Market News

Resourceful Automobile IPO frenzy decoded: THIS is the biggest reason behind 419x subscription

6 min read | Updated on August 28, 2024, 07:24 IST

SUMMARY

Resourceful Automobile was founded in 2018 and sells Yamaha two-wheelers under the name “Sawhney Automobile”. The company currently has two showrooms with an attached workshop.

As of July 31, 2024, the company has a total of 8 permanent employees.

The mind-boggling subscription of nearly 419 times of the SME IPO, Resourceful Automobile, has left netizens and market watchers in awe. The share sale, which ran between August 22 and August 26, was precisely subscribed 418.82 times by the last day of the offer.

The public issue was subscribed 496.22 times in the retail category and 315.61 times in the Other category.

The company's IPO price was ₹117 per share. The minimum lot size for an application was 1,200 shares. The minimum amount of investment required by retail investors was ₹140,400, and the minimum lot size investment for HNI was two lots (2,400 shares) amounting to ₹280,800.

Resourceful Automobile was founded in 2018 and sells Yamaha two-wheelers under the name “Sawhney Automobile”. The company currently has two showrooms with an attached workshop. The Blue Square showroom in Dwarka, New Delhi, showcases the entire range of Yamaha two-wheelers, apparel, and accessories. Another showroom is located on Palam Road in New Delhi.

As of July 31, 2024, the company has a total of 8 permanent employees.

So, what's the reason behind the frenzy?

Analysts note there is nothing out of the ordinary with an over 400x subscription, as the average subscription of the SME IPOs that have been launched in 2024 is 200 times. Moreover, this is not the correct way to look at it. The issue size is small. So, when one talks about oversubscription, the small issues get a much higher subscription, notes Pranav Haldea, Managing Director at PRIME Database Group.

What needs to be looked at is that there is a lot of retail interest in the SME segment. Data shows that the average number of retail applications for SME IPOs has surged from 408 in 2019–20 to 2.13 lakhs in 2024–25. That shows the amount of retail interest that is coming in.

IPOs, whether mainboard or SME segment, retail investors look at them from the listing pop point of view. Very few get into the details, such as who is the promoter or director of the company. Most investors apply to the issue with the aim of exiting it with 30–40% gains, Haldea added.

Deepak Shenoy, the CEO of Capitalmind, a SEBI-registered portfolio manager, on social media platform X (formerly Twitter), said, "It's an SME with a 12 crore IPO. Firstly, the oversubscription is BS; your money stays in your bank account and you simply cannot get an entry easily, so you keep money in your account and bid; if you don't get an allocation, it will just get released and you still earn the interest. So oversubscription nowadays doesn't make sense to look at."

Even earlier, it didn't because people would borrow, like crazy, 100–200 crore for four days to fund an ASBA application from NBFCs. The RBI and SEBI put an end to that, so now the smaller IPOs are getting oversubscribed, Shenoy added.

"The bigger point is that no one is forcing you to buy into this or any IPO. You can take it as a sign of euphoria in the markets, if you like. Yes, it could go bust or the business may fail. There is a risk. If you don't understand it, please make fixed deposits. Don't apply to FOMO," Shenoy said further.

Meanwhile, Bikram Gupta, also a SEBI-registered research analyst at Northpull Capital, notes that from the fundamental point of view, there is nothing remarkable in the company to drive such crazy demand.

“If I were to choose between the fundamentals of the company and the stock price, I would definitely go for the fundamentals," Gupta added.

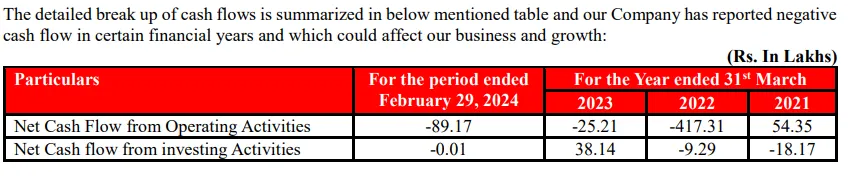

Another point raised by Gupta was that the company had negative cash flows in recent fiscals.

"Sustained negative cash flow could adversely impact the business, financial condition, and results of operations," the company mentioned in its RHP.

The analyst continued, "At the IPO price, the market capitalisation will be around ₹31 crore and its net worth is around ₹1.5 crore, and thus the price to book at which it will list is roughly 20x book, a valuation that appears to be stretched for a company that is reporting negative cash flow from operations."

Further, it has often been observed that whenever there is extreme positive consensus—reflected in the phenomenal oversubscription—the markets tend to do something different, the anlayst said.

As per Amit Kumar Gupta, a SEBI-registered research analyst and founder of Fintrekk Capital, SEBI has changed the criterion from September 1 for IPOs of small businesses, so SME IPOs will be difficult for operationally loss-making companies going forward. That could potentially be a reason for the rush. Many would like to try their luck one last time, the analyst added.

A few days ago, NSE introduced a new eligibility requirement for small businesses as regards their IPOs: companies must now demonstrate positive Free Cash Flow to Equity (FCFE) for at least two of the three financial years leading up to the filing of their draft IPO papers.

The move aims to encourage financial robustness before going public, which is likely to enhance confidence in the SME market. Recently, capital market regulator SEBI observed signs of manipulation at both the trading and issuance levels in the SME space.

Madhabi Puri Buch, Chairman, SEBI, said the regulator was working to introduce more disclosures to safeguard investors and use artificial intelligence to improve document examination, besides moving towards automated supervision.

Amid rising concerns of froth-building up in SME stocks, NSE imposed a price control cap of 90% on the pre-open session on the listing of SME after the IPO.

In simpler terms, it means that a SME stock cannot be listed at a premium of more than 90% over its issue price.

For example, suppose there is an IPO whose price band is set at ₹100-₹115 per share. In such a scenario, the shares will open at not more than ₹218.5 per scrip, which will mark a premium of 90% against the upper end of the IPO price band of ₹115.

About The Author

Next Story