Market News

Infosys Q4 results: Check earnings preview and technical structure ahead of Q4FY25 results

.png)

4 min read | Updated on April 17, 2025, 07:53 IST

SUMMARY

Infosys is consolidating within last week's range and is forming an inside candle, suggesting range-bound movement in the short term. Unless Infosys breaks out of the ₹1,524–₹1,307 range on a closing basis, the trend may remain sideways.

Stock list

The options market is pricing in a ±5.4% move from the April 16th close, with at-the-money strike of 1,420.

IT major Infosys will announce its March quarter earnings on Thursday, April 17. According to experts, Infosys could report flat revenue growth and a low single-digit rise in net profit on a sequential basis.

Infosys' net profit may range between ₹6,480 to ₹7,250 crore, down 9 to 15% on a yearly basis. Meanwhile, the net profit could see low single-digit growth of 4-6% compared to the December quarter. The company reported a net profit of ₹6,822 crore in Q3FY25 and ₹7,975 crore in the December quarter of FY24.

As per experts, Infosys Q4 revenue could increase by 10 to 11% on a year-on-year basis to ₹42,050 to ₹42,150 crore. Sequentially, revenue could see a marginal rise of 0.5-1%. The company registered revenues of ₹41,764 crore in Q3FY25 and ₹37,923 crore in the same quarter last year.

Infosys is likely to report tepid earnings in the fourth quarter, due to the impact of furloughs, wage hikes and seasonal weakness in demand. The company’s EBIT margins are expected to decline by 60 to 70 basis points to range between 20.5 to 20.9%.

Investors will closely track Infosys' revenue growth guidance for FY26. Experts believe the IT giant may increase its revenue guidance for FY26. New deals win during the fourth quarter, and management’s commentary on the IT discretionary spending scenario amid US recession fear will also be closely watched.

Ahead of the Q4 result announcement, Infosys shares were trading 0.5% higher at ₹1,412 per share on Thursday, April 17. So far this year, Infosys shares are down over 24%, along with other IT stocks, amid US recession fear following tariff hikes by the government.

Technical View

Options outlook

The options market is pricing in a ±5.4% move from the April 16th close, with at-the-money strike of 1,420. For the April 24 expiry, open interest shows the highest call build-up at the 1,600 strike, suggesting possible resistance at that level.

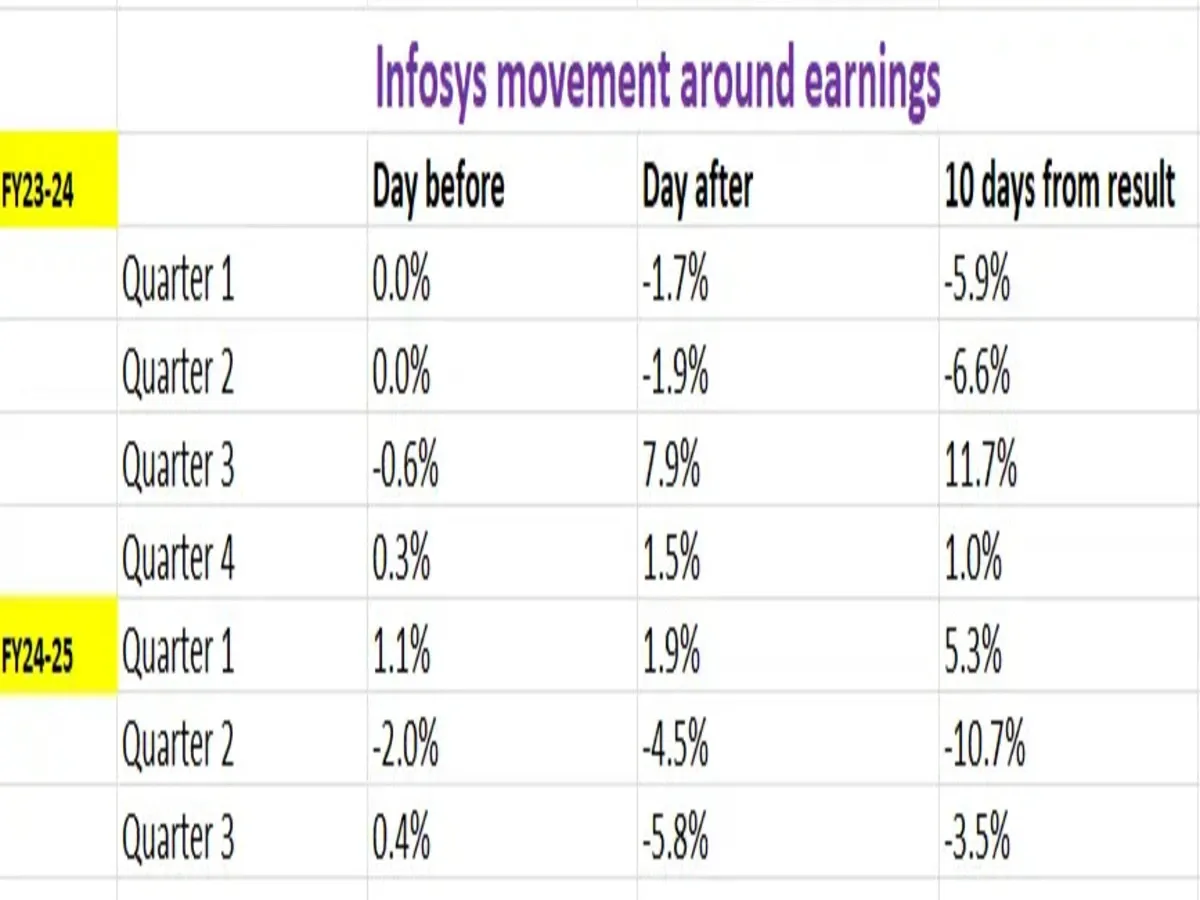

Before diving into strategy, let's review Infosys share price movements around its earnings announcements over the last six quarters.

Options strategy for Infosys

With the options market pricing in a ±5.4% move by the April 24 expiry, traders can look at Long or Short Straddle strategies to trade the expected volatility.

Disclaimer

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story