Market News

HDFC Bank Q3 results: Check earnings preview and options strategy ahead of results

.png)

4 min read | Updated on January 22, 2025, 09:22 IST

SUMMARY

Ahead of its third quarter earnings announcement, shares of HDFC Bank has been consolidating between ₹1,662 and ₹1,624 for the past six trading sessions. With options market pricing in a ±3.9% ahead of its 30 January expiry, traders can monitor this range. A breakout from this range will provide further directional clues.

Stock list

Analysts expect HDFC Bank to post a 1-3% YoY rise in net profit, estimated to be in the range of ₹16,600 to ₹16,700 crore.

In its Q3FY25 business update, HDFC Bank reported a 3% year-on-year (YoY) growth in gross advances, reaching ₹25.42 lakh crore in the third quarter. Deposits saw a strong 15.8% YoY increase, totalling ₹25.63 lakh crore. The bank's Current Account-Savings Account (CASA) deposits also grew by 4.4% YoY, amounting to ₹8.72 lakh crore during the quarter.

Analysts expect HDFC Bank to post a 1-3% YoY rise in net profit, estimated to be in the range of ₹16,600 to ₹16,700 crore. However, sequentially, net profit may decline by 1-2% due to sluggish loan disbursements. Meanwhile, the Net Interest Income (NII) is projected to grow by 7-9% YoY, ranging between ₹30,100 and ₹30,800 crore.

Investors will closely monitor the management's commentary on credit and deposit growth. They will also track key performance indicators such as net interest margin, and gross and net non-performing assets (NPAs) during the results announcement.

Ahead of the Q3 results, HDFC Bank shares are trading 0.52% higher at ₹1,651 per share on Wednesday, January 22 at 9:20 am. However, the stock has declined by 6.86% so far this month.

Technical View

From the technical standpoint, shares of HDFC Bank are currently consolidating between ₹1,662 and ₹1,624 from the past six trading sessions. It is currently trading below all the crucial exponential moving averages like 21, 50 and 200, signalling weakness.

For the upcoming sessions, traders can monitor the range of ₹1,662 and ₹1,624. A break of this range on a closing basis will provide further directional clues.

Options build-up

The current open interest (OI) build-up of the 30th January expiry has the significant call base at 1,700 strike, indicating that the stock may face resistance around this level. On the other hand, the highest put OI is placed at 1,560 strike.

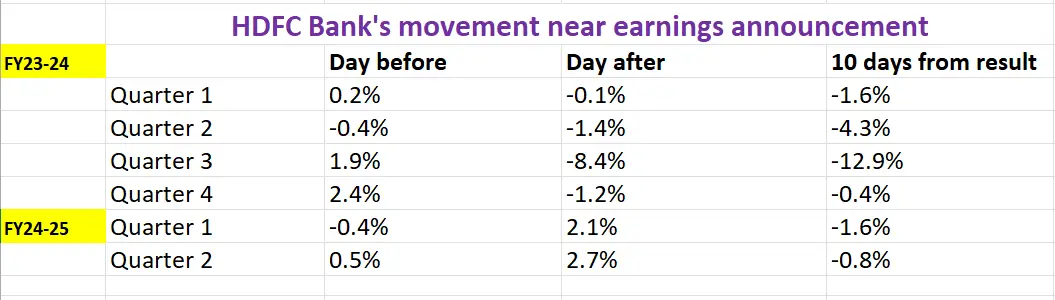

Before diving into strategies, let's review HDFC Bank’s share price movements around its earnings announcements over the last six quarters.

Options strategy for HDFC Bank

With the options market expecting a price movement of ±3.9% before 30 January expiry, traders can consider Long and Short Straddle strategies to capitalise on the expected volatility.

Disclaimer

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story