Market News

HUL Q4 results: Date, earnings preview, dividend, key technical levels & more

.png)

4 min read | Updated on April 24, 2025, 09:06 IST

SUMMARY

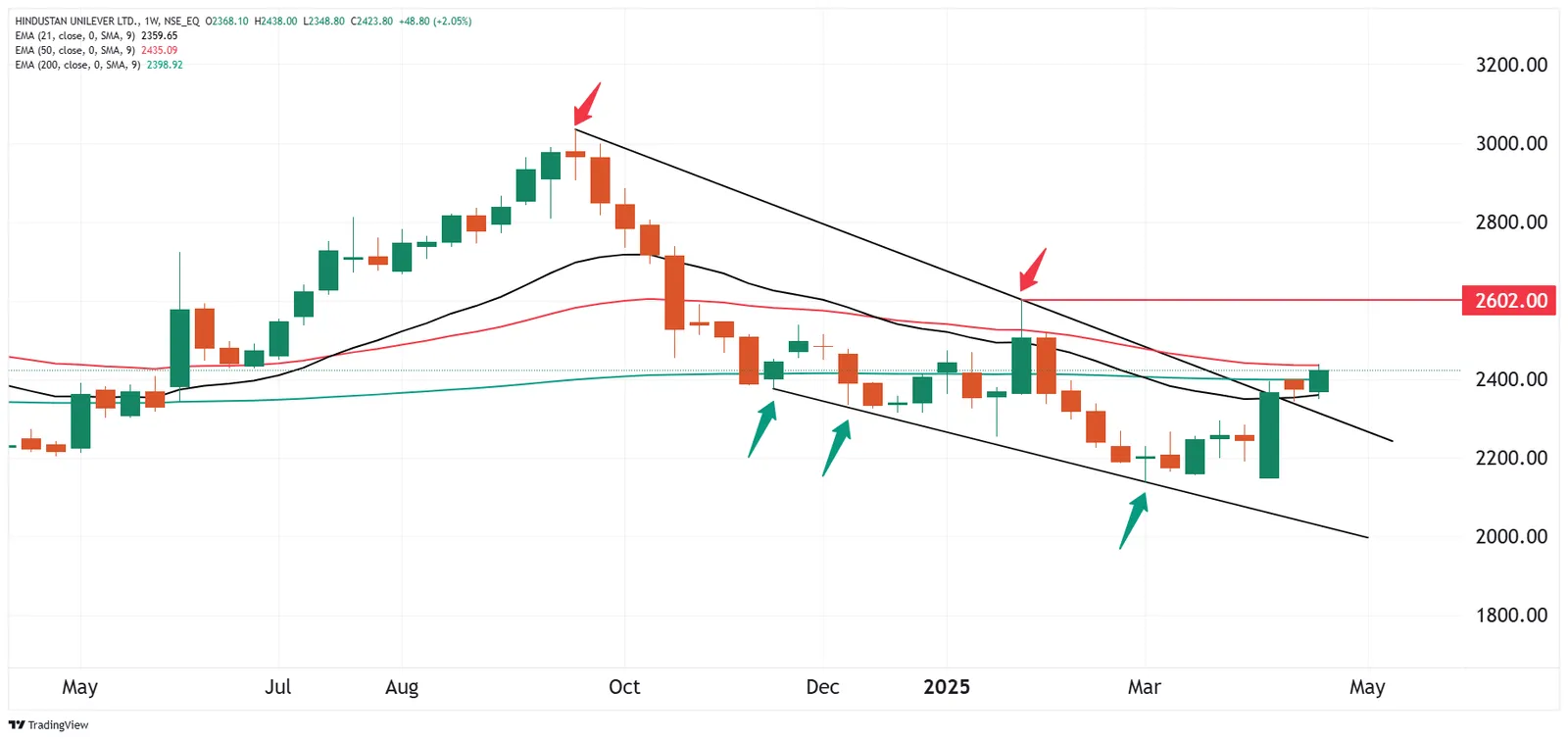

Hindustan Unilever technical setup remains bullish on the weekly chart, trading above key 21 week EMA and breaking out of a falling wedge pattern. A weekly close above the 50-week EMA would confirm the breakout. In the short term, holding above ₹2,423 supports the bullish view, while a close below ₹2,300 may signal weakness.

Stock list

Muted volume growth along with weak urban demand and rising raw material prices likely to take a toll on HUL’s quarterly earnings.

FMCG major Hindustan Unilever (HUL) will announce its March quarter results (Q4FY25) on Thursday, April 24. After blockbuster Q4 earnings by Tata Consumer Products, investors are expecting similar performance from HUL.

According to experts, HUL could report flat to low-single digit growth in net profit and revenue. HUL’s revenue is expected to rise 1-3% on a yearly basis to ₹14,950 to ₹15,150 crore. The company reported revenue of ₹14,693 crore in the March quarter last year and ₹15,408 crore in Q3FY25.

Meanwhile, HUL’s net profit could increase by 1-4% YoY to ₹2,420 to ₹2,490 crore. In Q4FY24, the company reported a net profit of ₹2,396 crore and it stood at ₹3,001 crore in the previous quarter. The company is expected to report volume growth of just 1% YoY, while its EBITDA margin is expected to fall by 20 to 50 basis points to 23.2% to 23.5%.

Muted volume growth along with weak urban demand and rising raw material prices likely to take a toll on HUL’s quarterly earnings.

During the Q4 result announcement, investors and traders will keenly watch management commentary on rural and urban demand and price inflation in key raw materials like palm oil and its impact on margins.

Ahead of the Q4 result announcement, HUL shares are trading 0.2% higher at ₹2,429 per share on the NSE. So far in 2025, the company’s shares has given 4.1% return to investors.

Technical view

Hindustan Unilever maintains a bullish technical setup on the weekly chart. Last week, it reclaimed its 21-week exponential moving average (EMA) and is now trading above the 200-week EMA. The stock is facing resistance near the 50-week EMA.

It has also broken out of a falling wedge pattern and cleared a downward trendline connecting key swing highs from September 2024 and January 2025. A decisive weekly close above the 50-week EMA would confirm the breakout.

For short-term signals, traders can watch the price action around ₹2,423 level on the daily chart. Sustained close above this level could extend the uptrend. On the flip side, a close below ₹2,300 would suggest weakness.

Options outlook 29 May expiry

The open interest data for the Hindustan Unilever at-the-money (ATM) straddle suggests that market participants expect a move of ±5.9% from the closing price of ₹2,423.

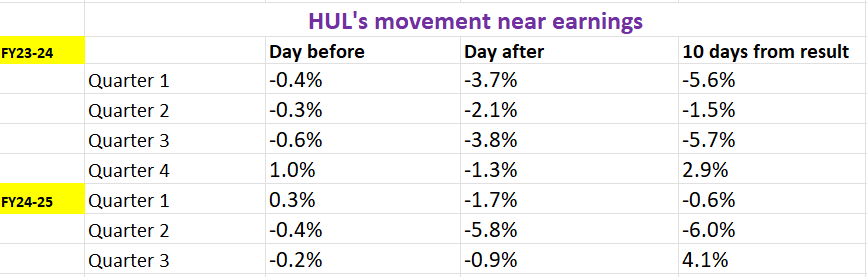

To get a clearer perspective on price behaviour, let's look at how Hindustan Unilever’ share price has performed over the seven quarters around its earnings announcements.

Options strategy for Hindustan Unilever

With an implied movement of ±5.9% from the options market, traders can strategise using Long and Short Straddles to capitalise on anticipated volatility and price movements.

About The Author

Next Story