Market News

Niva Bupa IPO: Growth, claim settlement and retention metrics compared with industry peers

.png)

3 min read | Updated on February 16, 2026, 17:18 IST

SUMMARY

Niva Bupa Health Insurance, with a 41.27% CAGR in GWP from FY22 to FY24, competes in India's insurance market, highlighting high claim settlement ratios and growing digital expansion amid industry giants.

Understanding Niva Bupa's market position: Growth, claim settlement and retention metrics compared with industry peers

Founded in 2008, Niva Bupa Health Insurance is a joint venture between the Bupa Group and Fettle Tone LLP. The company offers comprehensive health insurance options via its digital platforms, including a mobile app and website. It provides insurance plans for individuals and families, along with group plans for employers and employees, covering 14.73 million lives as of March 31, 2024.

Niva Bupa operates in 22 states and four union territories in India and has grown strongly, with a Gross Written Premium (GWP) compound annual growth rate (CAGR) of 41.27% from FY 2022 to FY 2024. The company leverages advanced technologies like machine learning for lead scoring and CRM tools, supported by a team of 410 telemarketers and 126 tech developers.

Comparing Niva Bupa to peers

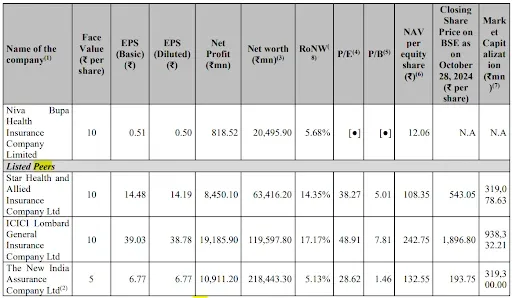

According to the RHP, Niva Bupa's listed peers include Star Health and Allied Insurance Company, ICICI Lombard General Insurance, and New India Assurance. However, New India Assurance is a public sector company, so it's not directly comparable.

For a clearer picture of the business, let’s look at the annual figures.

Financial comparison

- Net Profit (FY24): Niva Bupa reported a net profit of ₹81.85 crore. In comparison, Star Health reported ₹845 crore, ICICI Lombard ₹1,918.59 crore, and New India Assurance ₹1,091.12 crore.

- Revenue (FY24): Niva Bupa earned ₹3,811.25 crore, while Star Health generated ₹13,579 crore, ICICI Lombard ₹19,752 crore, and New India Assurance ₹40,592 crore.

Key metrics

- GDPI Growth (3-Year CAGR): GDPI, or Gross Direct Premium Income, is the total income from premiums. A higher CAGR here indicates business expansion and an ability to attract more customers. Aditya Birla Health Insurance had the highest GDPI growth at 47.6%, with Niva Bupa close behind at 41.4%. Star Health's growth was the lowest at 15.4%.

- Retention Ratio (3-Year Average): The retention ratio shows how much of the premium income a company keeps after paying for reinsurance, which helps manage risk. Higher retention suggests greater control over premiums but may also mean taking on more risk. Manipal Cigna has the highest retention at 95.6%, whereas Niva Bupa and Aditya Birla Health Insurance have the lowest at 78.0% and 79.0%, respectively.

- Claim Settlement Ratio (3-Year Average): A higher ratio is better, as it reflects a company’s trustworthiness in fulfilling claims. Niva Bupa and Care Health are leaders, with ratios above 90%, showing strong reliability in settling claims. Aditya Birla Health Insurance has the lowest at 74.3%.

- Solvency Ratio (3-Year Average): This metric indicates a company’s ability to meet long-term debt and financial obligations. Higher ratios reflect greater stability, with a regulatory minimum set at 1.5. Most companies, including Niva Bupa, Star Health, and Aditya Birla Health Insurance, have a solvency ratio of 2.0, while Manipal Cigna's ratio is slightly lower at 1.6.

- Combined Ratio (FY24): The combined ratio shows profitability; a ratio below 100% indicates profitability, while a ratio above 100% suggests losses, meaning more is paid out than earned in premiums. The most efficient companies here are Star Health (96.7%) and Care Health (94.9%), followed by Niva Bupa (98.8%). Manipal Cigna and Aditya Birla Health Insurance have ratios above 110%, suggesting higher expenses and claims compared to their premiums.

About The Author

Next Story