Market News

IT sector Q2FY25 results preview: Revenue growth to remain intact, new deal win to improve & more

.png)

3 min read | Updated on October 09, 2024, 15:16 IST

SUMMARY

The Indian IT sector's Q2FY25 earnings are expected to show moderate growth, driven by deal wins, improved client sentiment, and recovery in BFSI and the healthcare sector, with AI investments and North American performance boosting momentum.

IT sector Q2FY25 earnings preview - Here are the key insights on revenue growth and market trends

The Indian IT sector is set to announce its second quarter (Q2) earnings for FY2025, covering the quarter ending September 30. Starting October 10, investors are hopeful about improved performance, driven by multiple deal wins and a positive shift in client sentiment across multiple vertical sectors like BFSI and healthcare.

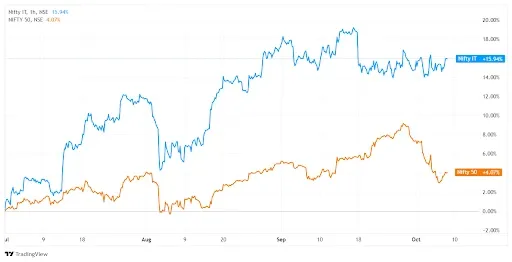

The Nifty IT index jumped 15.94% in the July to September quarter, greatly outperforming benchmark indices NIFTY50 (+11.5%) due to optimistic comments from the management about upcoming quarters' performance and no negative surprise for the Q1 results.

Q2 Earnings Expectations

According to industry experts, Tier-I companies are expected to see revenue growth ranging from flat to +3.0% QoQ in constant currency (CC) terms. In contrast, Tier-II companies are projected to achieve revenue growth between flat and +4.5% QoQ in CC.

Outlook for Q2FY25

The Q2 performance will be influenced by steady deal flow, improving client sentiment, and continued pass-through revenues from billing third-party costs such as software licenses and cloud services. While the BFSI and healthcare sectors in the U.S. show signs of recovery, weak demand in the Eurozone may offset some of the revenue growth. Clients are prioritising efficiency over large transformation projects between global uncertainties. Most Tier-1 firms have postponed salary hikes to maintain margins. Despite these challenges, leading companies are expected to create 81,000 to 88,000 new jobs and report slightly improved results, building on momentum from the previous quarter.

Tailwinds for the Sector

Growth in the IT sector is anticipated from increased momentum, strong performance in North America, and positive trends in BFSI and healthcare. A rise in technology spending is expected in H2CY25, supported by potential interest rate cuts (two 25 bps each from the U.S. Fed), but this depends on macroeconomic stability. The sector is also benefiting from generative AI investments.

Indian IT services firms, operating in a similar landscape as Accenture, can gauge potential revenue from Generative AI. Accenture recently reported $3 billion in Generative AI order inflows and $900 million in revenue for FY24, up from $300 million and $100 million in FY23, respectively. Notably, new bookings for Q4 reached $1 billion.

Review of Q1FY25

The Q1FY25 performance of the top five IT firms was mixed, yet total contract values (TCV) remained strong. TCS led with over $8 billion in TCV, double that of Infosys and nearly triple Wipro's. The sector has shown early recovery signs that were evident in the BFSI sector, especially in North America, which contributes over 30-40% of revenue and 50-60% of income for TCS, Infosys, HCL Tech, and Wipro. Management comments suggested a likely demand pick-up in the second half of FY25, pointing to a more normalised spending environment by FY26.

About The Author

Next Story