year-on-year (YoY) increase in net profit at ₹164.8 crore for the third quarter that ended December 31, 2024. In the corresponding quarter of the previous fiscal year, KEI Industries posted a net profit of ₹150.6 crore.

The company's revenue from operations rose 19.8% to ₹2,467.2 crore against ₹2,059.3 crore in the year-ago quarter.

At the operating level, EBITDA was up 12.3% to ₹240.7 crore in the third quarter of this fiscal year over ₹214.4 crore in Q3 FY24, as per the CNBC-TV 18 report.

The EBITDA margin stood at 9.8% in the reporting quarter compared to 10.4% in the third quarter of the last fiscal year. EBITDA is earnings before interest, tax, depreciation, and amortisation.

About The Author

Next Story