Market News

ATC Energies System IPO allotment: How to check status online on NSE, KFin Technologies

.png)

4 min read | Updated on March 28, 2025, 03:25 IST

SUMMARY

ATC Energies System IPO allotment: Successful bidders can expect the shares to be credited to their Demat accounts by April 1. The stock will be listed on the NSE SME platform on April 2.

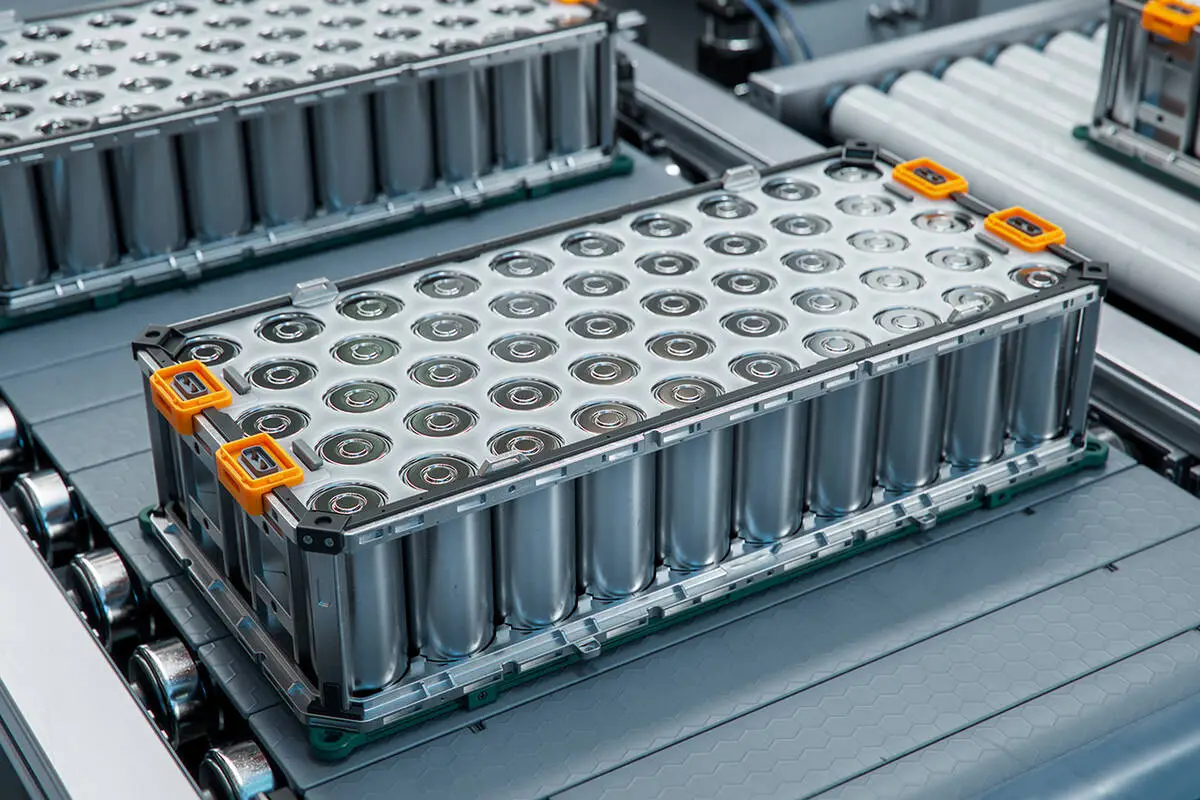

ATC Energies System Ltd, established in 1998, is a leading manufacturer of rechargeable batteries. | Image: Shutterstock

ATC Energies System IPO allotment status is expected to be finalised on Friday, March 28, after the successful subscription.

The SME (small and medium enterprise) issue saw muted demand, with an overall subscription of 1.61 times.

Investors can check bid finalisation details online either on the NSE website or on the portal of the issue’s registrar, KFin Technologies Ltd.

How to check ATC Energies System IPO allotment status on NSE

- Visit NSE’s allotment status page: https://www.nseindia.com/invest/check-trades-bids-verify-ipo-bids

- Select ‘Equity & SME IPO bid details’

- Choose ‘ATC Energies System’ under the symbol ‘ATCENERGY’.

- Enter your PAN details and application number.

- Click on submit

Steps to check ATC Energies System IPO allotment status on KFin Technologies

- Visit KFin Technologies' official website- https://ris.kfintech.com/ipostatus/

- Select any one of the five links to view the IPO allotment status.

- In the ‘Select IPO’ dropdown menu, select ‘ATC Energies System Ltd’.

- Select whether you want to identify yourself using your IPO application number, Demat account number or PAN.

- Share details as per the selected option.

- Complete the Captcha verification and click on ‘Submit’

ATC Energies System IPO details

- ATC Energies System aims to raise ₹63.76 crore through its maiden share sale.

- The IPO comprised a fresh issuance of 43.24 lakh shares, aggregating to ₹51.02 crore, and an offer-for-sale (OFS) of 10.8 lakh shares, worth ₹12.74 crore.

- The IPO price band was fixed at ₹112 to ₹118 per share. The lot size, or the minimum bid quantity to apply for the issue, was 1,200 shares.

- Indorient Financial Services Ltd was the book-running lead manager of the IPO, while Kfin Technologies Ltd was the registrar for the issue.

- After the allotment is announced, successful bidders can expect the shares to be credited to their Demat accounts by April 1, with others receiving refunds on the same day.

- ATC Energies System shares are scheduled to be listed on the NSE SME platform on April 2.

ATC Energies System IPO: Use of proceeds

ATC Energies System Ltd, established in 1998, is a leading manufacturer of rechargeable batteries. Its product portfolio comprises rechargeable lithium ion battery, electric vehicle lithium ion battery, lifepo4 lithium battery and lithium ion battery, among others. The company offers integrated energy storage solutions for industries like banking, automobiles and other end users.

The Mumbai-headquartered company operates factories in Vasai, Thane and Noida. These factories house advanced equipment for battery assembly, including temperature chambers, welding systems, and testers.

ATC Energies System proposes to utilise the net proceeds from the IPO mainly towards repayment of loans and funding the company’s expansion plans. The company plans to use nearly ₹9.5 crore of the IPO proceeds for repayment of loans with respect to purchase of the Noida factory. It also proposed to use ₹6.7 crore for funding the capital expenditure requirements towards refurbishment, civil and upgradation works at the factory.

Another ₹7.5 crore would be earmarked for funding the capital expenditure requirements for IT upgradation at the Noida factory, Vasai factory and the registered office. The remaining portion of the funds will be used for working capital requirements and general corporate purposes.

ATC Energies System: Key financials

For the first six months of the current financial year, ended September 2024, ATC Energies System reported a revenue of ₹22.57 crore and a profit after tax (PAT) of ₹5.77 crore.

For the previous financial year 2023-24, the company reported revenue of ₹51.51 crore against ₹33.22 crore in FY 2022-23. Its net profit increased ₹10.89 crore in FY24 compared to ₹7.76 crore in the previous fiscal.

Key performance indicators (As of March 2024)

| KPI | Values |

|---|---|

| Return on Equity | 39.38% |

| Return on Capital Employed | 42.66% |

| Debt/Equity | 0.32 |

| Return on Net Worth | 39.38% |

| PAT margin | 21.27% |

| Price to Book Value | 5.73 |

Related News

About The Author

Next Story