Market News

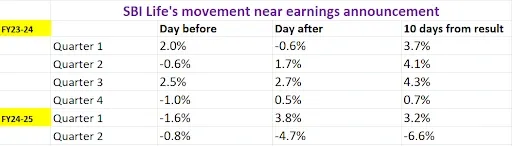

SBI Life Q3 results: Check earnings preview and options strategy ahead of Q3 results

.png)

4 min read | Updated on January 17, 2025, 11:29 IST

SUMMARY

SBI Life Insurance has reclaimed its 21-day and 50-day exponential moving averages (EMAs) on the daily chart and is now trading near the critical resistance zone of the 200 EMA. Traders should closely watch the price action around this level, as a decisive close above the 200 EMA could indicate a shift in momentum and signal a potential upward trend.

Stock list

SBI Life Insurance 30 January ATM strike sits at 1,520, with both the call and put options priced at ₹83.

APE, a commonly used metric in the life insurance industry to estimate sales, is projected to grow 6-8% year-on-year (YoY) to ₹6,400-₹6,700 crore. Meanwhile, VNB, which measures the profitability of new business achieved during the quarter, is expected to increase by 3-5% YoY to ₹1,650-₹1,750 crore.

Meanwhile, net profit for the quarter is likely to fall between ₹430 crore and ₹580 crore. For context, SBI Life reported a net profit of ₹529 crore in Q2 FY25 and ₹322 crore in the same quarter last year.

However, VNB margins are expected to contract during the quarter, primarily due to the new surrender value rules implemented by the Insurance Regulatory and Development Authority of India (IRDAI) in October 2024. These rules require higher payouts to policyholders who surrender their policies early, impacting profitability for insurers.

Investors will closely watch the results for insights into the impact of these regulatory changes, as well as the company’s product mix and growth in sales through bancassurance channels.

Ahead of the earnings announcement, SBI Life shares were trading 0.9% higher at ₹1,528 per share on Friday, January 17. This month, the stock has gained over 9%. While it declined by 2.9% in calendar year 2024 and underperformed the NIFTY50 index, which rose by 8.8% during the same period.

Technical View

After a sharp fall of over 21% in previous five months from it's all-time high, SBI Life Insurance rebounded from the crucial support zone of ₹1,300. As of 16 January, SBI Life reclaimed its 21-day and 50-day exponential moving averages (EMAs) but witnessed rejection from its 200 EMA.

In the upcoming sessions, traders can monitor the price action around 200 EMA. If SBI Life reclaims its 200 EMA on closing basis along with the crucial resistance zone of ₹1,515, it may further extend its gains. On the other hand, a close below 21-EMA will signal weakness.

Options build-up

Options strategy for SBI Life Insurance

Given the implied movement of ±5.5% from the options market ahead of the 30 January expiry, traders can take a look at the long and short Straddle strategies to take advantage of the anticipated volatility and price swings.

Disclaimer

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story